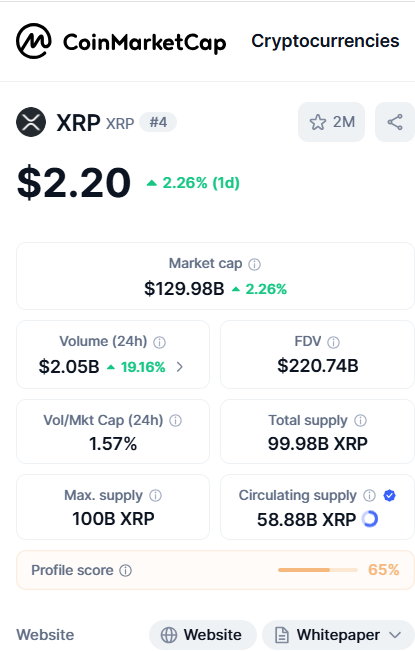

XRP, the fourth-largest cryptocurrency by market capitalization, is drawing fresh attention after recording $2 billion in trading volume over the past 24 hours. According to CoinMarketCap data, $2.02 billion were reported in trading volumes over the past 24 hours, marking a 20% surge.

This comes as XRP begins to regain lost momentum after a weekend drop and broader crypto market sell-off that weighed on investor confidence.

Over the past week, XRP experienced a significant decline in market activity amid broader risk-off sentiment that swept through the cryptocurrency market. However, there might be hope on the horizon. With $2 billion flowing into XRP trades in just one day, analysts are beginning to eye the possibility of a major move ahead.

The uptick in volume could suggest that traders are reentering positions, potentially positioning for a bullish reversal or bracing for increased volatility around key macro triggers this week.

Key macro triggers expected this week

The market is anticipating key macroeconomic events, including the Federal Reserve policy decision and a statement from Chair Jerome Powell.

The Federal Reserve will hold its latest policy meeting this week. The Federal Reserve's most recent interest rate decision kept the benchmark rate at 4.5%. The upcoming decision is expected to maintain it at 4.5% and will be released on June 18.

With Federal Reserve officials signaling an extended pause on interest rates, the market will look to Chair Jerome Powell's statements this week for hints on what may eventually prompt the central bank to act.

At press time, XRP was up 2.09% in the last 24 hours to $2.19, extending its rebound after five days of dropping for the second consecutive day. A decisive break above the daily SMA 50 and 200 at $2.27 and $2.38 would signal a new move for XRP, causing the cryptocurrency asset to exit its current range.

u.today

u.today