Over the past day, Hedera’s price has risen nicely, moving up from its previous level of $0.28 to now trade at $0.335, marking an increase of over 11.5%. Although it briefly peaked at $0.347, it has had trouble constantly staying above that key Fibonacci level. Meanwhile, Hedera’s trading volume over the last 24 hours has surged by 93.7%, reaching $1.35 billion.

Zooming out, Hedera’s price fell below $0.39 on December 3 and has been trending downward since. After stabilizing between $0.23 and $0.25 for some time, Hedera has started to recover, avoiding further declines. As a result, its market capitalization has grown by 11.7% to $12.93 billion in just one day.

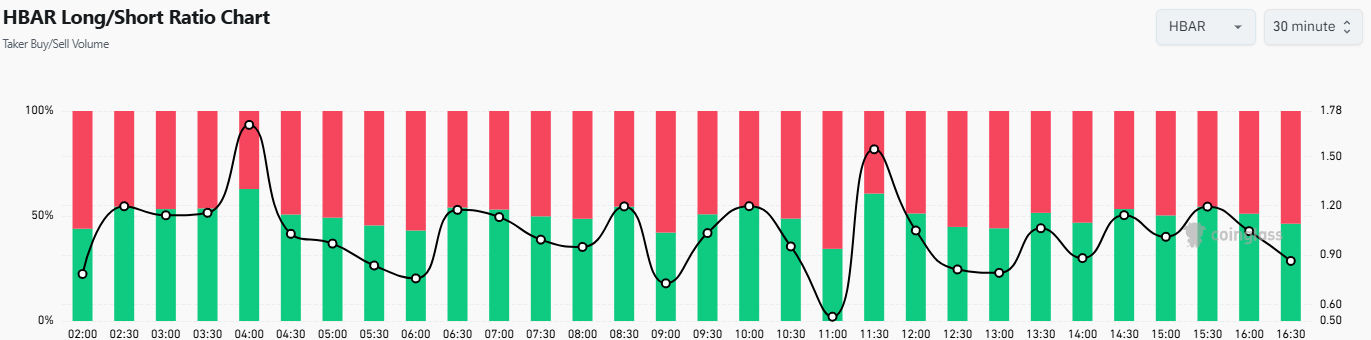

$HBAR Faces Drop in Long/Short Ratio

On Wednesday, Bitcoin and other cryptocurrencies saw a significant increase in value, adding nearly $100 billion to their total market capitalization after reports that the US Consumer Price Index (CPI) for December had risen to 2.9%.

In the last 24 hours, trading activity around Hedera ($HBAR) has been intense, with equal action from both buyers and sellers. According to Coinglass, there was a total liquidation of around $2.67 million in Hedera trades. Of this, $1.28 million came from buyers closing their long positions.

$HBAR) Price Prediction for January 16 2">

$HBAR) Price Prediction for January 16 2">Following this recent price jump, there has been more interest in trading Hedera. The open interest, which reflects the total number of outstanding derivative contracts, has risen to $415 million, showing increased demand. However, despite the current upward trend, the market could shift to a bearish (downward) trend as the ratio of long to short positions has been falling.

Currently, the long/short ratio is at 0.86, indicating a rise in short positions—trades betting that prices will fall. This means more traders are expecting a decrease in prices soon. Right now, 46.3% of traders anticipate a price increase in Hedera, while 53.7% are betting against it.

Hedera Price Prediction: Technical Analysis

Following the release of CPI data, $HBAR price sharply rose from the low of $0.3 to over $0.34 in just a few hours. However, it faced intense selloff from STHs, resulting in a consolidation around the EMA20 trend line on the 1-hour chart. As of writing, $HBAR price trades at $0.335, surging over 10% in the last 24 hours.

$HBAR) Price Prediction for January 16 3">

$HBAR) Price Prediction for January 16 3">The $HBAR/USDT trading pair continues to hover around $0.34, which could be a major obstacle. If the price falls below the EMA20 trend line on the 1-hour chart, the sellers will likely try to push it back down to $0.28 at the downtrend line.

However, the RSI level continues to trade above the midline at level 61, which might trigger a retest of the resistance channel. If the price manages to hold above $0.35, it would favor the buyers. The trading pair could then increase to $0.4.

Hedera Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, Hbar price might continue to struggle around $0.35. If the price moves above that level, we might see a trade around $0.38.

Long-term: According to the current Hedera Hashgraph price prediction on Coincodex, the price of Hedera Hashgraph is expected to increase by 25.33% and reach $0.417329 by February 15, 2025. The technical indicators on Coincodex suggest a bullish sentiment, while the Fear & Greed Index indicates a level of 75, which represents ‘Greed’. Over the last 30 days, Hedera Hashgraph has had 14 out of 30 green days, with a price volatility of 5.25%. Based on these forecasts, Coincodex suggests that it is now a good time to buy Hedera Hashgraph.

newsbtc.com

newsbtc.com

ambcrypto.com

ambcrypto.com

u.today

u.today