PEPE risks a pullback to $0.000010 as bearish momentum intensifies, despite large-holder inflows. Will the support level at $0.00001108 hold?

As meme coins mirror Bitcoin’s pullback, Pepe faces a steep correction amid growing bearish momentum. The emergence of an evening star pattern signals a potential decline toward the psychological support level at $0.000010.

PEPE Price Analysis

On the daily chart, PEPE’s price action shows a bullish failure to surpass the 50% Fibonacci retracement level at $0.00001212. With a 3.59% drop on Wednesday, PEPE formed an evening star pattern near a critical support-turned-resistance level.

This marks a post-breakout retest turnaround for PEPE, raising the risk of a drop below the 50-day EMA at $0.00001146. If the bearish trend persists, the 200-day EMA at $0.00001108 remains the next crucial support level.

However, if bearish pressure continues, PEPE could retest the next key supply zone near $0.0000090.

Essentially, this short-term reversal underscores the growing risk of the meme coin losing the $0.000010 psychological support.

Supporting this downside risk, the daily RSI remains below the midpoint, signaling a gradual increase in bearish momentum.

On the flip side, a breakout above the 50% Fibonacci level could pave the way for a rally toward last month’s peak at $0.0000155.

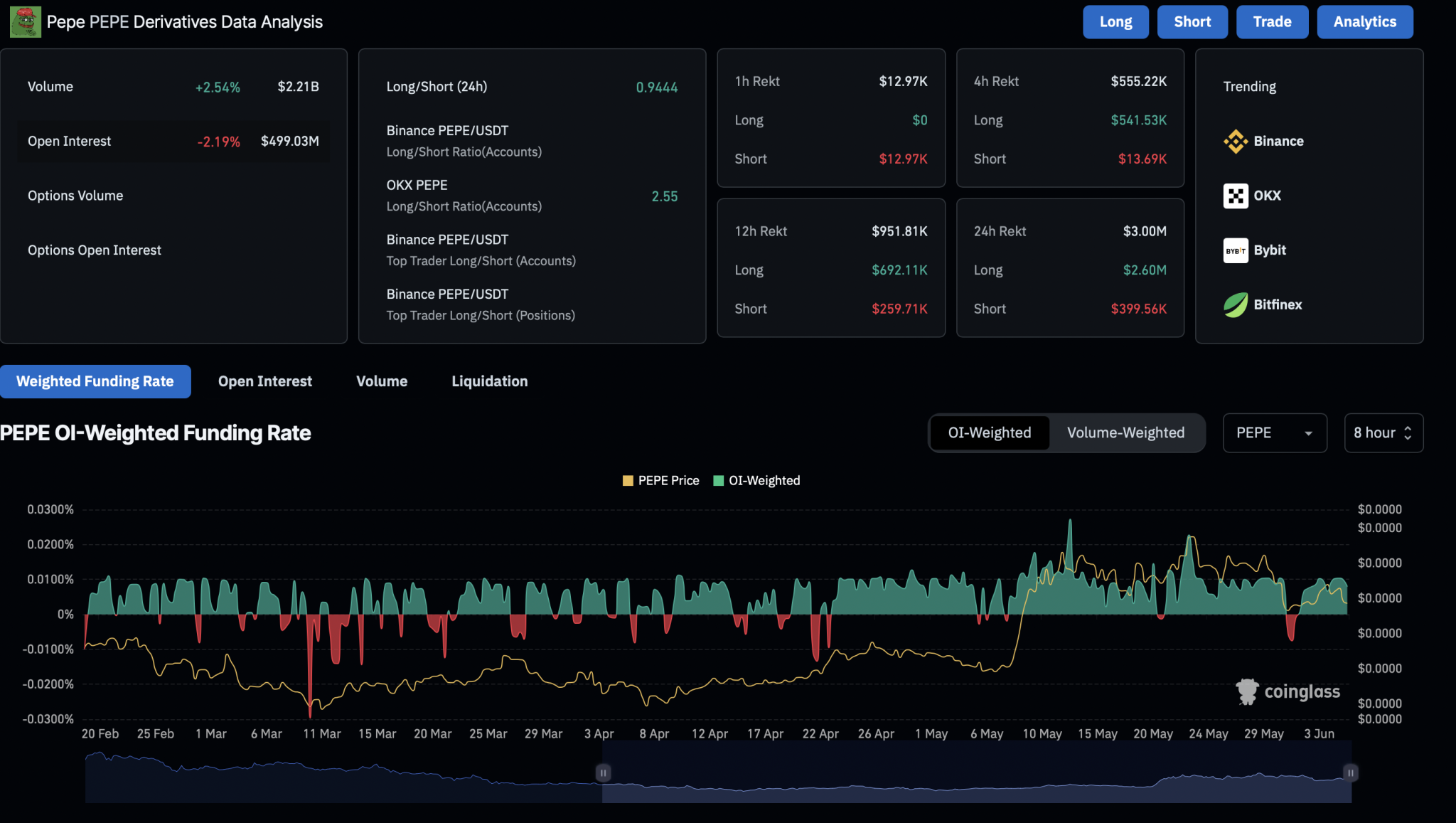

Pepe Derivatives Reveal Bears in Action

Amid the rising pullback risk, derivatives interest in Pepe has turned negative. Open interest is down 2.19% to $499 million. Meanwhile, long liquidations have surged to $2.6 million in the past 24 hours, indicating a major wipeout of bullish positions compared to just $399K in short liquidations.

Additionally, the funding rate has declined to 0.0079%, reflecting weakening bullish sentiment in trading activity. Data from CoinGlass points to a potential pullback in Pepe amid increasing market volatility.

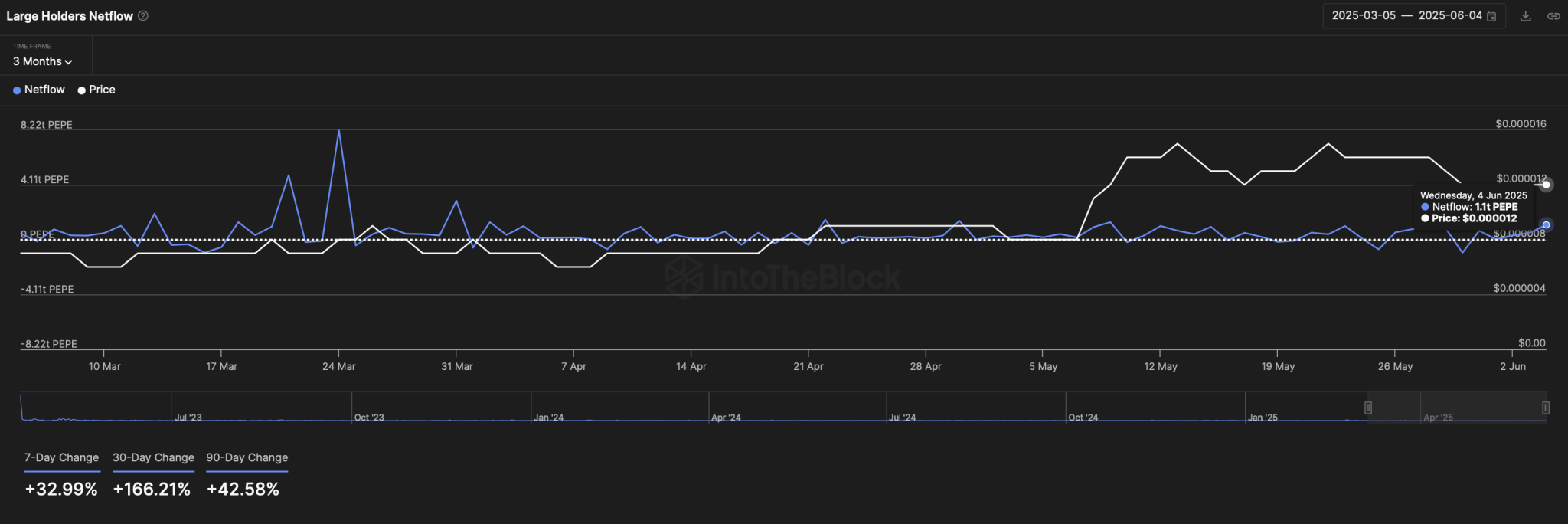

Large Holder Netflow Surge Signals Growing Confidence

According to IntoTheBlock data, net inflows from large holders have risen nearly 33% over the past seven days. On June 4, net inflows reached 1.1 trillion PEPE, indicating significant accumulation and rising investor confidence.

Positive net flow trends over the past 30 and 60 days further support the possibility of a bullish reversal in Pepe.

thecryptobasic.com

thecryptobasic.com