Aptos (APT) is up more than 3% in the last 24 hours and 5.3% over the past week, but it remains down 13% in the last 30 days. The move comes just ahead of a $59 million token unlock scheduled for tomorrow, which could introduce short-term volatility.

Despite the recent rebound, APT continues to trade below its monthly highs, with key resistance and support levels now in focus. Technical indicators are starting to turn bullish, but the upcoming unlock and broader market sentiment will likely shape the next major move.

APT Set for $59 Million Unlock – Will It Move the Price?

Aptos will unlock 11.31 million tokens tomorrow, worth around $59 million. This scheduled event takes place on the 12th of each month.

The distribution includes 3.21 million tokens to the community, 3.96 million to core contributors, 1.33 million to the foundation, and 2.81 million to investors.

Despite these regular unlocks, 43.5% of APT’s total supply is still locked. Future releases remain a key part of the token’s overall supply structure.

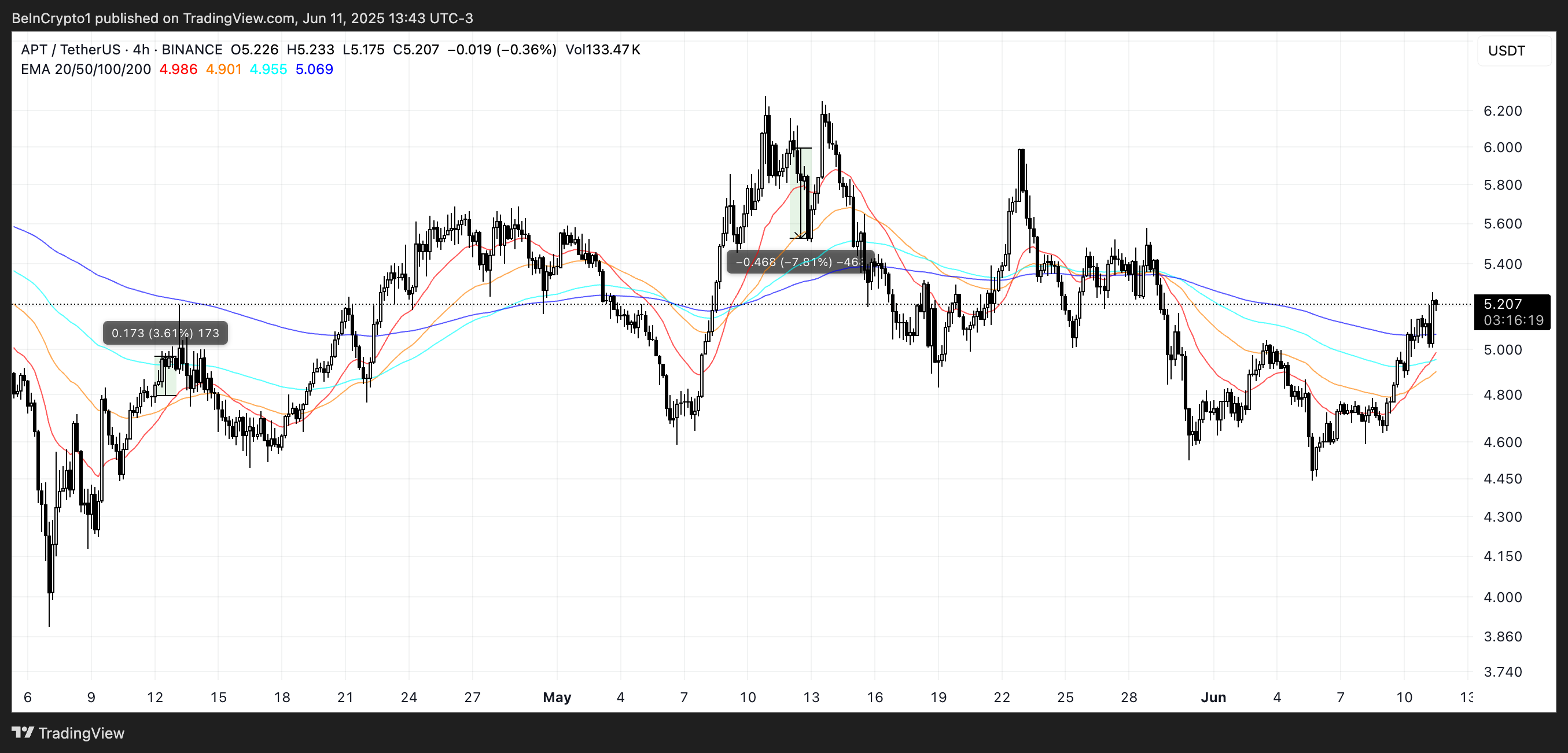

Historically, these unlocks have shown inconsistent impact on APT’s price. After the April unlock, the token rose 3.6% in 24 hours, while the May unlock coincided with a 7.8% drop, indicating no clear pattern of market reaction.

