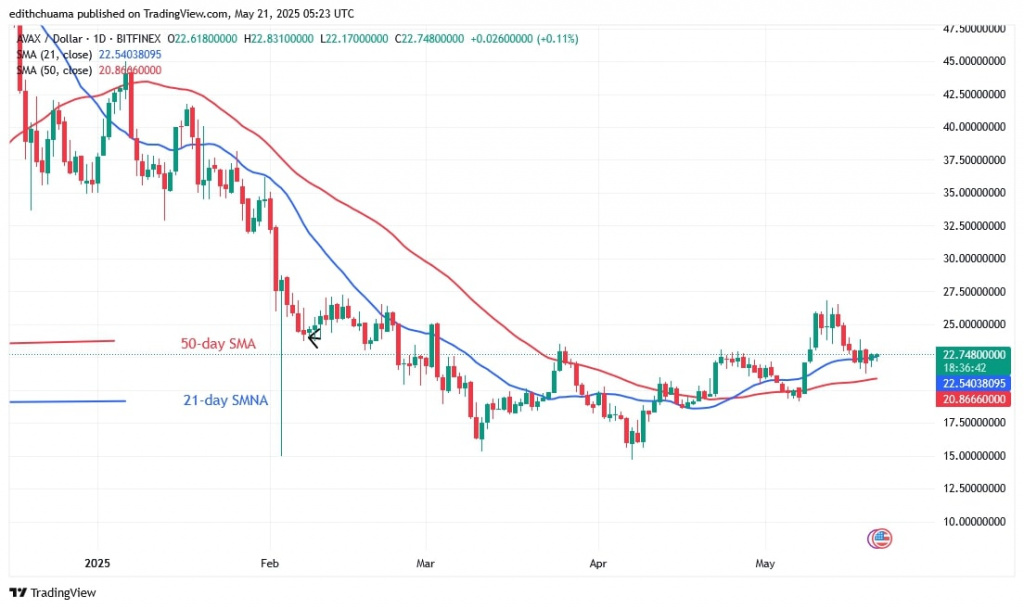

Avalanche (AVAX) has continued its uptrend after retracing above the 21-day SMA.

Avalanche price long-term analysis: bullish

The cryptocurrency was pushed back after hitting a high of $26.82. The altcoin has pulled back above the moving average line. Since May 17, AVAX has been trading above the 21-day SMA support but below the resistance at $26.

The altcoin began its upward movement today. A breakout above the $26 mark will catapult the altcoin to a high of $35. However, the price of the cryptocurrency is rising steadily and remains above the 21-day SMA.

AVAX will come under renewed selling pressure if the bears break the 21-day SMA support. The altcoin will fall below the moving average lines and hit a low of $20.

In the meantime, the price of the altcoin continues to fluctuate above the 21-day SMA support. AVAX is currently worth $22.52.

Analysis of the Avalanche indicator

On May 12, the cryptocurrency was pushed back as shown by a long candlestick wick pointing to the $26 barrier. The decline has paused above the 21-day SMA support as the altcoin begins a range-bound rise above the current support. AVAX will be forced to execute a bound move as it is confined between the moving average lines on the 4-hour chart.

Technical Indicators:

Key Resistance Levels – $60 and $70

Key Support Levels – $30 and $20

What is the next direction for Avalanche?

AVAX is bearish below the moving average lines but has started to meander sideways below these lines.

AVAX is trading above the $21 support but below the moving average lines and resistance at $24. Doji candlesticks have emerged above the $22 support, causing the altcoin to fluctuate in a range.

Coinidol.com reported on May 12 that AVAX was at a minor retracement above the moving average lines. The altcoin's bullish rise could continue if it retraced above the $23 level.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

coindesk.com

coindesk.com

thecryptobasic.com

thecryptobasic.com

news.bitcoin.com

news.bitcoin.com