A resurfaced 2013 email shows Jeffrey Epstein being briefed on Google’s plans to expand digital payments in Africa using Ripple’s blockchain technology.

Key Points

- A 2013 email shows Jeffrey Epstein being briefed on Google’s plans to expand digital payments in Africa.

- Part of that effort includes Google’s investment in Ripple.

- A crypto commentator says the email framed Ripple and $XRP as a Google-endorsed alternative to traditional banking systems.

- Despite the early investment, there is no evidence that Google ever adopted Ripple’s technology or the $XRP Ledger.

Epstein Emails Spotlight Google’s Early Investment in Ripple

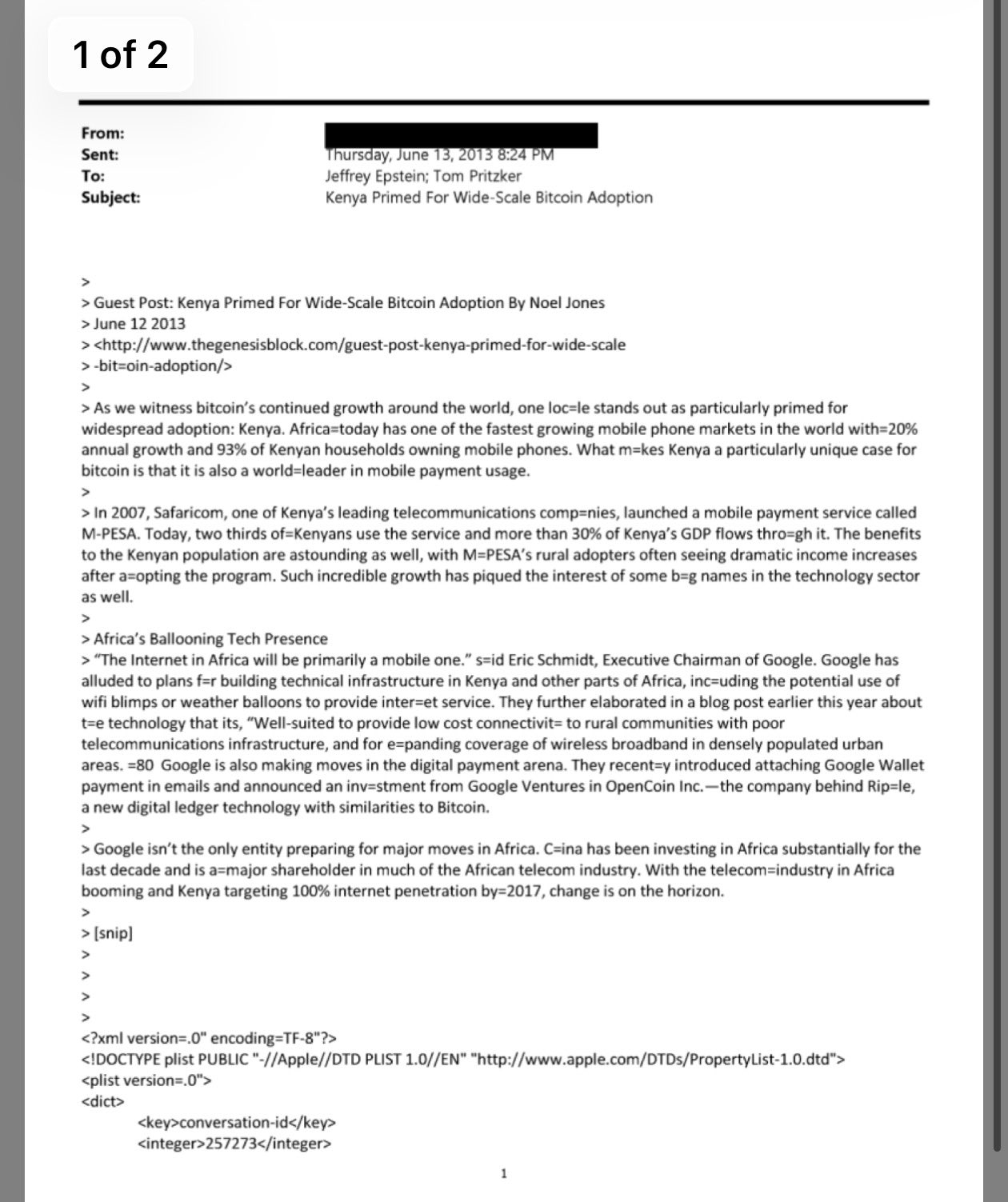

According to the document, a redacted sender informed Epstein that Google invested in OpenCoin, which later rebranded as Ripple, as part of efforts to expand digital payments in Africa.

The email identified Kenya as a key adoption market, citing the country’s rapid mobile phone growth and the widespread use of Safaricom’s M-PESA as a strong foundation for digital finance.

It also noted Google’s broader strategy in achieving this vision, which includes linking Google Wallet payments to email and Google Ventures’ investment in OpenCoin.

Interestingly, the email described OpenCoin as the company behind a blockchain technology similar to Bitcoin. The document provides insight into how major technology firms were already exploring partnerships with Ripple to transform cross-border and mobile payments. This has happened years before crypto entered the global regulatory spotlight.

Ripple and $XRP as a Google-Endorsed Alternative to Traditional Banking Systems

Commenting on the development, popular crypto commentator Jungle Inc said the email framed Ripple and $XRP as a Google-endorsed structural alternative to traditional banking systems.

He noted that Bitcoin was widely viewed as “anarchic play money” in 2013, while influential players already saw Ripple and the $XRP Ledger (XRPL) as a scalable solution for global payments.

Consequently, he argued that $XRP’s utility-first role was established early, with major institutions exploring its potential long before the broader crypto market caught on.

His commentary aligns with the broader community’s view, which consistently emphasizes $XRP’s role in global payments. The token and the $XRP Ledger have already built credibility in finance, driven by Ripple’s partnerships with major institutions, including Japan-based SBI Group.

No Evidence of Google’s Adoption of Ripple Tech

However, despite Google’s early investment in Ripple, there is no evidence that it ever used Ripple’s payment technology or the $XRP Ledger for global payments. Instead, Google later began developing its own blockchain for financial services last year. The blockchain, known as Google Cloud Universal Ledger (GCUL), was labeled an “$XRP killer.”

Nonetheless, the two systems differ fundamentally. GCUL is designed as a private, permissioned blockchain, while the $XRP Ledger remains public and decentralized. Moreover, Google’s planned ledger does not include a native token.

coindesk.com

coindesk.com

u.today

u.today