Since January 17, Hedera ($HBAR) has been on a downward trajectory, shedding 20% of its value as selling pressure intensifies. The altcoin has since traded below a descending trendline, indicating persistent bearish sentiment in the market.

As demand for the altcoin continues to plummet, $HBAR risks extending its price drop. This analysis has the details.

Hedera Bears Overrun Market

BeInCrypto’s assessment of $HBAR’s price performance on a daily chart reveals that the altcoin has traded below a descending trendline since January 17. The token trades at $0.31 at press time, noting a 20% price decline since then.

A descending trendline is a bearish pattern that connects a series of lower highs in an asset’s price movement, indicating a consistent downtrend. When an asset trades below this trendline, it suggests that the price is under bearish pressure and the prevailing market sentiment is bearish.

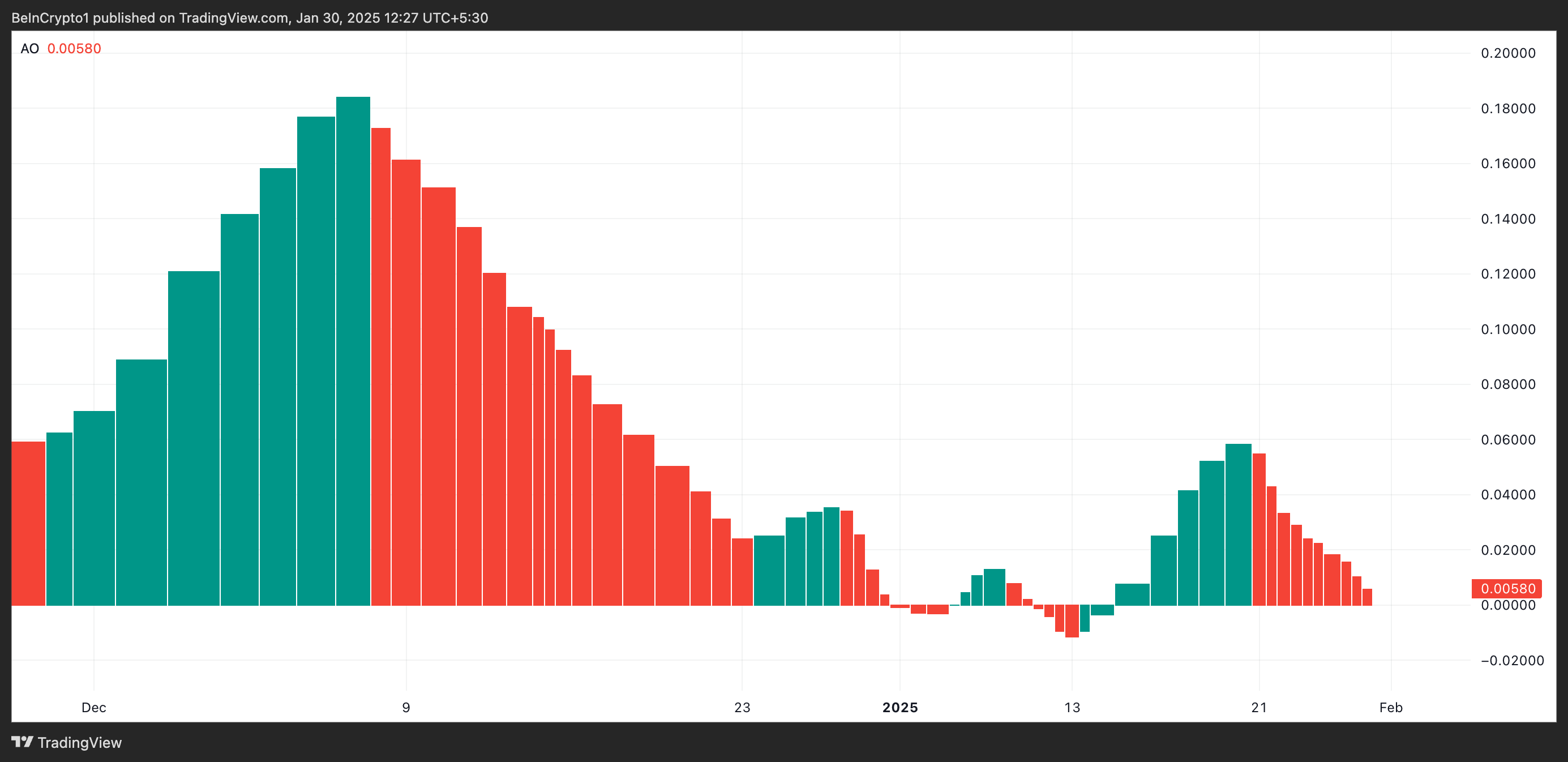

Readings from $HBAR’s Awesome Oscillator (AO) confirm this prevailing bearish sentiment. For context, this momentum indicator has posted only red histogram bars since January 21, indicating that $HBAR has been trailed by negative bias for a while.

An asset’s AO measures market momentum by comparing the difference between two simple moving averages (SMA) of an asset’s price. When its bars are red, it indicates a shift towards bearish momentum, suggesting that sellers are gaining strength and the market may be poised for further downside.

$HBAR Price Prediction: Token Under Threat of 18% Decline to $0.26

If sellers retain market control, $HBAR risks falling 18% to trade at $0.26. According to its Fibonacci Retracement tool, if selloffs increase at this point, that support level may not hold, and the token’s price could drop further to $0.22.

However, a positive shift in market sentiment could prevent this from happening. If $HBAR witnesses a spike in buying pressure, its price could rebound and climb toward its multi-year high of $0.40.

cryptopolitan.com

cryptopolitan.com

cryptoslate.com

cryptoslate.com

coingape.com

coingape.com

cryptobriefing.com

cryptobriefing.com