Hedera remains under heavy pressure, marking yet another day of decline as traders continue to bet against the altcoin. It trades at $0.18 at press time, noting a 2% price drop over the past 24 hours.

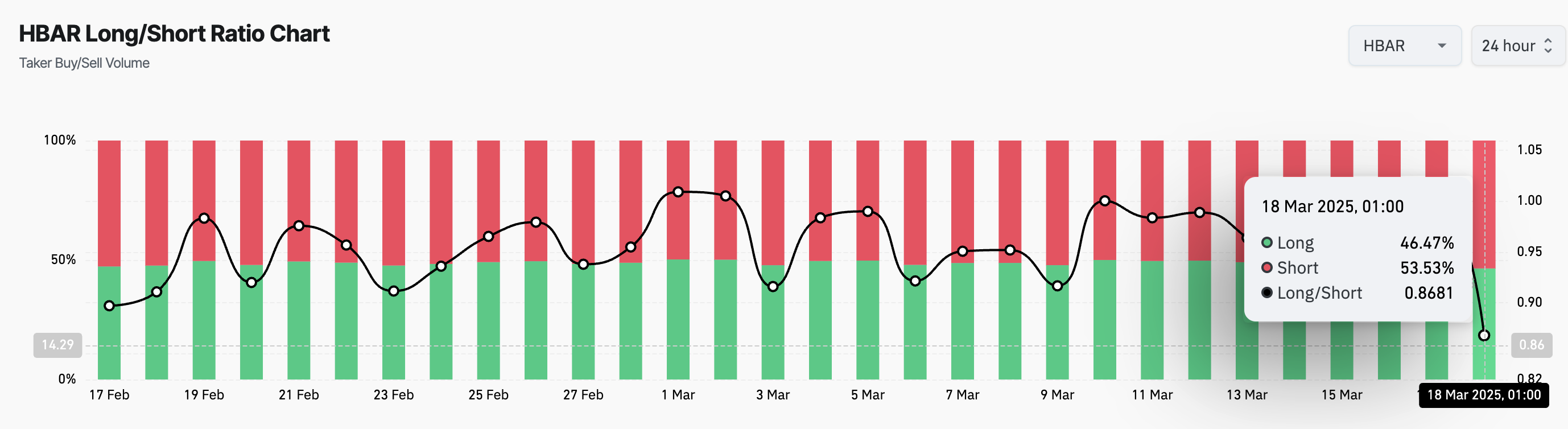

With its long/short ratio signaling a surge in short interest, market sentiment has turned increasingly pessimistic.

Short Sellers Tighten Grip on $HBAR

$HBAR’s long/short ratio has dropped to 0.86, its lowest level in a month. This reflects a sharp increase in short positions among derivatives traders.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market. A ratio below one means there are more short positions than long ones. This indicates that traders are predominantly bearish on $HBAR and hints at a higher likelihood of continued downside movement.

