Are you still waiting for the headlines to confirm a bull market? If you’re relying on ETF flows, price pumps, or crypto Twitter hype to tell you what’s real, you’re already late. The real signals show up earlier, quieter, and smarter. This piece breaks down the underrated bull market signs that pros watch long before retail catches on. Here’s what to know so you can show up early and avoid being exit liquidity.

- 7 bull market signs professionals use

- 1. Stablecoin movement patterns

- 2. Cross-chain bridge activity

- 3. Shift in builder focus

- 4. Wrapped token usage

- 5. Liquidity changes on DEXs

- 6. Market response to token unlocks

- 7. Disconnect between on-chain usage and search interest

- Signals that used to work but now mislead

- Can pros spot a bull market before everyone else?

- Frequently asked questions

7 bull market signs professionals use

So, how do you actually know you’re in a bull market before the headlines catch up? It starts with subtle shifts in behavior, capital, and in code. Here are the seven signs you should closely monitor to become a pro:

- Stablecoin movement patterns

- Cross-chain bridge activity

- Shift in builder focus

- Wrapped token usage

- Liquidity changes on DEXs

- Market response to token unlocks

- The disconnect between on-chain usage and search interest

Now, let’s go over each sign and understand it in detail.

1. Stablecoin movement patterns

One of the earliest bull market signs is hidden in how stablecoins behave when prices are still flat.

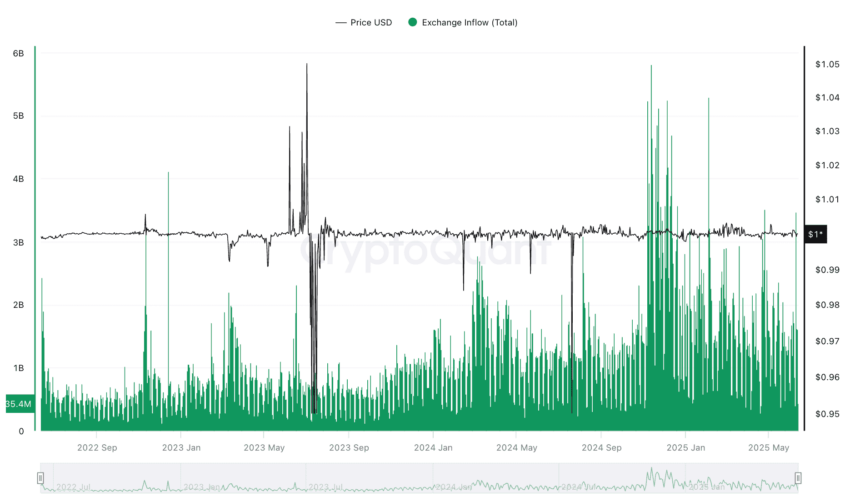

Start by watching the on-chain supply of major stablecoins like $USDC, USDT, and DAI. If supply across chains is stable or gradually rising, but those coins aren’t flowing into centralized exchanges, it’s a strong sign that users aren’t planning to exit. The capital is staying inside the ecosystem, ready but not in a rush.

You might also notice stablecoin balances growing on L2s or alt-L1s while remaining inactive. That’s another clue: early accumulation before rotations begin.

Even if you don’t have charts for everything, a single dashboard comparing stablecoin supply vs exchange inflow (from tools like DeFiLlama, Glassnode, or CryptoQuant) can often reveal this mismatch clearly.

This mismatch — rising or stable supply followed by falling inflow — is the quiet tension before a breakout.

