The XRP Ledger now hosts over $150 million worth of tokenized U.S. Treasury Debt amid a rapid increase in RWA value over the past year.

Real-world asset (RWA) tokenization, a growing narrative that has captured the attention of industry leaders such as BlackRock’s Larry Fink and SEC Chair Paul Atkins, has continued to see rapid expansion, and the XRP Ledger (XRPL) is already capturing a good portion of this expansion.

Data confirms that tokenized U.S. Treasury Debt on the XRPL has grown in value to $150 million at press time, with leading tokenization platforms like Ondo, Zeconomy, and OpenEden contributing to this figure. While $150 million appears modest, it represents a 2,900% increase from the figures reported exactly a year ago.

Key Points

- The XRP Ledger is now home to $150 million worth of tokenized U.S. Treasury Debt as RWA value sees a rapid spike over the past year.

- Popular tokenization platforms OpenEden Digital, Zeconomy, and Ondo contribute the most to the current figure.

- The total value of tokenized U.S. Treasury currently sits at $10 billion across all blockchain networks.

- While the $150 million share from the XRPL appears modest compared to other platforms, it represents a 2,900% rise over the last year.

XRP Ledger Now Hosts $150M in Tokenized U.S. Treasury Debt

This is according to on-chain data provided by RWA.xyz, the lead platform on tokenized RWA market data. Specifically, the XRPL boasts over $1 billion worth of total tokenized RWA, including distributed and represented assets. The Crypto Basic confirmed this milestone in a recent report.

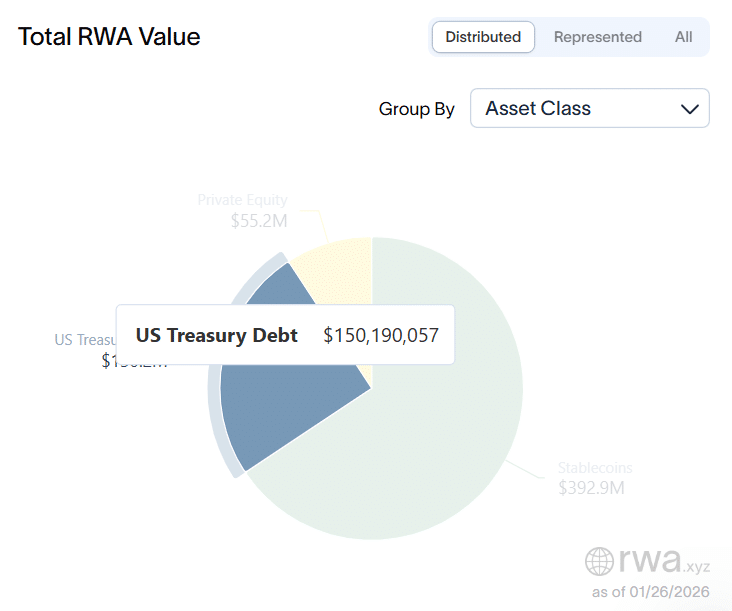

Of the $1 billion figure, distributed RWA makes up $598 million. Meanwhile, according to the classification from RWA.xyz, distributed assets include U.S. Treasury Debt, Private Equity, and Stablecoins. Notably, U.S. Treasury Debt accounts for $150.2 million, much higher than Private Equity ($55.2 million) but less than half of Stablecoins ($392.9 million).

However, the XRPL is dwarfed by other networks in terms of tokenized U.S. Treasury value. Notably, the total worth of on-chain U.S. Treasuries sits at $10.13 billion, indicating that the XRPL only hosts 1.4% of all tokenized U.S. Treasuries. Despite this, the current $150 million figure represents a 2,900% increase from the $5 million worth of U.S. Treasuries on the XRPL exactly a year ago.

Platforms Tokenizing U.S. Treasuries on the XRPL

Meanwhile, most of the U.S. Treasury Debt value on the XRP Ledger is accounted for by just three platforms. Notably, OpenEden Digital, a subsidiary of the OpenEden Group, hosts $61.6 million worth of U.S. Treasuries on the XRPL with its OpenEden TBILL Vault product. This represents 41% of the total value of XRPL-based U.S. Treasuries.

Ondo accounts for $40.8 million worth of U.S. Treasuries on the XRPL with its Ondo Short-Term U.S. Government Bond Fund (OUSG). Zeconomy comes third with $40.039 million in U.S. Treasuries with the Guggenheim Treasury Services DCP product. Meanwhile, Archax boasts $7.712 million worth of U.S. Treasuries on the ledger through its abrdn Liquidity Fund (Lux) – US Dollar Fund.