Algorand price has bounced back this month as the crypto market rally accelerated and its network growth continued.

Algorand (ALGO) rose to a high of $0.2075, its highest swing since May 30 and 17% above the lowest point this month. It remains 66% below its highest point since December last year.

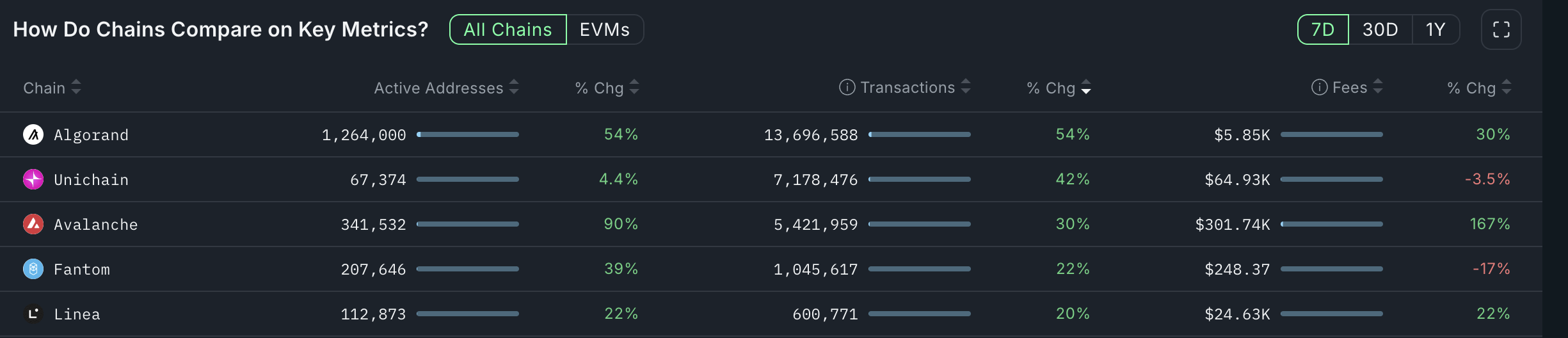

Nansen data shows that Algorand was the best-performing blockchain in the crypto industry over the last seven days. The network handled 13.69 million transactions during that period, a 54% increase from a week earlier. Similarly, active addresses rose by 54% to 1.264 million.

More data shows that the stablecoin supply on Algorand is slowly bouncing back. The stablecoin market cap has jumped by 12% in the last seven days to $53.8 million, up from $41.5 million on May 28.

In a recent X post, the Algorand Foundation said that online stake jumped to 7.1%, crossing the 2 billion milestone for the first time.

Its Real World Asset tokenization total value locked rose by 2.64%, while monthly active users increased by 4.14%. Most of the RWA growth is on Lofty, a tokenized real estate marketplace that has surpassed $50 million in TVL.

May was a great month for Algorand:

— Algorand Foundation (@AlgoFoundation) June 9, 2025

🔒 Online Stake +7.1%

🔨 Asset Creation +4.72%

📈 Monthly Active Users +4.14%

🌎 RWA TVL +2.64%

📊 Transaction Volume +2.2%

We hit 3 billion transactions and 2 billion in online stake ✅

Join our X Space on the 11th to hear what’s next 👇 pic.twitter.com/LfzX8oVqMb

Algorand has been in the spotlight after losing a FIFA deal on NFT to Avalanche (AVAX).

Algorand price technical analysis

The daily chart shows that the ALGO price bottomed at $0.1462 on April 7 before bouncing back. It has formed an ascending channel, connecting the higher highs and higher lows since April 7. This channel is part of a bearish flag pattern, a common continuation signal.

Algorand price remains below the 50-day and 100-day Exponential Moving Averages. It is also consolidating at the 78.6% Fibonacci Retracement level at $0.2083.

Therefore, the token will likely resume the downtrend and potentially retest the key support level at $0.1462, its lowest point on April 8. A move above the psychological level at $0.25 would invalidate the bearish outlook.

news.bitcoin.com

news.bitcoin.com

coindesk.com

coindesk.com

cryptopotato.com

cryptopotato.com