Hedera Hashgraph ($HBAR) has struggled to maintain significant momentum, with its price action reflecting a bearish-neutral trend over the past month. Despite its potential, $HBAR has faced difficulties rallying due to declining market enthusiasm.

Even long-time $HBAR supporters appear to be pulling back as market conditions weigh on investor sentiment.

$HBAR Traders Are Disappointed

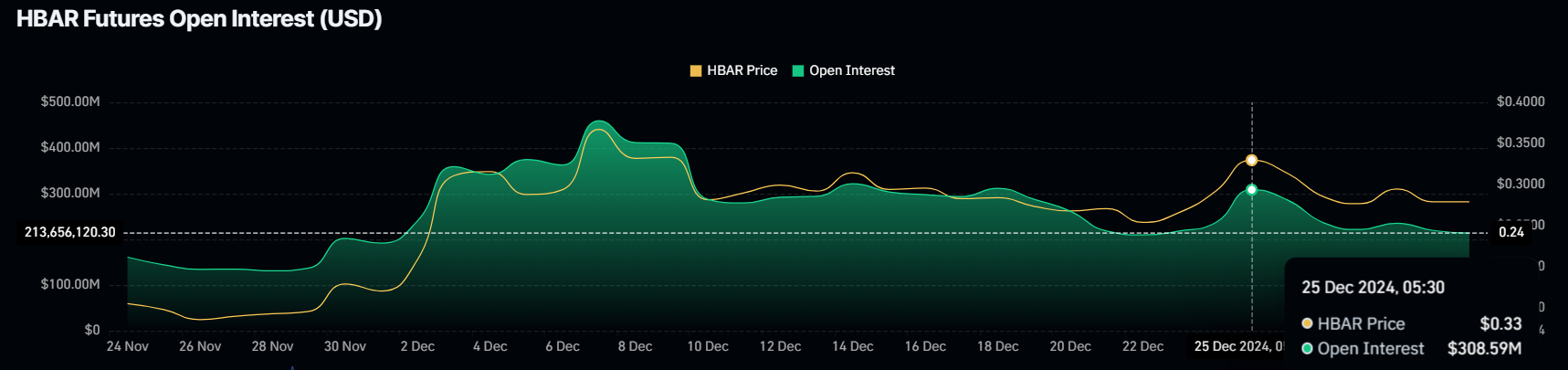

$HBAR’s Open Interest has dropped by $95 million in just six days, highlighting a notable decline in trader activity. This significant reduction reflects traders pulling their funds out of the asset, dampening liquidity and trading volume. The prolonged consolidation period is eroding confidence, reinforcing a bearish sentiment across the $HBAR market.

The persistent lack of price movement has led traders to reduce exposure as expectations for short-term gains dwindle. This shift in sentiment has compounded bearish pressure, making it increasingly challenging for $HBAR to build the momentum needed to stage a recovery. The asset remains stuck in a cycle of uncertainty.

