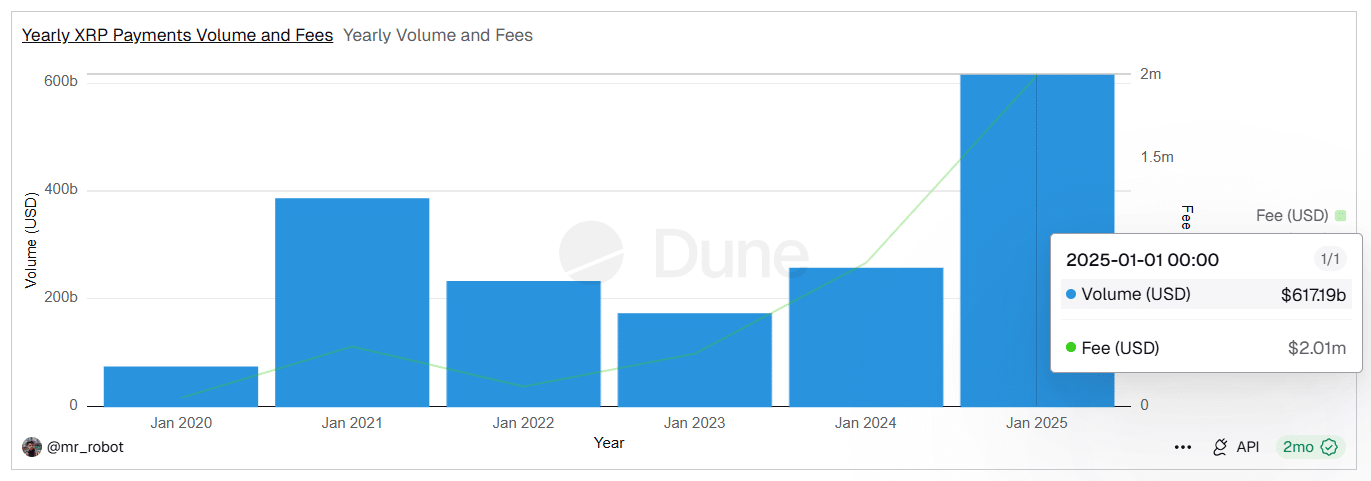

The annual $XRP payment volume more than doubled to $617 billion in 2025, marking the highest-ever recorded annual volume in history.

This is according to data provided by Dune Analytics in its latest annual multichain report, which tracked the performances of over 35 blockchain networks throughout 2025. Specifically, data confirms that the annual $XRP payment volume stood at $259 billion in 2024.

However, last year, this figure more than doubled to $617.19 billion, representing a 138% increase from the previous year’s readings. More importantly, this total marks the highest annual $XRP payment volume ever recorded. This was accompanied by other milestones across DEX volume and AMM performance throughout 2025.

Key Points

- In 2024, $XRP payment volume hit $259 billion, a considerable increase from figures recorded in 2022 and 2023.

- By 2025, the total volume surged further to $617.19 billion, representing a 138% increase from 2024 figures.

- The $617 billion volume also marked the highest-ever recorded annual $XRP payment volume in history.

- Despite the large payment volume, the $XRP Ledger ($XRP) only saw $2 million worth of fees throughout 2025.

