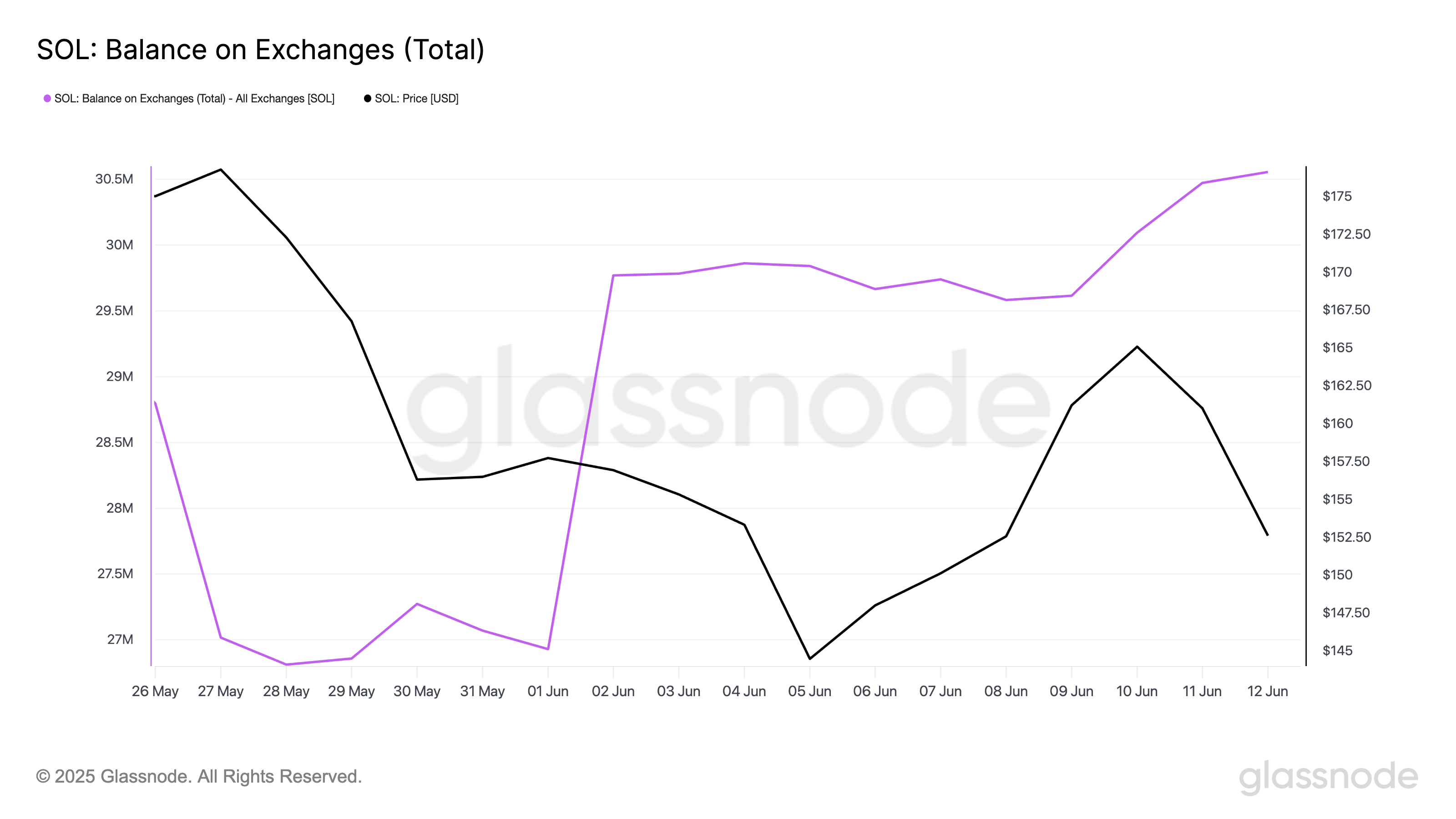

The total amount of Solana coins held on exchange addresses has surged to its highest level in the past 14 days. This uptick in exchange-held balances suggests that more investors are preparing to offload their SOL holdings amid a cooling crypto market.

