Hedera’s Long/Short ratio has soared to a 30-day high, signaling a bullish shift in market sentiment.

This comes amid severe market volatility and huge long liquidations across many assets. With growing bullish sentiment, $HBAR could reverse its downward trend and record gains in the near term.

$HBAR Shows Bullish Signs as Long Positions Surge

Despite a broader market downturn that has weighed on altcoin prices, $HBAR is bucking the trend in terms of investor positioning.

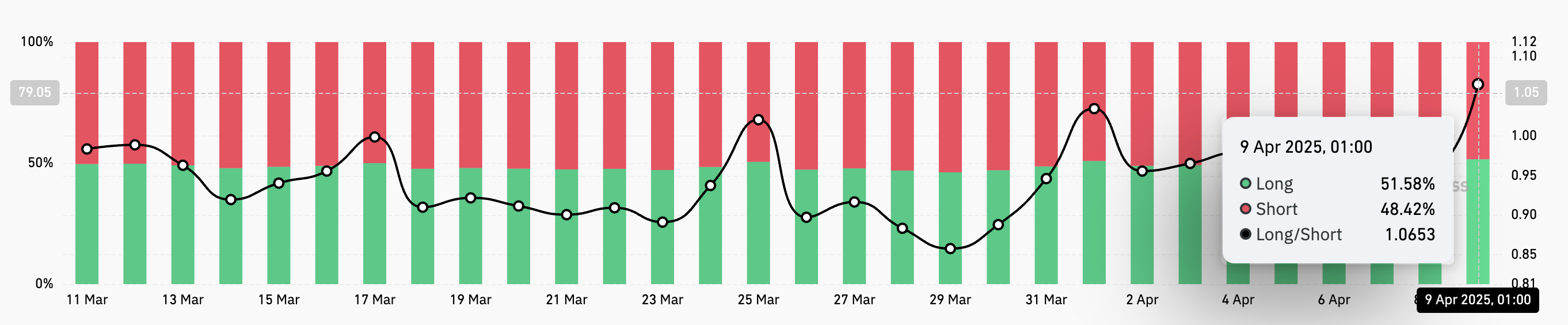

Coinglass data shows that many traders are entering long positions on the token, indicating growing confidence in a potential upside move. This is reflected by its Long/Short, which currently sits at a 30-day high of 1.06 at press time.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market. A ratio below one means there are more short positions than long positions.

Conversely, as with $HBAR, when an asset’s long/short ratio is above one, more traders are holding long positions than short positions, indicating a bullish market sentiment.

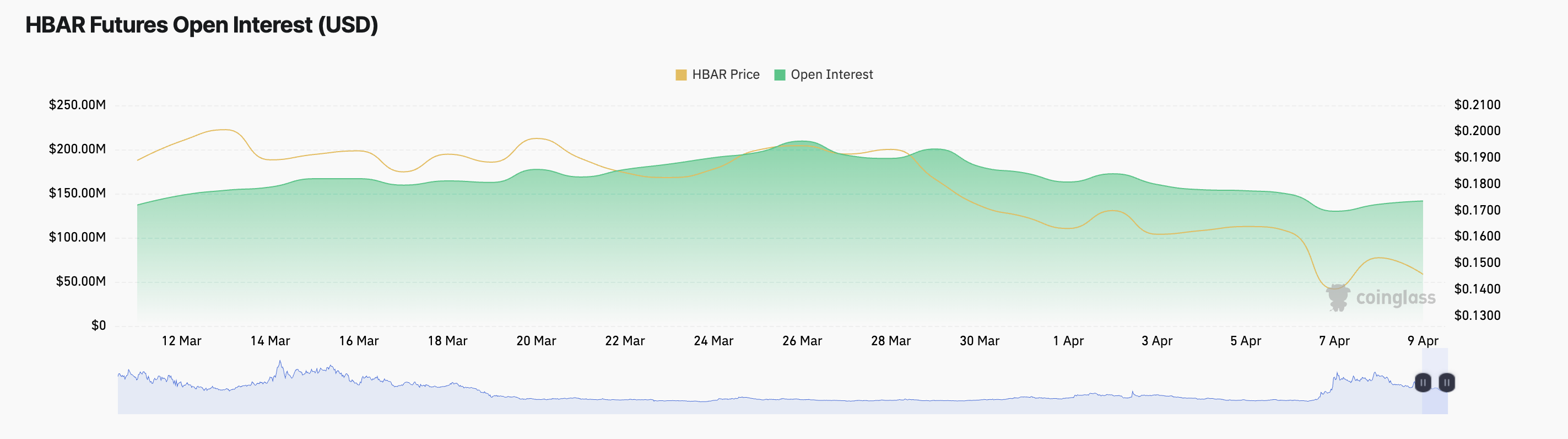

Further, $HBAR’s open interest has climbed, supporting this bullish outlook. As of this writing, it is at $142 million, rising 3% in the past 24 hours. Notably, during this period, $HBAR’s price is down 2%.

When an asset’s price falls, but open interest rises, it suggests that traders are still actively entering new positions, potentially anticipating a future price rebound despite the current decline.

A combined reading of $HBAR’s long/short ratio and rising open interest amid falling prices signals that the majority of its traders have a bullish outlook. This indicates that even with price declines, $HBAR traders anticipate an upward trend in the near future.

Profit-Taking Threatens $HBAR’s Rally

At press time, $HBAR exchanges hands at $0.15. The gradual resurgence in bullish sentiment and new demand could reverse its current downtrend and push $HBAR toward $0.17.

However, if profit-taking continues and bullish pressure becomes subdued again, $HBAR could contain its decline and fall to $0.11.

u.today

u.today

coinpedia.org

coinpedia.org

cryptopolitan.com

cryptopolitan.com