Ripple has increased the number of its dollar-pegged stablecoin $RLUSD tokens in circulation by 20 million, as reported by Ripple Stablecoin Tracker, a move that slightly strengthens on-chain liquidity as competition in the regulated stablecoin market gets more intense.

💵💵💵💵💵💵💵 20,000,000 #$RLUSD minted at $RLUSD Treasury.https://t.co/UJ37cINglF?from=article-links

— Ripple Stablecoin Tracker (@RL_Tracker) February 19, 2026

According to the Etherscan, 20,000,000 $RLUSD were minted at the $RLUSD Treasury and transferred via a confirmed Ethereum transaction on Feb. 19, 2026. The transfer was made by a wallet labeled "Ripple: Deployer" and was finalized in seconds.

How latest $20 million mint impacts $RLUSD’s market position

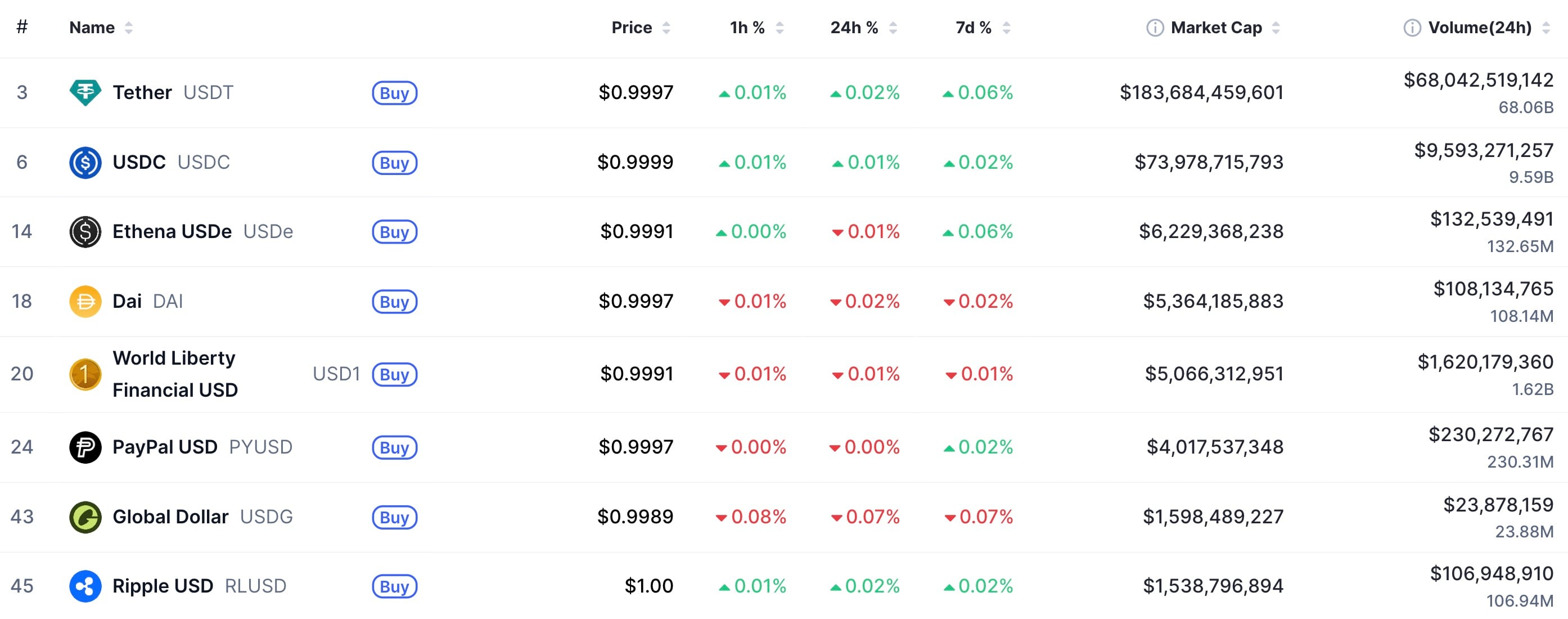

After the release, $RLUSD's supply is 1.53 billion tokens, putting it in the middle of the pack for dollar stablecoins in terms of market capitalization, according to CoinMarketCap. For comparison, Tether's USDT is still above $183 billion in market cap, while USDC is over $74 billion, showing the big difference $RLUSD is still trying to close.

$RLUSD has been slowly becoming a part of Ripple's bigger plan for the ecosystem, which includes things like custody infrastructure, RWA tokenization for institutions and use cases for cross-border settlement. Increases in supply usually indicate new demand from institutions, rebalancing of the treasury or liquidity provisions for exchanges and DeFi platforms.

Market data shows $RLUSD trading close to its $1 peg, with daily volume above $100 million, suggesting active circulation rather than dormant treasury stock. Stablecoin issuance in this range is not big enough to cause major disruptions to the market, but it is significant for $RLUSD's own liquidity profile.

For starters, a $20 million expansion will boost the available depth for payments flows, exchange pairs and potential DeFi integrations on Ethereum. Whether or not this leads to long-term use depends less on the total amount of $RLUSD created and more on whether counterparties use it to settle, collateralize and manage their treasury operations in the coming months.

thecryptobasic.com

thecryptobasic.com