- Tron extends recovery with a bullish start to the week, holding above the range breakout.

- The Total Value Locked on Tron has dropped significantly over the last month, indicating a slowdown in the network.

- The rising Open Interest suggests growing optimism in Tron derivatives as traders anticipate an extended rally.

Tron (TRX) extends gains with an upside move of over 1% at press time on Tuesday, following the 1.88% gains recorded the previous day. Diverging from the declining Total Value Locked (TVL), which signals lowered liquidity, TRX upholds bullish momentum, fueling optimism in the derivatives market.

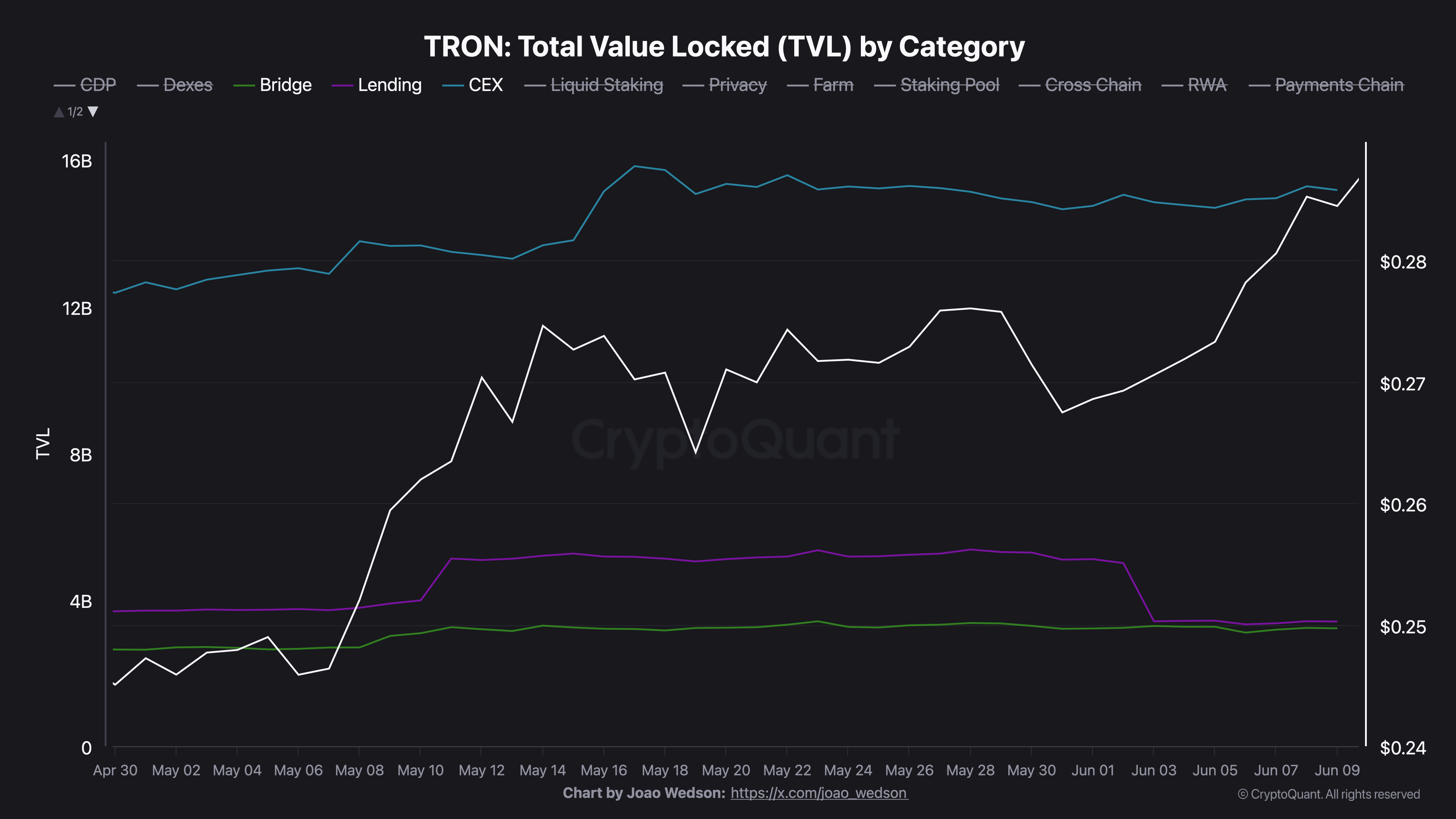

Declining lending activity drops Tron’s TVL

The Total Value Locked on the Tron Network has dropped to $4.909 billion from $6.511 billion so far this month. It signals a massive capital withdrawal from the network, suggesting a decline in users’ confidence and engagement in Tron’s Decentralized Finance (DeFi) ecosystem.

CryptoQuant data reveals that the lending category of Tron takes a massive $1.5 billion hit, dropping to $3.40 billion on June 3. Meanwhile, the Centralized Exchange (CEX) and Bridged assets remain relatively flat.

Tron TVL by Category. Source: CryptoQuant

Notably, a diverging trend between Tron’s TVL and token price was witnessed for the majority of 2024. A similar trend in the rest of 2025 could prolong the TRX rally to potentially new swing highs.