2. Cross-chain bridge activity

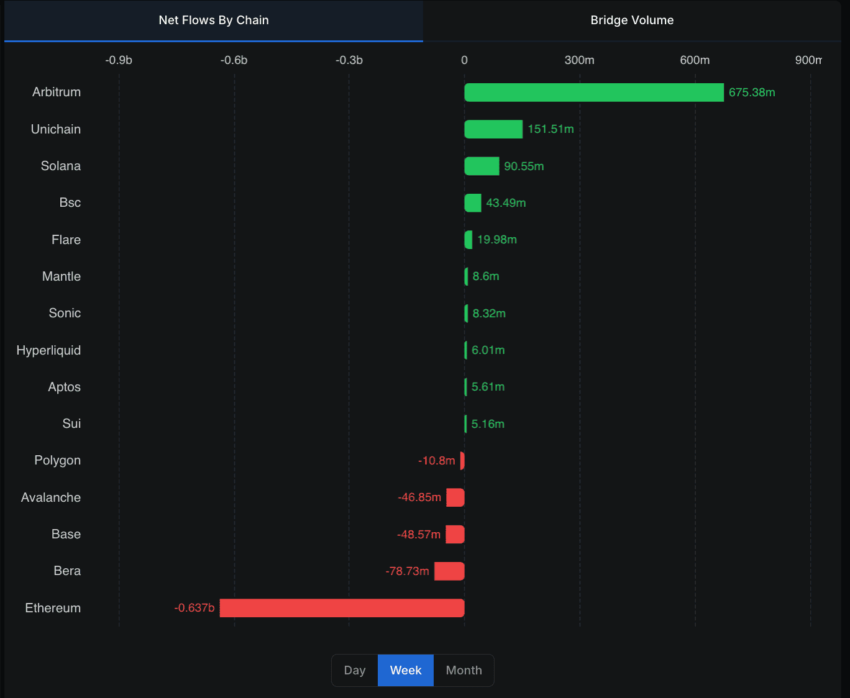

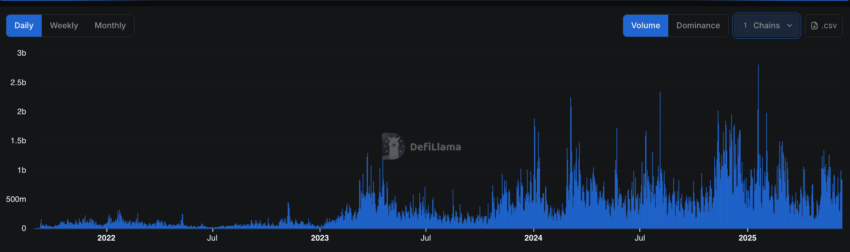

The next underrated bull market sign shows up in bridge activity: quiet, steady flows between chains when prices haven’t moved yet.

You’re not looking for total hype volume. Instead, keep an eye out for net inflows moving into ecosystems like Arbitrum, Base, or Optimism via major bridges (Hop, Stargate, LayerZero) while price action remains dead quiet.

Here’s what to track:

- Weekly bridge inflows increasing

- Withdrawals staying flat or low

- Destination chain tokens still stable in price

You can spot this using the DeFiLlama Bridges dashboard — switch to “Net Flow by Chain,” set it to weekly view, and look for rising inflows into a specific chain. Bonus: if the chain’s TVL is also increasing (L2Beat or DeFiLlama TVL tracker), it confirms that liquidity is settling in.

If inflows are rising, withdrawals are calm, and tokens are still asleep, you’re watching the early signs of rotation before ignition.

3. Shift in builder focus

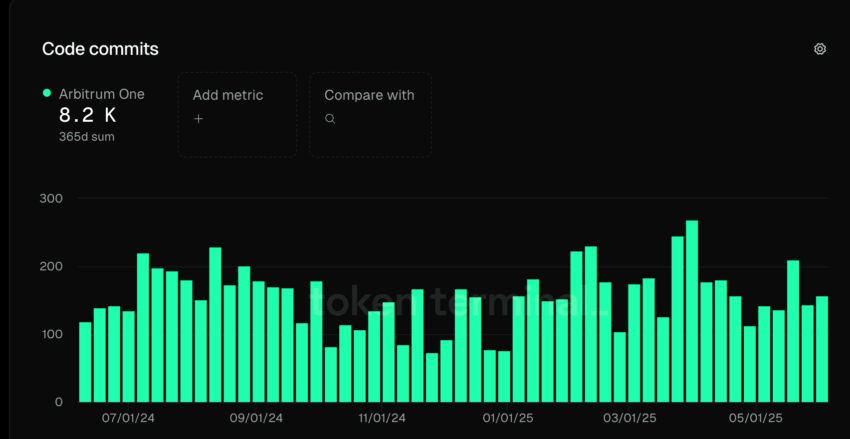

Another underrated bull market sign comes not from price or volume but from what builders start shipping.

In deep bear markets, most developer attention is on infrastructure, such as bridges, L2s, staking layers, restaking, and zk tooling. It’s quiet, low-level, and necessary — but not user-facing.

However, once momentum begins to shift, so does builder attention. That’s when you start seeing consumer-facing launches: wallets, games, social apps, NFT tools, interfaces. Not just infrastructure but also UX.

Here’s the scenario you want to catch:

- Projects start shipping frontends, not just APIs or SDKs

- GitHub commit activity picks up on apps, not just protocols

- You hear about wallets, DEXs, tools, and games; not new consensus models

- Seed and Series A funding rounds start going to apps, not infra

That same month, Base TVL increased by over 30%, and daily active users began to climb. Within weeks, token activity followed.

To track it, look at GitHub dashboards on Token Terminal, dev count data in the Electric Capital Developer Report, and launch announcements on DappRadar (Games / Social tabs) or CryptoRank. You’ll start to see the pivot.

