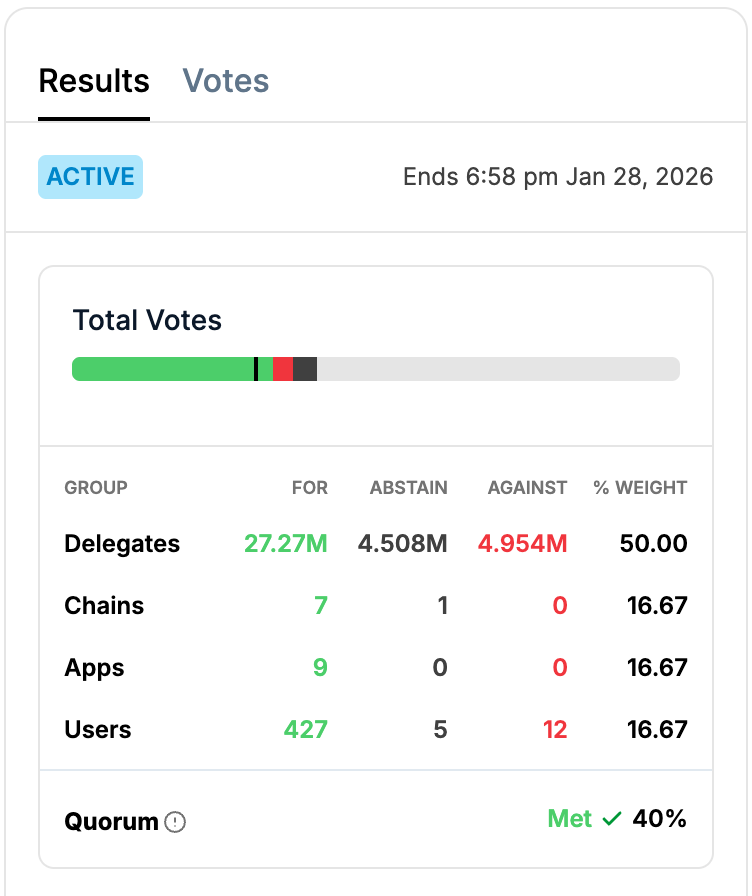

Optimism tokenholders have approved a proposal from earlier this month to launch a 12-month OP buyback program, after the measure cleared quorum with support from more than 84% of participating votes.

The vote — which reached a quorum today, Jan. 28, just before it was scheduled to end, at 1:58 p.m. ET — authorizes allocating 50% of Superchain sequencer revenue toward monthly OP purchases, now subject to a final Joint House vote, requiring a 60% majority.

If that final step is secured, the Optimism Foundation would begin converting $ETH revenue into OP starting in February, holding the repurchased tokens in the Collective treasury. Execution would initially rely on an over-the-counter provider, with transactions disclosed through a public dashboard.

Proposal Sparks Debate

The proposal aims to tie the OP token more closely to activity on Optimism’s Superchain, an ecosystem of Layer 2 chains for Ethereum, including Coinbase’s Base and World Chain. Per Optimism’s proposal, originally published on Jan. 7, Superchain generated around 5,868 $ETH (around $17.6 million at current prices) in revenue over the proceeding year.

Data from DefiLlama indeed shows Superchain's gross protocol revenue for 2025 was $17.27 million.

The Foundation said in the proposal that using 50% of that revenue for buybacks would move OP beyond a pure governance token and give it protocol-linked demand.

But the proposal also saw sharp debate during the voting period.

Some called for opposing the measure, arguing that buybacks funded alongside ongoing token emissions are “financially self cancelling and value destructive.” Others supported the proposal’s intent but warned that off-market purchases could hurt confidence unless moved on-chain.

The Optimism Foundation responded in the forum thread, saying the buyback program is meant to “link the OP token to the growth of the Superchain and demonstrate a meaningful shift in the role of the token” without reducing funds for ecosystem development.

OP is flat today, though it rallied 8% over the past 30 days. The token is down a brutal 79% over the past year, however.

Crypto projects with native tokens have been increasingly introducing buyback mechanisms in recent months, evidently in an effort to support token prices and better align platform success with tokenholders.

Among the most recent examples, on-chain trading platform Magic Eden last week said it will begin buybacks of its ME token, while in November, DeFi giant Aave approved a $50 million annual allocation from protocol revenue to buyback AAVE.

u.today + 1 more

u.today + 1 more