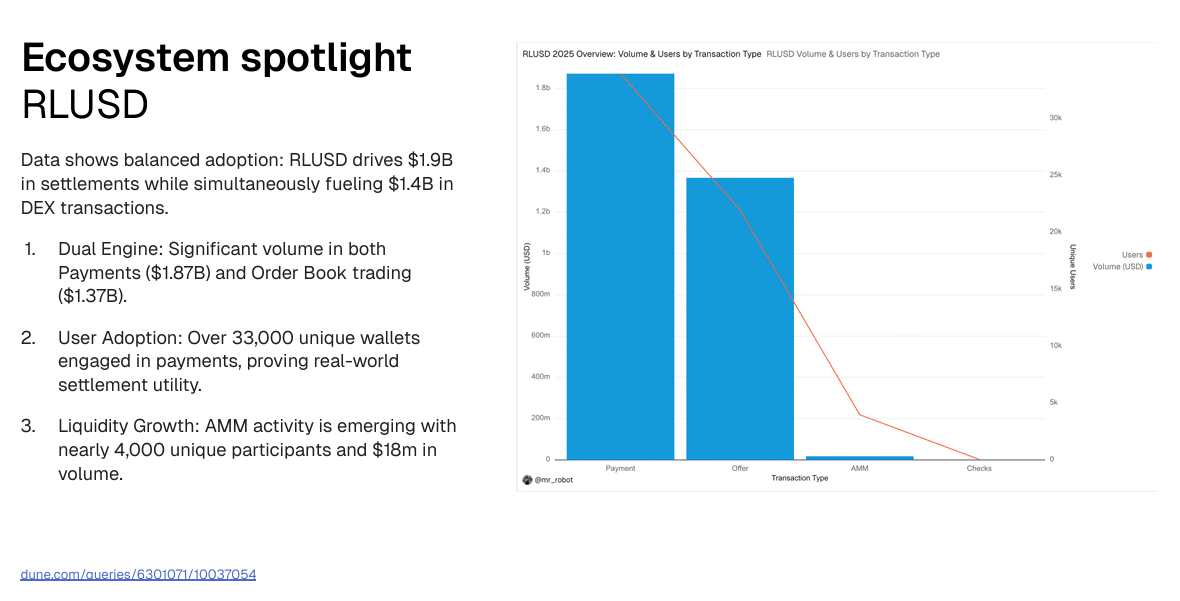

- In 2025, $RLUSD also recorded $1.87 billion in payment volume and $1.37 billion in order book trading on the XRPL DEX.

Annual $XRP Payment Volume Recovering After Past Struggles

According to Dune, the $617 billion annual $XRP payment volume in 2025 confirmed the ecosystem’s recovery push after years of stifled growth triggered by broader crypto market downturns and unique legal issues.

For context, annual payment volume increased from $75.69 billion in 2020 to $388.17 billion in 2021 before dropping to $234.39 billion in 2022 during the bear market. The decline continued in 2023, with volume falling to $174 billion. However, in 2024, activity began to recover, reaching $258 billion, before surging strongly in 2025.

Low Fees and Transaction Burns

Dune also emphasized that low fees remain one of XRPL’s biggest strengths. Despite processing $617 billion in 2025, the network only charged $2 million in total fees. On average, users paid about $0.32 to move every $100,000. This makes the XRPL one of the most cost-efficient settlement networks in the industry.

In addition, the report pointed out that every transaction continues to reduce $XRP’s supply. Notably, the ledger permanently removes all fees from circulation, meaning increased usage steadily lowers the total number of $XRP tokens.

$RLUSD Volumes

Meanwhile, the Ripple stablecoin ($RLUSD), which launched in December 2024, also contributed to the ecosystem’s growth. In 2025, $RLUSD recorded around $1.9 billion in payment settlements and supported about $1.4 billion in decentralized exchange trading.

Also, data found that more than 33,000 unique wallets used $RLUSD for payments in 2025. Further, liquidity also improved, with nearly 4,000 participants joining automated market maker pools that produced close to $18 million in volume.

$XRP Ecosystem Milestones in 2025

The Dune report also spotlighted several major events in 2025. For instance, the XRPL EVM sidechain launched on June 30, 2025. In addition, $XRP ETFs began trading in late 2025, with these products now seeing over $1.2 billion worth of net inflows since then.

Further, the network also introduced Multi-Purpose Tokens in October 2025, as it moved to bolster its position in the tokenization market. Meanwhile, CME’s $XRP futures recorded $18.3 billion in trading volume and $70.5 million in open interest in November 2025.

beincrypto.com

beincrypto.com

coingape.com

coingape.com