4. Wrapped token usage

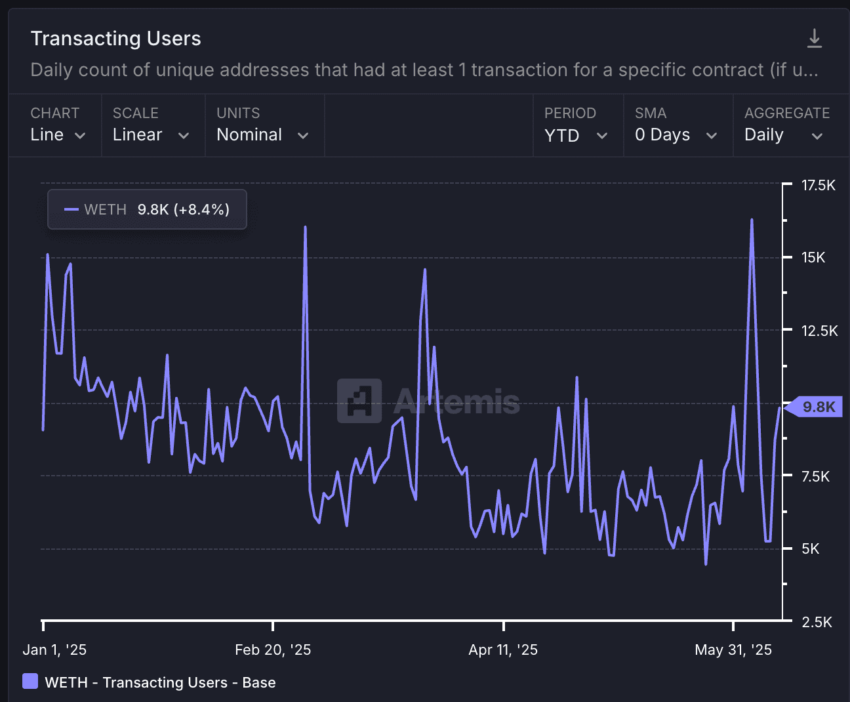

Another subtle but telling bull market sign is a spike in the usage of wrapped tokens, like wETH, wSOL, or wAVAX.

Here’s what to look for:

- Transfer volume of wrapped tokens increasing

- More wallets holding wETH or wSOL

- Activity picking up on protocols that require wrapped tokens (e.g., Uniswap, Aave, Curve)

- Base-layer token price still flat

This pattern tells you users are getting ready to deploy.

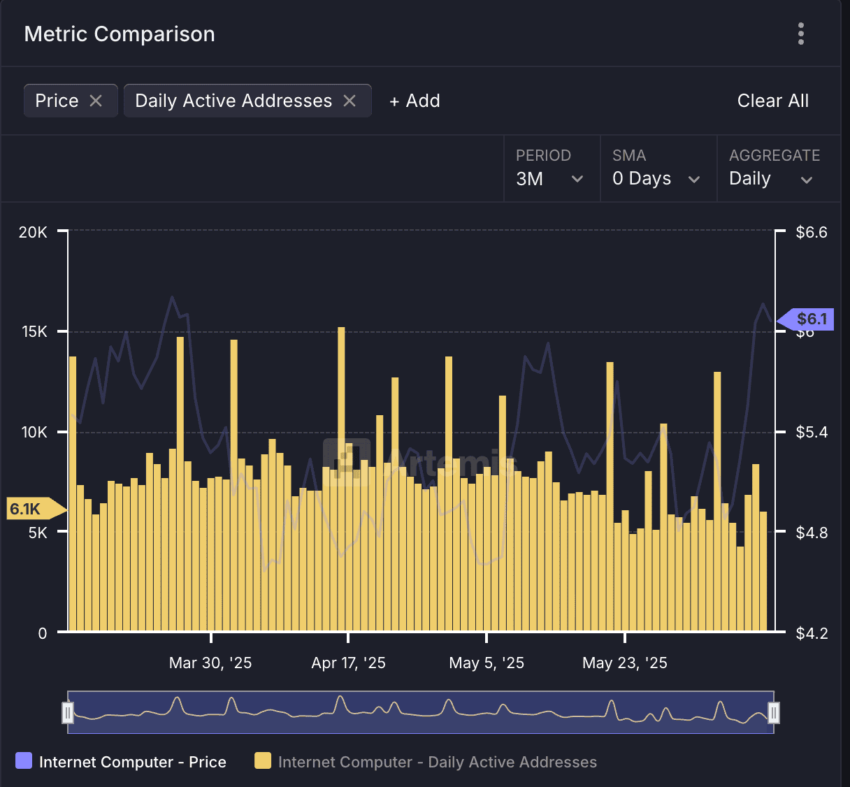

You can track this on Artemis.xyz by monitoring daily transactions and transacting user count for wETH or the chain’s wrapped gas token. A consistent uptick in activity, without price movement, usually means smart capital is preparing to deploy.

