Blockchain network Avalanche saw rising institutional adoption across tokenized money market funds, loans, and indices in the fourth quarter, driving the value of real-world assets on the layer 1 to a new high, even as its token underperformed the broader market.

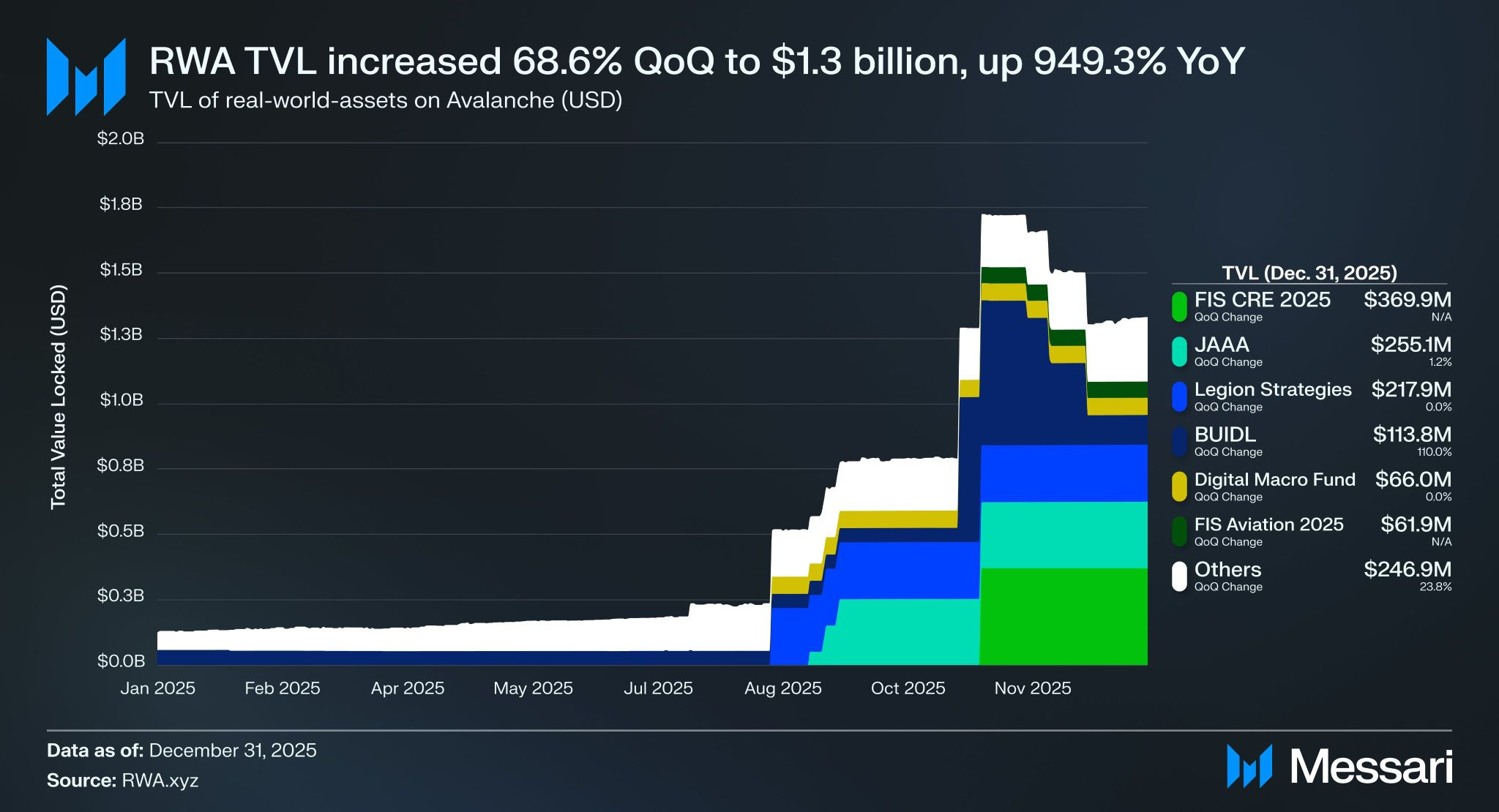

The total value locked of tokenized real-world assets on Avalanche rose 68.6% over the fourth quarter of 2025 and nearly 950% over the year to more than $1.3 billion, boosted by the $500 million BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that launched in November, Messari research analyst Youssef Haidar said in a report on Thursday.

Fortune 500 fintech FIS partnered with Avalanche-based marketplace Intain to launch tokenized loans in November, further boosting Avalanche’s TVL, Haidar said. Intain enables 2,000 US banks to securitize over $6 billion worth of loans on Avalanche.

The S&P Dow Jones also partnered with Dinari, an Avalanche-powered blockchain, to launch the S&P Digital Markets 50 Index tracking 35 crypto-linked stocks and 15 crypto tokens on Avalanche.

TradFi firms are increasingly experimenting with crypto tokenization under the Paul Atkins-led Securities and Exchange Commission, which has shown an openness to approving more innovative crypto products over the past year.

Asset managers Bitwise and VanEck filed S-1s to launch spot Avalanche exchange-traded funds late last year, which included staking. VanEck’s spot Avalanche ETF launched on Monday.

$AVAX continues to tank

The Avalanche ($AVAX) token didn’t fare too well in Q4, dropping 59% to $12.3 and has slid another 10.5% so far in 2026 to around $11.

$AVAX hasn’t seen price action like Bitcoin (BTC) and Ether (ETH) this market cycle, which have both hit new all-time highs, with AXAX down over 92% from its all-time high of $144.96 in November 2021, CoinGecko data shows.

Avalanche DeFi on the up

The value locked in native decentralized finance in $AVAX rose 34.5% over Q4 to 97.5 million $AVAX, while the number of average daily transactions on the Avalanche blockchain increased 63% to 2.1 million over the same timeframe, Haidar said.

The total stablecoin market cap on the Avalanche main chain remained relatively flat in Q4, increasing 0.1% over Q4 to $1.741 billion, adding around $1 million.

Tether’s stablecoin USDt (USDT) overtook Circle’s $USDC ($USDC) to become the dominant stablecoin on Avalanche, representing 42.3% of the total supply by the end of 2025 with $736.6 million in circulation.

bsc.news

bsc.news