Table of Contents

PancakeSwap just slashed its $CAKE token max supply from 450 million to 400 million after a community vote, while quietly crossing $3.5 trillion in cumulative trading volume. For the biggest DEX on $BNB Chain, 2026 is off to a strong start.

Why Did PancakeSwap Cut $CAKE's Supply?

The 11% supply reduction, approved in January 2026, is designed to limit future dilution and reinforce long-term value for holders. It builds directly on the Tokenomics 3.0 overhaul from April 2025, which killed the veCAKE model and cut daily emissions from roughly 40,000 to 22,500 $CAKE. That upgrade turned $CAKE net deflationary, and the trend has held ever since.

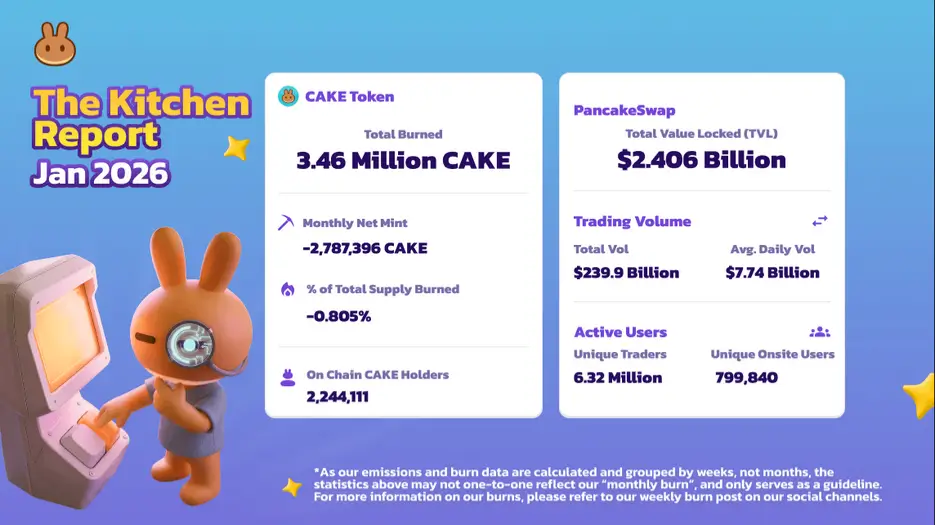

January's numbers tell the story clearly. PancakeSwap minted 674,316 $CAKE across farms (391,199), product usage (123,960), and ecosystem growth (159,157). Burns dwarfed that at 3,461,712 $CAKE. The bulk came from swap and perpetual trading fees at 3,070,906 $CAKE, with predictions adding 267,126, and other features, including lottery, contributing 123,680.

Net result: a supply reduction of 2,787,396 $CAKE, or roughly 0.805% of total supply in a single month.

That makes 29 consecutive months of supply contraction. Over 42 million $CAKE have been removed from circulation since September 2023. The circulating supply now sits at approximately 332.9 million, with the hard cap locked at 400 million.

PancakeSwap also holds around 3.5 million $CAKE in its Ecosystem Growth Fund. That reserve can fund future development without printing new tokens, a model more DeFi protocols could learn from.

How Big Is $3.5 Trillion in Volume?

Big enough to matter. PancakeSwap processed over $2.36 trillion in volume during 2025 alone, and the lifetime total now sits above $3.5 trillion. That kind of throughput puts it in rare company among decentralized exchanges, and it's doing it across 10 different networks.

What Else Is PancakeSwap Building?

Beyondtokenomics and volume, PancakeSwap made a notable push into real-world assets. Through a partnership with Ondo Finance, the platform integrated over 200 tokenized RWAs on$BNB Chain, including stocks, bonds, and ETFs. The launch included a 30-day zero-fee trading promotion to onboard users into the new asset class. That's a meaningful bridge between TradFi and DeFi that gives users access to traditional instruments without leaving the decentralized ecosystem.

PancakeSwap is also pushing into prediction markets through Probable, incubated alongside YZi Labs. The platform has already climbed to #4 by notional volume with over $2.53 billion processed and 26,000 users in just over a month since launch.

The platform has also been expanding yields onBase chain, continuing its multi-chain strategy across its 10 supported networks. Diversification across chains reduces dependency on any single ecosystem and broadens the user base.

Where Does $CAKE Stand Now?

$CAKE is trading at $1.35 with a 24-hour trading volume of around $125 million. The price isn't turning heads, but the fundamentals underneath tell a different story. Consistent burns, reduced emissions, growing volume, and real utility through RWA integration all point to a protocol focused on long-term positioning rather than short-term noise.

Sources:

- PancakeSwap Blog — Official January 2026 Kitchen Report with detailed $CAKE mint and burn breakdown

- Cryptopolitan — Reporting on PancakeSwap's community vote to reduce $CAKE max supply from 450M to 400M

- Yahoo Finance — Coverage of PancakeSwap's Tokenomics 3.0 upgrade and emission changes

- AMBCrypto — Additional data on January 2026 $CAKE supply dynamics

- BSC News — Reporting on PancakeSwap's RWA integration through Ondo Finance partnership

thecryptobasic.com

thecryptobasic.com

u.today

u.today