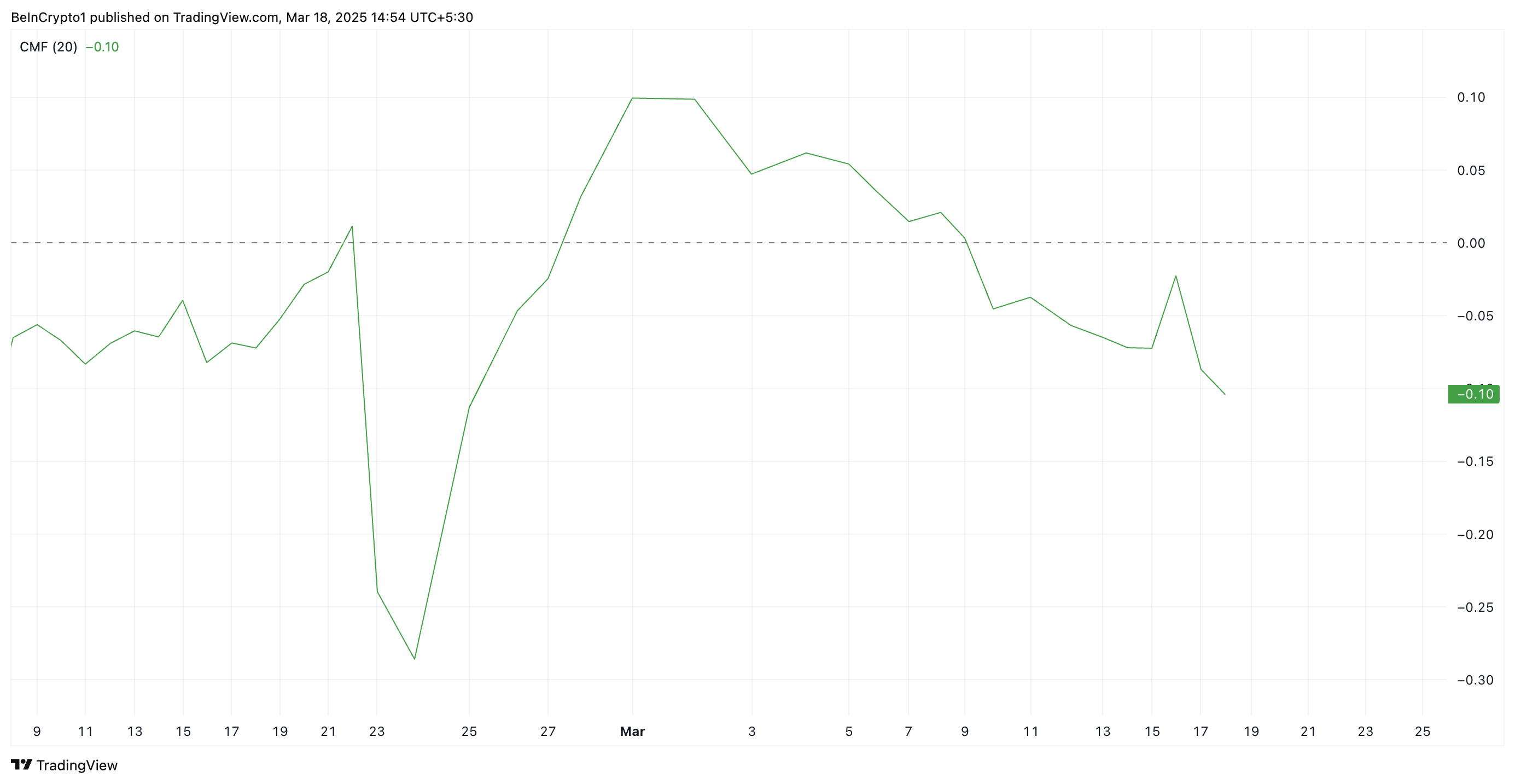

Further, $HBAR’s negative Chaikin Money Flow (CMF) on the daily chart supports this bearish outlook. This indicator, which measures how money flows into and out of the asset, is below zero at -0.10 when writing.

$HBAR’s negative CMF reading suggests high selling activity, with its sellers dominating the market and looking to push prices lower.

$HBAR Traders Brace for Volatility as Price Flirts with Key Support Levels

The growing demand for short positions highlights investors’ expectations of further downside, raising concerns about $HBAR’s ability to hold above the critical support level formed at $0.17.

If it fails to hold, the token’s price could plummet to a multi-month low of $0.11, which it last traded at in November.

However, a resurgence in demand for the altcoin could invalidate this bearish projection. If buyers regain market dominance and increase demand, $HBAR could rebound toward $0.22.

Should $HBAR successfully breach this resistance zone, its price could reach $0.26.

u.today

u.today

finbold.com

finbold.com

coindesk.com

coindesk.com

thecryptobasic.com

thecryptobasic.com