These mixed results suggest that price movements are likely driven more by broader market sentiment and trading dynamics than by the unlocks themselves.

While tomorrow’s event may increase short-term volatility, past data shows it’s not a reliable predictor of price direction.

Directional Momentum Favors Bulls Ahead of APT Unlock

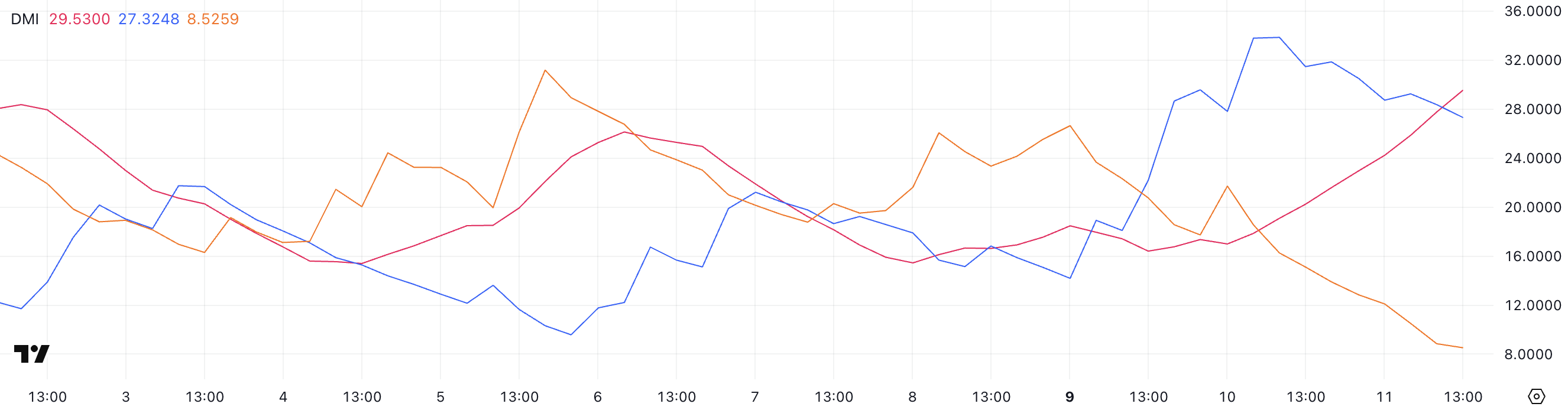

Aptos is showing signs of renewed strength on its DMI chart, with the ADX (Average Directional Index) climbing sharply to 29.53 from 17 just a day earlier.

The ADX measures trend strength, with values above 25 typically indicating a strong trend is underway. The rising ADX suggests momentum is building, even as directional components shift.

The +DI is at 27.32, down from 33.85 yesterday. The -DI has dropped sharply to 8.52 from 21.72. The wide gap between them shows bulls are still in control, even as momentum cools slightly.

