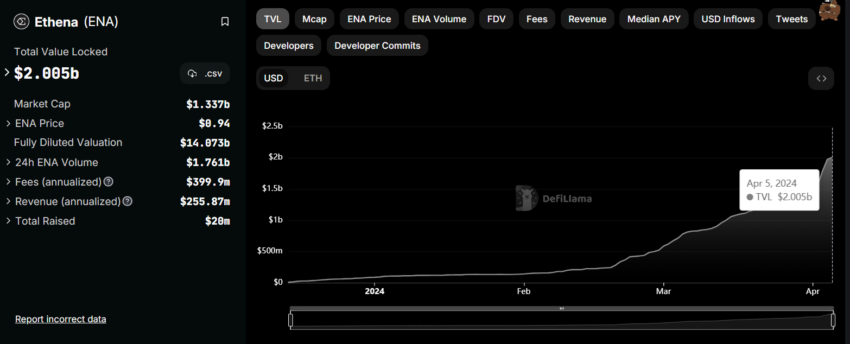

Ethena Protocol ($ENA), the project behind the synthetic dollar stablecoin $USDe, has catapulted its total value locked (TVL) beyond the $2 billion mark.

This significant growth spurt comes amidst a wave of skepticism from seasoned industry experts, echoing concerns reminiscent of the Terra ($LUNA) debacle.

Experts Voice Their Skepticism on Ethena’s $USDe

Based on the data from DefiLlama, on April 1, Ethena’s TVL stood at $1.54 billion. In just four days, it has surged past the $2 billion mark, marking a growth of about 30%. This significant increase highlights the growing investor interest in what Ethena offers.

The protocol’s lucrative 27% annual percentage yield (APY) and its recently launched $ENA token airdrop undoubtedly attract investors. Ethena’s airdrop on April 2 rewarded eligible users with a generous 750 million tokens.

This news follows another attention-grabbing decision from MakerDAO, which oversees the $DAI stablecoin. MakerDAO is exploring a sizeable 600 million $DAI allocation toward $USDe through Morpho Labs.

Ethena’s surge is underpinned by substantial backing from prominent investors like Delphi Digital, Wintermute, and Galaxy Digital. This adds a layer of perceived credibility to the platform.

Yet, Ethena’s breakneck growth has come with warnings. DeFi luminary Andre Cronje voiced concerns about $USDe potentially facing a collapse mirroring the TerraUSD (UST) debacle. Cronje’s worries center on Ethena’s use of perpetual contracts and the reliance on yield-based collateral.

CryptoQuant founder Ki Young Ju echoed Cronje’s warning, focusing on Ethena’s announced plans to integrate Bitcoin ($BTC) as a $USDe backing asset. He questions Ethena’s ability to maintain a delta-neutral $BTC strategy during bear markets.

“I’m just concerned about a repeat of $LUNA’s scenario: selling $BTC to stabilize $USDe’s peg if their algorithm fails during bear markets,” Ki Young Ju emphasized.

It’s worth noting that Anchor Protocol offered around 20% APY on UST. It means $USDe’s APY is even higher than UST’s.

Despite these critical voices, $USDe has become the fifth-largest stablecoin by capitalization. $ENA, Ethena’s native token, has seen a remarkable price increase from $0.62 to $1.25 in less than two days following the successful airdrop. However, at the time of writing, $ENA is trading at $0.99.

u.today

u.today

coinpedia.org

coinpedia.org

cryptopolitan.com

cryptopolitan.com