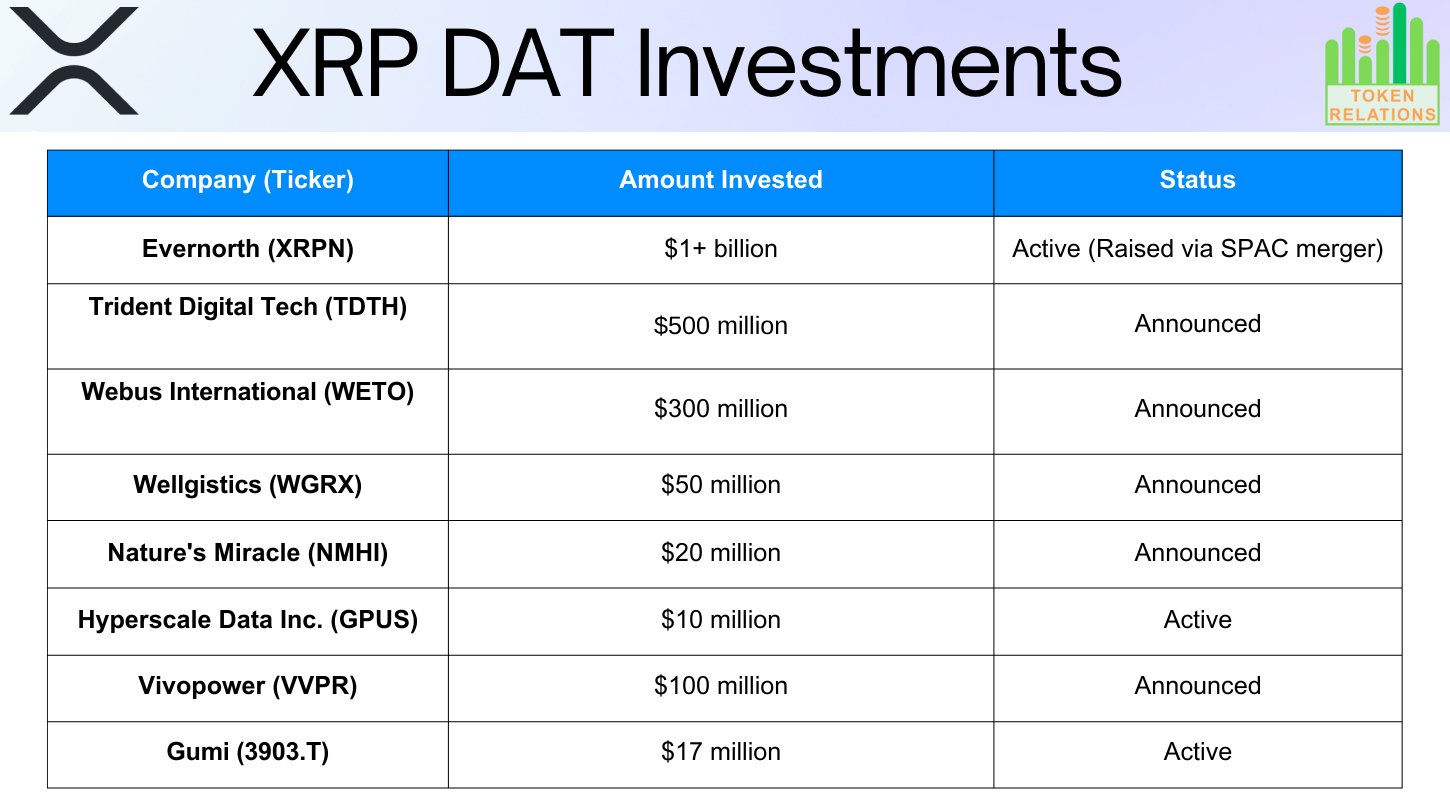

A growing number of publicly traded companies have added $XRP to their balance sheets, committing more than $2,000,000,000 ($2 billion) combined to their announced treasury strategies.

According to a breakdown shared by crypto educator X Finance Bull, at least eight public firms have disclosed $XRP treasury allocations through public filings or official announcements. The data was attributed to TokenRelations and compares the trend to MicroStrategy’s early Bitcoin treasury strategy, this time centered on $XRP.

Key Points

- Over $2B committed across eight publicly traded companies

- Institutions are positioning early ahead of regulatory clarity

- $XRP may shift from a payment tool to a treasury reserve asset

- Market watching filings, timelines, and balance-sheet impact

$XRP From Speculation to Balance Sheets

X Finance Bull argues that the move signals a shift in how institutions view $XRP, from a short-term trade to a long-term treasury asset. He stressed that the firms are not private funds or venture capital, but public companies across multiple industries, including healthcare, energy, gaming, technology, and agriculture.

Indeed, several of the firms have already begun deploying capital, while others have formally announced future allocations.

Largest Allocation: Evernorth Leads With Over $1B

The largest reported $XRP treasury commitment comes from Evernorth (XRPN).

- Investment: $1+ billion

- Status: Active via SPAC merger

According to the report, Evernorth has already raised the funds and begun deploying capital, making it the largest $XRP treasury strategy disclosed to date.

$500M–$300M Commitments

Other firms are also making sizable balance-sheet decisions. Trident Digital Tech (TDTH) has disclosed a $500 million investment, while Webus International (WETO) has also announced a $300 million investment in $XRP.

These nine-figure allocations suggest $XRP is being considered at scale, not as an experimental exposure.

Energy, Healthcare, and Logistics Join In

Beyond tech firms, traditional industries are also appearing on the list

Vivopower (VVPR)

- Investment: $100 million

- Sector: Sustainable energy

Wellgistics (WGRX)

- Investment: $50 million

- Sector: Healthcare logistics

X Finance Bull noted that these are conventional businesses making formal treasury decisions, rather than crypto firms chasing short-term trends.

Smaller Allocations Expand Industry Diversity

Several additional companies round out the reported list:

- Nature’s Miracle (NMHI) – $20 million (AgTech)

- Gumi (3903.T) – $17 million (Japanese gaming company, active holding)

- Hyperscale Data Inc. (GPUS) – $10 million (Data infrastructure, active holding)

While smaller in size, the allocations further broaden the range of sectors and regions adopting $XRP as a reserve asset.

$2B Total, Spanning Multiple Sectors

In total, the report cites over $2 billion committed across eight publicly traded companies. X Finance Bull says institutions are positioning early, ahead of clearer regulations and market conditions. The move signals a shift for $XRP, from mainly a payment asset to a treasury reserve held by public firms.

theblock.co

theblock.co

coinpedia.org

coinpedia.org

cryptobriefing.com

cryptobriefing.com