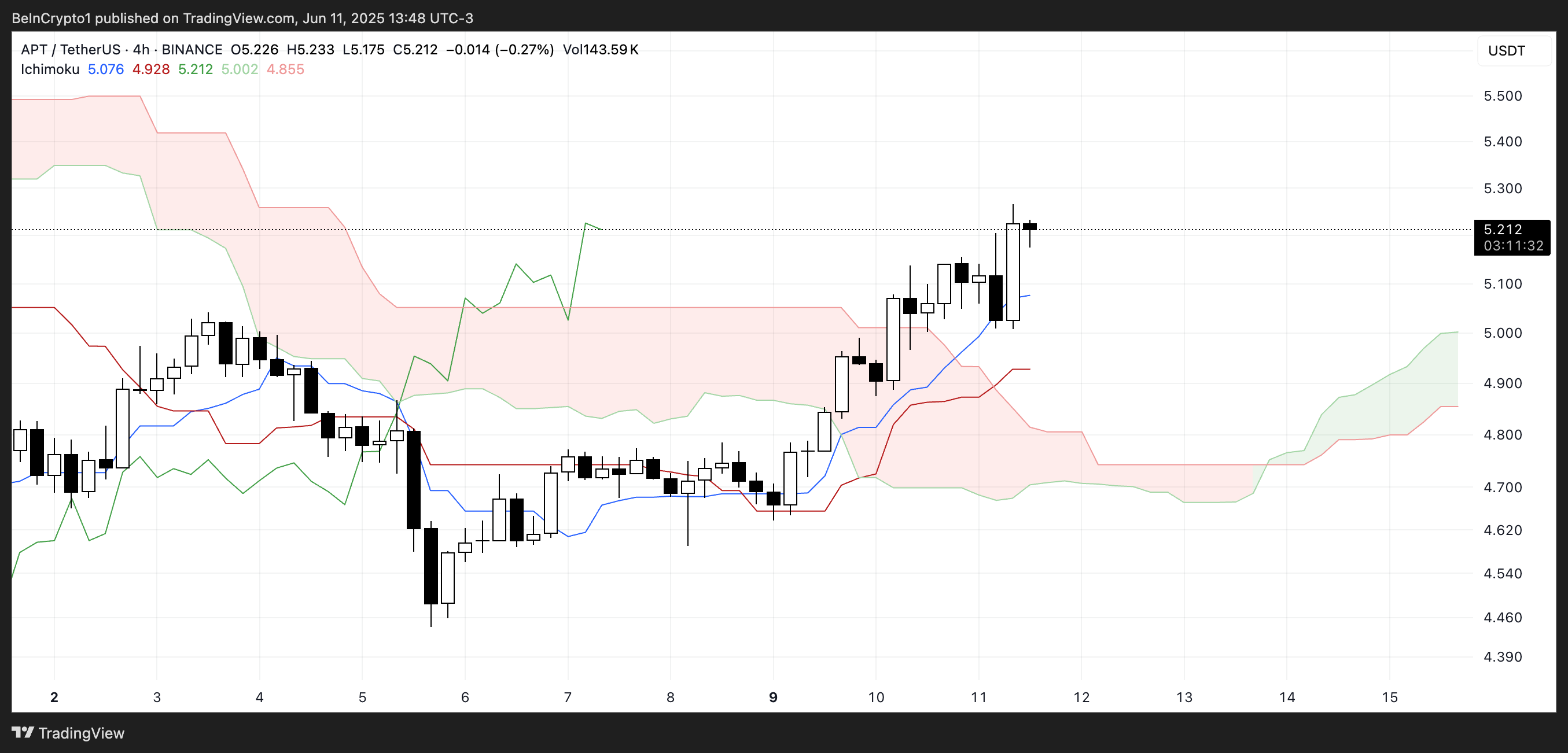

The Ichimoku Cloud also supports this view. Price is above the cloud, which is a bullish signal. The green Leading Span A is turning upward, suggesting the trend may continue.

The blue Tenkan-sen line remains above the red Kijun-sen, indicating short-term momentum remains stronger than the mid-term trend. Additionally, the green Chikou Span is above both the price and the cloud, confirming bullish sentiment.

With the cloud ahead turning green and widening, the chart indicates support is strengthening underneath the current price action, adding further confidence to the upward setup.

Aptos Eyes Golden Cross With Key Support in Focus

APT’s EMA structure is setting up for a potential golden cross, a bullish signal that occurs when shorter-term EMAs move above longer-term ones.

This crossover would confirm growing bullish momentum and could set the stage for an upward move toward the next resistance levels.

If the uptrend continues, APT may attempt to break above the initial resistance zone and potentially extend higher, supported by improving technical sentiment.

However, downside risks remain in play. The $5 level is a key support that was recently tested and held, but if that level fails under renewed selling pressure, it could trigger a deeper pullback.

In that case, APT may decline toward the $4.83 region, and if bearish momentum intensifies, a drop to $4.44 could follow.

Whether the golden cross materializes and holds will likely determine the token’s short-term direction.

beincrypto.com

beincrypto.com