When wrapped token activity rises before the price does, it shows capital is moving into position. That’s one of the cleanest signals that a crypto bull market is warming up under the surface.

5. Liquidity changes on DEXs

One of the cleanest early bull market signs is when liquidity quietly deepens on DEXs, even before prices move. It usually starts with core trading pools like wETH/$USDC, $ARB/wETH, or OP/$USDC gradually filling back up.

In this scenario, LPs are adding capital, but price and trading volume are still flat. This isn’t yield hunting. Rather, it’s smart money preparing for volume before it shows up.

Here’s the nuance. If capital is returning to wETH/$USDC, that’s a broad market signal. It means that liquidity providers are expecting movement across the ETH ecosystem, not just in one token.

However, if liquidity is ramping up in a specific pair like $ARB/wETH, that’s a more targeted signal — likely tied to expectations around that token or its chain.

The pattern to watch:

- TVL in DEX pools rising quietly

- No pump, social buzz, or major emissions push

- Just liquidity quietly flowing in

You should track this. Go to DeFiLlama’s Protocol tab, pick a chain like Arbitrum or Base, and check if TVL is rising in key pools even when the price isn’t.

If wETH/$USDC depth is growing, it’s a sign that the broader market is warming up. If project-specific pairs are growing, it means someone expects that token to move.

6. Market response to token unlocks

Most people treat token unlocks as bearish, and usually, they are. New supply hits the market, early holders dump, and the price dips. That’s the default.

It gets interesting when the market absorbs an unlock without flinching, or the event even pushes price up. That’s a sign of real strength, and one more common in early bull markets.

Here’s the signal: If a token with a major unlock sees little to no price dip, or even a price increase shortly after, it means demand is outpacing supply.

Buyers are stepping in and liquidity is soaking up the release. This happens when capital is confident, engaged, and hungry.

You should track this. Check token unlock calendars like TokenUnlocks.app, look at historical unlock events, and compare them to price and volume behavior in the following 24–72 hours.

If a token can handle a large unlock without flinching — especially if price goes up — that’s demand you don’t ignore.

7. Disconnect between on-chain usage and search interest

One of the last but most reliable bull market signs is when on-chain activity quietly rises, but search interest and social chatter stay low. In other words, usage is up, but no one’s talking about it yet.

No spike in Google Trends or trending tokens. Not even any influencer threads. Just real users showing up while retail is still distracted. This disconnect is a setup phase.

You can also track this. Use DappRadar, Artemis, or Chain-specific explorers to monitor daily active wallets, new contract deployments, and transaction counts.

Then cross-check with Google Trends, Twitter/X chatter, or Telegram activity. If usage is up but search volume is flat, that’s not a coincidence — it’s likely early accumulation before attention floods in.

Signals that used to work but now mislead

Some signals get louder the more people believe in them, but louder doesn’t mean smarter. These are the signs many retail traders still follow to try and “confirm” a crypto bull market. But in reality, they’ve become reaction indicators, not early bull market signs. Here’s why they don’t hold up — and where they’ve recently failed.

ETF inflows

ETF hype used to be front-run-worthy. Now it lags.

When the actual ETFs went live, BTC dropped to $39K in the following weeks. The inflows didn’t mark the beginning — they marked the short-term top.

Trending tokens on Twitter/X

If a token is trending, it’s usually too late.

In October 2023, meme coins like $PEPE and $TURBO trended for days on X with huge social engagement. But both had already done 4–6x runs, and once they trended, volume topped out and prices collapsed within a week.

Sudden exchange volume spikes

High volume can signal activity, but not direction.

In August 2023, $APT saw a massive CEX volume spike after a 20% move, only to reverse 18% within 48 hours. Volume came from short-term speculation, not directional accumulation.

These signals aren’t useless, they’re just late. They confirm momentum after it’s started. So, if you’re trying to catch the early signs of a crypto bull run, they’ll leave you chasing green candles.

The real signals — stablecoin flows, bridge activity, DEX liquidity, and the rest — are on-chain, behavioral, and quiet.

Can pros spot a bull market before everyone else?

Yes — if you know what to look for. The earliest bull market signs don’t show up in headlines. As demonstrated throughout this guide, they show up in liquidity flows, on-chain behavior, and how capital moves before attention does. Ignore the noise and watch the setups. The real crypto bull run doesn’t start when prices pump; it starts well before that, when smart money stops waiting.

coindesk.com

coindesk.com

u.today

u.today

cryptoslate.com

cryptoslate.com