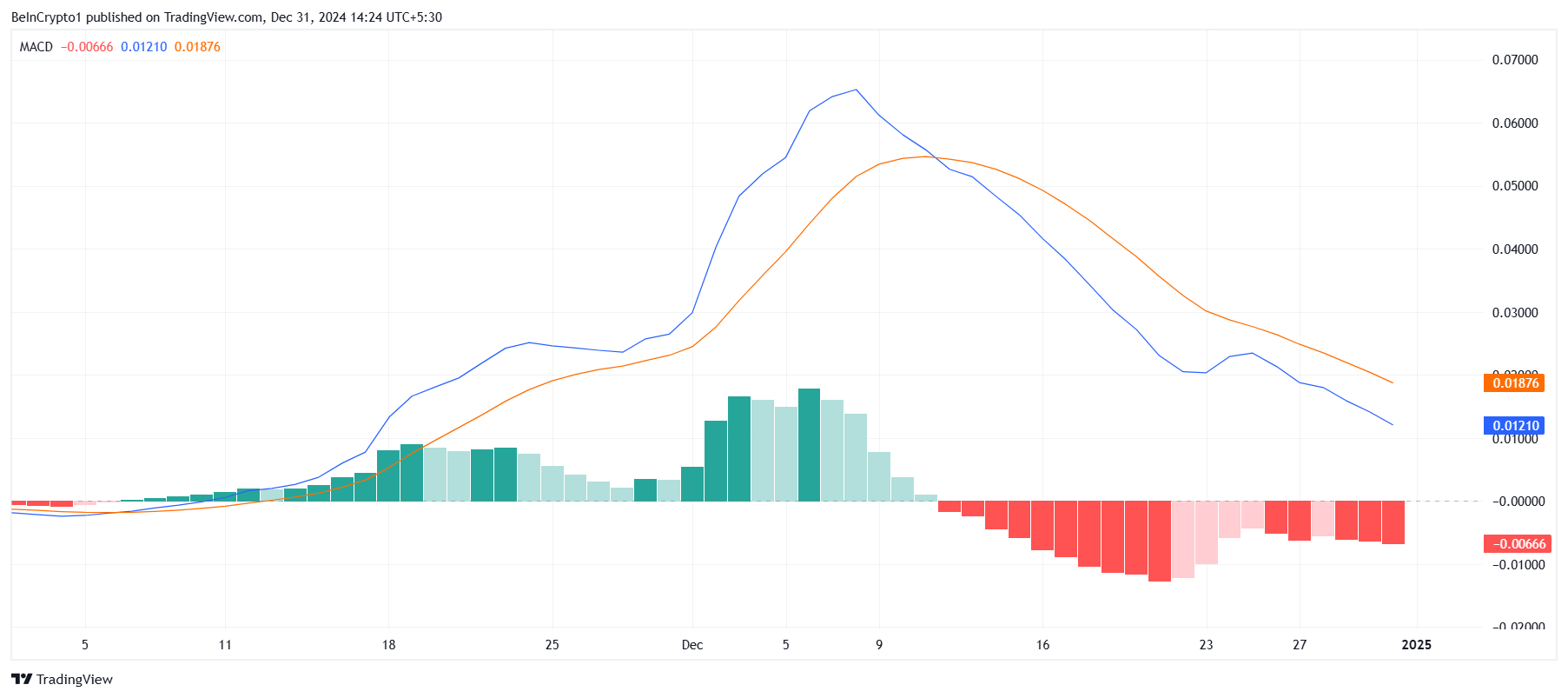

Technical indicators paint a worrying picture for $HBAR’s macro momentum. The Moving Average Convergence Divergence (MACD) indicator shows bearish momentum strengthening after a brief pause, signaling increased selling pressure. This shift indicates that the downtrend may accelerate, further limiting $HBAR’s ability to break out of its current range.

The bearish divergence is concerning, as it was expected to ease but has instead gained pace. This renewed momentum suggests $HBAR’s price could remain under pressure unless significant bullish catalysts emerge. Without a reversal in macro trends, the altcoin may face additional headwinds in the coming months.

$HBAR Price Prediction: Arranging A Breakout

$HBAR has been consolidating between $0.39 and $0.25 for over a month, struggling to break out of this tight range. With the current price at $0.27, the all-time high of $0.57 remains 109% away. To reach $0.57 and potentially set a new $ATH, $HBAR would require sustained bullish momentum akin to its 637% rally in November.

While a rally of that magnitude is unlikely in January 2025, even moderate momentum could push $HBAR higher. However, failure to breach $0.39 could extend the consolidation or lead to a decline below $0.25. In this scenario, $HBAR might drop as low as $0.18.

Thus, breaking above the consolidation range of $0.25 to $0.39 is crucial for initiating an uptrend and restoring market confidence. $HBAR achieving performance similar to November and posting a new $ATH would depend on favorable market conditions and renewed investor interest, both of which remain uncertain for now.

ambcrypto.com

ambcrypto.com

u.today

u.today

newsbtc.com

newsbtc.com