Dogecoin is holding near the $0.1869 support level. Will a bounce trigger a breakout rally toward $0.50, or will DOGE fall to $0.14? A trader eyes a potential 2x breakout rally.

As the crypto market sees top altcoins in a weak position, Dogecoin is trading at $0.19. Last week, the largest meme coin fell by nearly 14%, extending its intraday decline to $0.1869. Dogecoin is expected to sustain support at the crucial 23.60% Fibonacci retracement level of $0.1869.

Dogecoin Analysis

On the daily chart, Dogecoin’s price action shows a bullish failure to surpass a long-standing resistance trendline near the 50% Fibonacci level at the psychological mark of $0.25. With a bearish reversal, Dogecoin has breached the 200-day, 100-day, and 50-day EMAs to test the 23.60% Fibonacci level at $0.1869.

With a couple of long-tailed Doge candles appearing over the weekend, the meme coin has managed to stay above the support level. However, the MACD and signal lines have formed a bearish crossover and are approaching the center line, indicating growing bearish momentum.

As the MACD and signal lines continue to decline, the likelihood of a steeper correction in Dogecoin increases. Furthermore, the downward movement in the 50- and 100-day EMAs has delayed the possibility of a bullish crossover that could signal a trend reversal.

A potential cup-and-handle pattern remains in play for Dogecoin if it rebounds from the 23.60% Fibonacci level. To re-test the resistance near the $0.25 supply zone, the meme coin must break above the long-standing resistance trendline. Doing so would increase the probability of a breakout rally, potentially targeting the 78.60% Fibonacci level at $0.3618.

On the other hand, a daily close below $0.1869 would likely extend the decline toward the $0.14 support level.

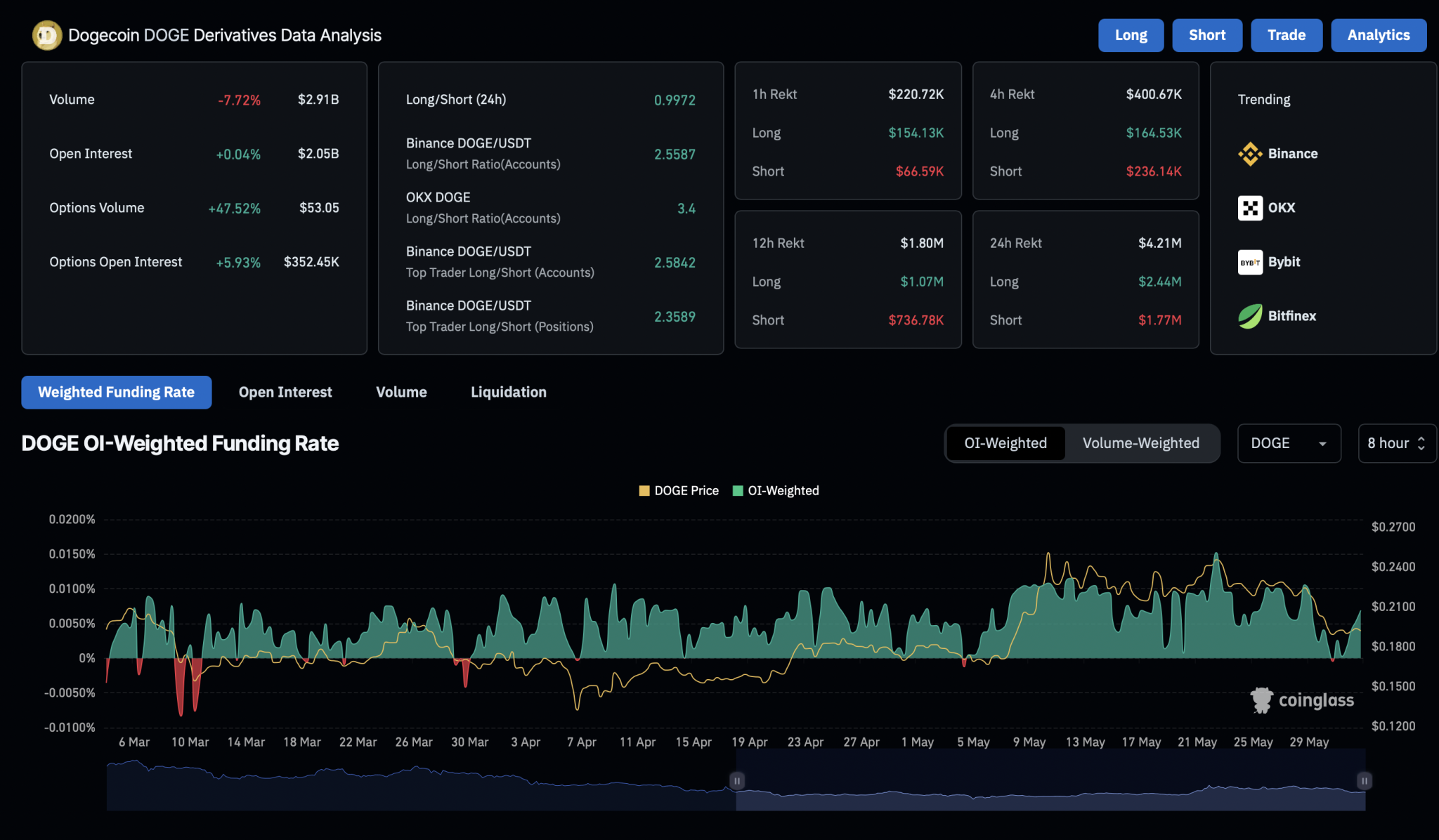

Neutral Grounds in Derivatives Market

Despite Dogecoin’s short-term pullback, the derivatives market remains neutral on the meme coin. DOGE open interest has remained relatively unchanged at $2.05 billion, while the long-to-short ratio at 0.9972 is nearly balanced.

However, liquidation data suggests a slight bearish tilt, with long liquidations rising to $2.44 million, compared to $1.77 million in short liquidations. Despite a larger wipeout of bullish-aligned traders, ongoing trading activity indicates a mildly bullish bias.

This is supported by the funding rate spiking to 0.0069%, reflecting optimism among Dogecoin traders. This increases the likelihood of a leverage-driven recovery that could complete a bullish pattern.

Analyst Predicts 2x rally in DOGE

Adding to the bullish outlook, crypto analyst Tardigrade has highlighted the potential for a new bull run in Dogecoin. The analyst points to a breakout from a base-three pattern within a step-like parabolic curve formation.

At the end of the third base, the analyst predicts Dogecoin could deliver a 2x return, potentially surpassing the $0.50 psychological level.

thecryptobasic.com

thecryptobasic.com