Tron TVL. Source: DeFiLlama

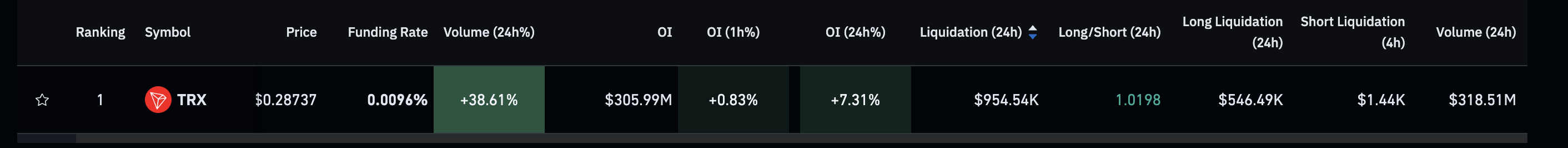

Optimism unshattered in Tron derivatives

CoinGlass data indicates an increase of over 7% in Tron Open Interest (OI) in the last 24 hours, reaching $305.99 million, which suggests rising optimism among derivative traders and additional capital inflows.

A positive shift in the OI-weighted funding rate, reaching 0.0096%, reflects a growth in bullish intent as bulls are willing to pay the premium required to balance swap and spot prices.

Tron Derivatives. Source: Coinglass

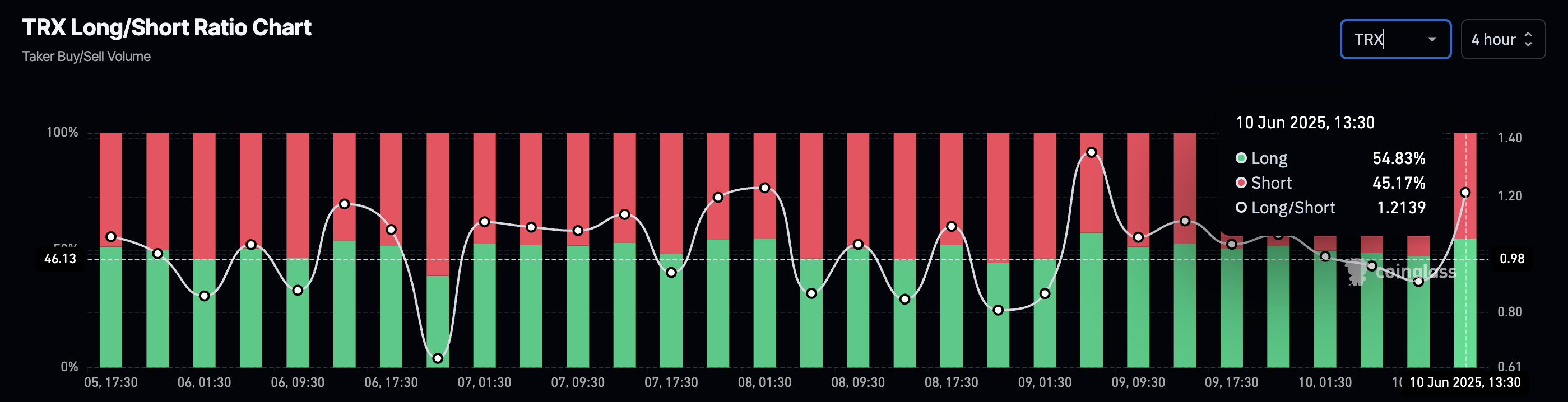

The Long/Short Ratio chart by Coinglass uses Taker buy/sell volume to calculate the ratio. Over the last 4 hours, the buy volume accounts for 54.83% while the short volume is at 45.17%, resulting in the long/short ratio of 1.2139.

TRX Long/Short Ratio Chart. Source: Coinglass

A ratio above 1 relates to a relatively greater number of longs signifying bullish dominance, and vice versa.

Tron range breakout targets $0.3227

Tron trades at $0.2886 at the time of writing, hinting at a second consecutive bullish candle to prolong Monday’s recovery. The altcoin surged by over 3% on Saturday, breaking a price range that had been formed between $0.2654 and $0.2791.

The immediate resistance for the altcoin stands at $0.2969, highlighted by the two peaks on December 12 and December 16.

A decisive daily closing above this resistance could stretch the recovery to $0.3227, aligning with the 50% Fibonacci level, retraced from the highest all-time closing at $0.4334 and the lowest year-to-date closing at $0.2119.

The Moving Average Convergence/Divergence (MACD) indicator and its signal line possess a positive trajectory following the recent bullish crossover in the daily chart, indicating a surge in trend momentum.

The Relative Strength Index (RSI) at 64 spikes higher and closes towards the overbought boundary at 70. Overbought conditions could signal a potential decline in an asset's price. However, a sideways trend is possible above 70 if the uptrend continues.

TRX/USDT daily price chart. Source: Tradingview

Conversely, a slip below the $0.2658 support floor formed by multiple lows in the second half of May will nullify the range breakout.

fxstreet.com

fxstreet.com