Avalanche ($AVAX) has needed help recovering its losses in this volatile crypto market. Compared to other Layer-1 (L1) blockchains, $AVAX consolidation could have been faster, raising concerns about its future performance.

$AVAX Funding Rate Turns Positive

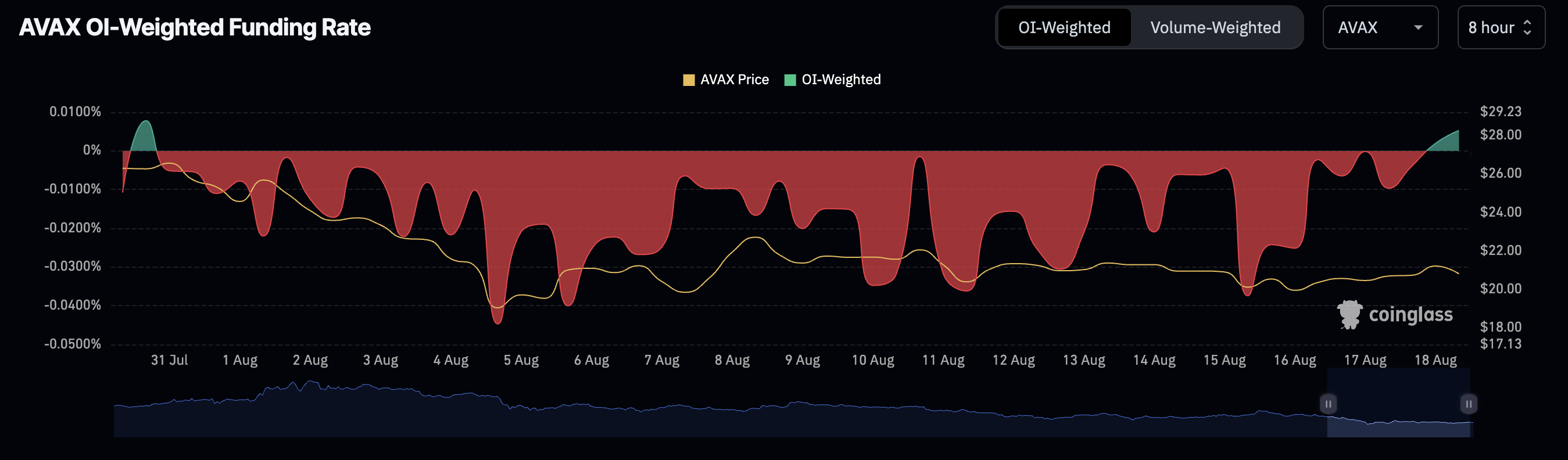

According to Coinglass data, $AVAX’s funding rate has flipped to positive territory, signaling a potential change in market dynamics.

A positive funding rate in futures trading typically indicates increased demand for long positions, as traders are willing to pay a premium to hold them. This bullish pressure suggests that more traders are betting on $AVAX’s price rising rather than falling, a notable shift from the bearish sentiment that has dominated the market in recent weeks.

The current positive funding rate for $AVAX indicates that bullish sentiment is gaining momentum, which could foreshadow a breakout if bulls successfully push the price above the crucial $23 level.

October 2023 Vs. August 2024: Avalanche AT A Turning Point?

Buyers hope a breakout above $22.79 will change the weekly bearish structure, and some investors are looking back to October 2023 for similarities.

Analysts like Daghan on X anticipate a reversal and have compared the current market conditions and those in October 2023, just before Avalanche’s price skyrocketed from $8 to this year’s peak of $65 by March 18th.

In his comparison, Daghan explains the intensity of $AVAX’s uptrends after long and deep corrections, showing how fast its price moves after it shifts from bearish to bullish.

Currently, Avalanche is trading at $22.11 and must break above this key resistance level to challenge the supply zone around $22.79 and establish a new higher high. If bulls can reclaim the $23 level, it could signal a broader market recovery for $AVAX. However, if the market fails to hold above the August 5 low at $19.53, there is a risk of a downside move, potentially retesting demand below $17.50, with the next bearish target at $15.

As the funding rate signals a possible shift in market sentiment, the coming days will be critical in determining whether $AVAX can break free from its current consolidation and resume its upward trajectory.

Cover image from Unsplash, chart from Tradingview

coindesk.com

coindesk.com