Judging by rising institutional interest and capital inflow, Sui (SUI) might be a ‘core pillar’ of the upcoming bull cycle, according to cryptocurrency analyst Michaël van de Poppe.

Accordingly, van de Poppe argued on June 9, that is only a matter of time until we see a new all-time high for SUI.

“SUI remains to be one of the core pillars of the upcoming bull cycle… It’s a matter of time until this one continues to rally towards a new ATH.” — Michaël van de Poppe.

As per CoinMarketCap, SUI now ranks as the 9th highest blockchain by total value locked (TVL). Suilend, a decentralized lending protocol built on Sui, has also seen no less than a 90% increase in TVL over the past month, locking in a total of $700 million.

Likewise, Bitcoin (BTC)-related assets now account for over 10% of SUI’s TVL, while multiple financial institutions have filed for a SUI-based exchange-traded fund (ETF).

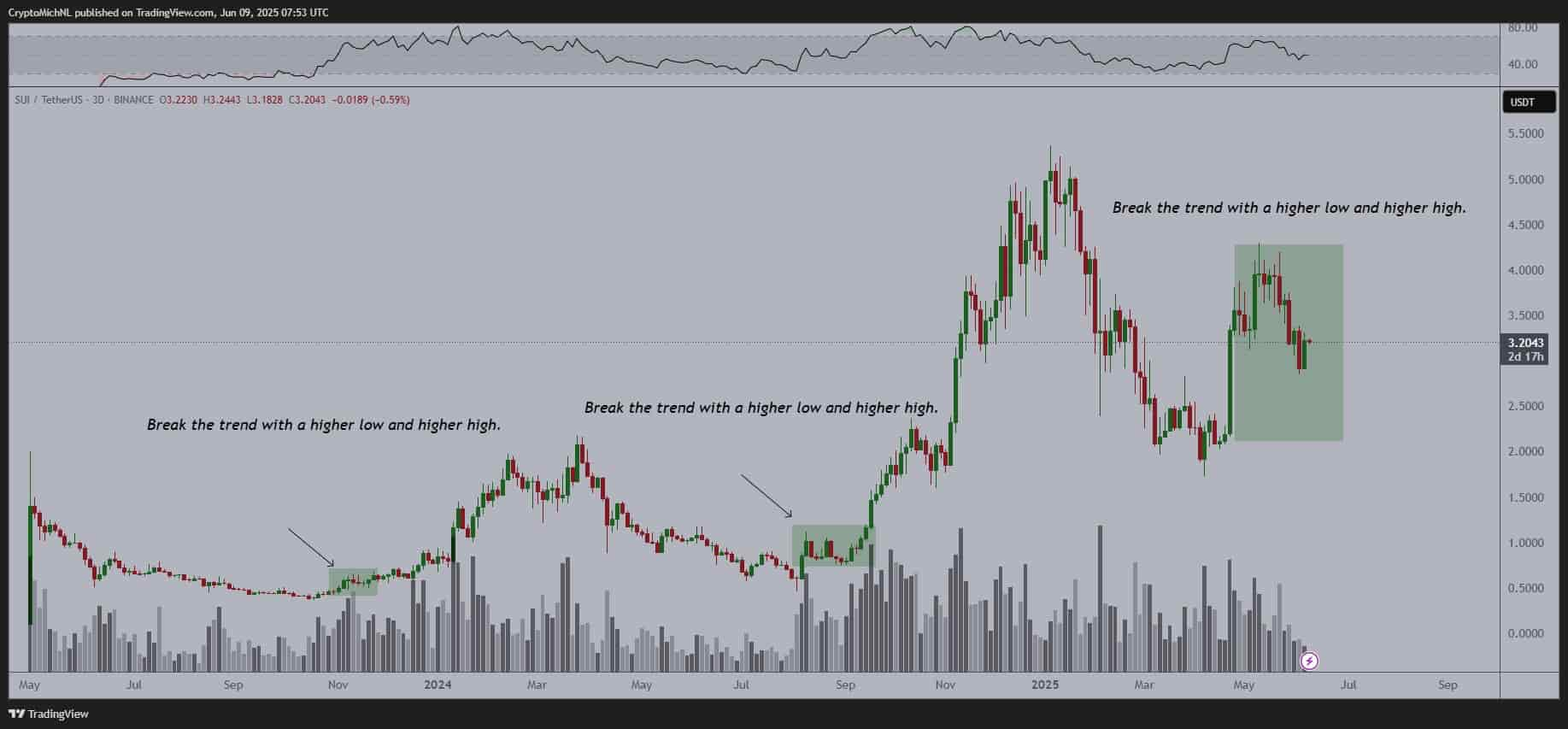

SUI performance

While a significant portion of Sui’s growth is due to BTC-pegged assets and protocols like Babylon and Lombard, the network also boasts over $1.1 billion in circulating stablecoins. The relative strength indicator (RSI) remains neutral at 44.

Moreover, its weighted funding rate has remained positive for nine consecutive days, and the SUI token is breaking out of a long wedge pattern. Both these facts indicate a consistent bullish trend.

Even more notably, SUI has recently shown a golden cross pattern. That is, its short-term (50-day) moving average crosses above the longer-term (200-day) moving average. This pattern is widely regarded as an early indicator of a sustained uptrend. In 2024, it preceded SUI’s 380% rally.

However, traders should remain cautious. Regulatory uncertainty around the delayed SUI ETF approval, for example, remains a near-term risk. What’s more, the golden cross pattern is not an infallible benchmark.

Featured image via Shutterstock

finbold.com

finbold.com

thecryptobasic.com

thecryptobasic.com

u.today

u.today

cointelegraph.com

cointelegraph.com