Unquestionably, $XRP has performed poorly on the market in recent weeks, with price action declining to levels not seen since the beginning of the previous recovery cycle.

$XRP's recovery

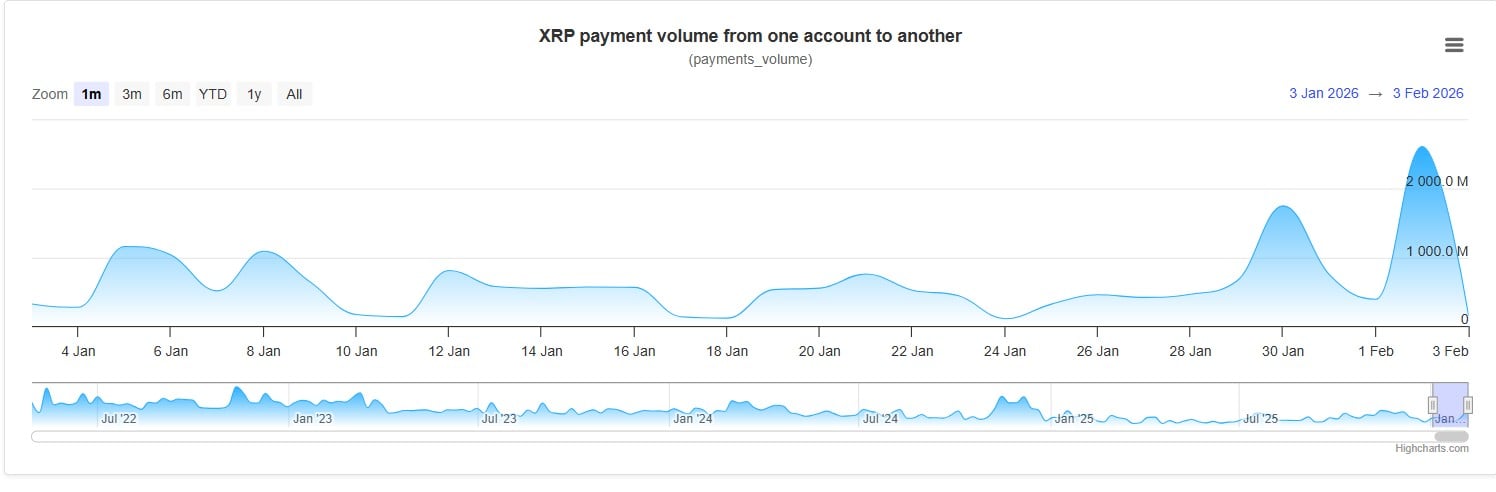

On the other hand, on-chain activity on the $XRP Ledger might indicate that the worst selling pressure phase is already over, even though the price structure still seems brittle. The significant increase in payments volume seen on the $XRP Ledger at the end of January, which was followed by a sharp decline in transaction flows soon after, is the primary cause of this interpretation.

One of the biggest short-term spikes seen on the network in recent months occurred when the volume of payments momentarily surpassed two billion $XRP transferred daily. An increase in network usage could initially appear to be bullish, but context is important.

The fact that this spike happened while the price of $XRP was already plummeting indicates that it was not the result of utility growth or organic adoption. Rather, it was probably the result of big holders shifting money and selling off holdings, which caused a surge in selling pressure on all exchanges. In other words, heavy distribution was correlated with high payment volume.

$XRP's rapid activity drop

The circumstances now appear to be different. Since then, payments activity has decreased by about 95%, indicating a significant slowdown in network transfer activity. Even though a collapse like this might seem concerning, it might actually be a sign that the selling wave is slowing down.

With rallies routinely rejected below significant moving averages, $XRP is still stuck in a larger downtrend channel on the price chart. However, volume spikes associated with panic-selling are less common, and momentum indicators are moving into oversold territory. This combination implies that, rather than a new collapse, the market might be entering an exhaustion phase.

$XRP has yet to regain the crucial resistance areas required to validate a reversal, so investors should continue to exercise caution. The foundation for a recovery attempt, however, might start to take shape if selling pressure keeps waning and network activity levels out at lower, healthier levels.

coinspeaker.com

coinspeaker.com

invezz.com

invezz.com