The spike in exchange balances comes amid the broader market retreat that has weighed heavily on investor sentiment. With the market struggling to maintain momentum, SOL is poised to extend its price decline.

SOL Investors Prepare to Sell

Over the past several days, digital assets have struggled to maintain upward momentum. This has dampened investor interest and triggered an uptick in SOL’s exchange-held balance. It now sits at 31 million SOL, its highest in two weeks.

When an asset’s exchange balance spikes, more of its coins ot tokens are being deposited into centralized exchanges. This is seen as a bearish signal, as traders typically move tokens to exchanges when they intend to sell.

Solana exchange balance climbing to a 14-day high confirms that its investors are preparing to exit their positions amid weakening market sentiment.

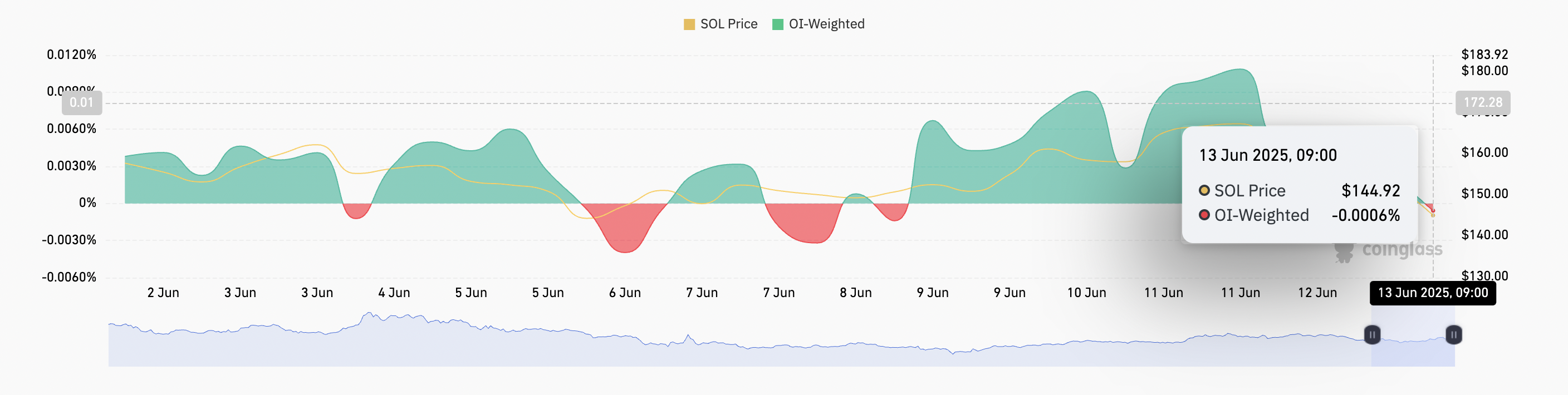

Moreover, SOL’s futures funding rate has turned negative for the first time in over a week, confirming the resurgence in bearish pressure. According to Coinglass, this is currently at -0.0006%.

The funding rate is a periodic fee paid by traders in perpetual futures contracts to keep the contract price aligned with the underlying asset’s spot price. A negative funding rate indicates short positions are in higher demand than longs.

This trend highlights the mounting selling pressure on SOL and hints at a possible continuation of its price fall.

Bearish Pressure Mounts on SOL

SOL’s rising exchange inflows and negative funding rates paint a cautionary picture for its near-term performance. If bearish pressure gains, SOL’s price could breach the support at $142.59 and fall toward $123.49.

However, if the bulls regain dominance, they could drive a rebound to $171.88.

beincrypto.com

beincrypto.com