The world’s largest derivatives marketplace, CME, has teased the imminent launch of new cryptocurrency futures products, including Cardano.

Set to go live in less than a week, the introduction of $ADA futures signals institutional recognition and provides Cardano with new hedging and professional trading tools.

Key Points

- Cardano futures are scheduled to launch on the CME derivatives marketplace in less than a week.

- Cardano will debut with both standard and micro futures contracts, expanding access for traders of different profiles.

- CME will also introduce Stellar and Chainlink futures.

- These futures will join CME’s existing crypto lineup, which already includes Bitcoin, Ethereum, Solana, and $XRP.

Cardano Futures Set for February 9 Launch on CME

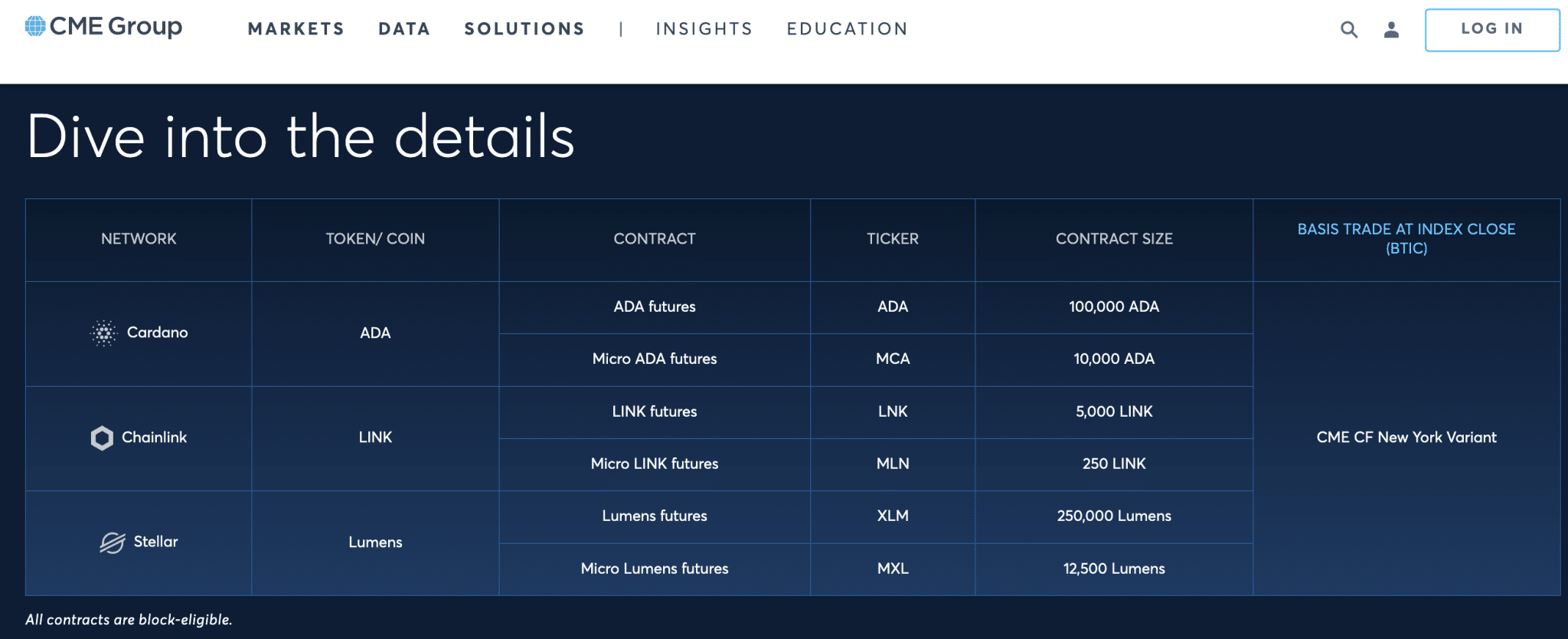

In a recent X post, CME urged traders to prepare for the launch on February 9, 2026, as it expands its regulated crypto derivatives lineup. Notably, Cardano will debut with both standard and micro futures contracts on CME.

The standard $ADA futures will represent 100,000 $ADA per contract, while the micro $ADA futures (MCA) will represent 10,000 $ADA per contract.

CME to Launch Stellar and Chainlink Futures

In addition, CME plans to roll out futures on Stellar and Chainlink alongside Cardano. Stellar’s standard contract ($XLM) will hold 250,000 $XLM, with a micro version (MXL) of 12,500 $XLM. Meanwhile, Chainlink’s contracts will feature 5,000 $LINK for standard futures (LNK) and 250 $LINK for micro futures (MLN).

Pricing for the new futures will track the CME CF New York Variant Index, enhancing transparency and aligning $ADA, $XLM, and $LINK with the same institutional benchmarks used for leading crypto derivatives.

Once launched, the contracts will join CME’s existing crypto futures lineup, which includes Bitcoin, Ethereum, Solana, and $XRP.

A Major Institutional Milestone for Cardano

The launch of $ADA futures represents a significant milestone for institutional investors. It offers regulated exposure for funds unable to hold spot $ADA, improves liquidity, and provides robust risk-management tools. The micro contract reduces capital barriers, broadening access while maintaining regulatory standards.

Notably, some Cardano community figures have described the initiative as $ADA’s strongest institutional validation to date, given CME’s stature in global derivatives.

With CME posting 278,300 contracts in average daily volume, worth $12 billion in notional value, and $26.4 billion in open interest last year, Cardano futures are widely expected to gain meaningful adoption on the platform.

coinfomania.com

coinfomania.com

u.today

u.today