Table of Contents

Injective's IIP-617 proposal, dubbed the "Supply Squeeze," is set to pass with 99.89% of voters backing the measure. The governance vote closes today, January 19, 2026, at 16:17 UTC, marking the largest tokenomics update in the protocol's history.

If approved, the proposal doubles INJ's deflation rate and positions the token among the most deflationary assets in crypto.

What Does IIP-617 Actually Change?

The proposal tackles both sides of the supply equation. On the issuance side, it reduces the current annual inflation rate of approximately 8.88%, which mints around 10 million INJ per year. On the burn side, it increases the rate at which auction proceeds from network fees are destroyed to 8%.

This creates a structural shift. Rather than relying on discretionary burns, deflation becomes baked into the protocol's mechanics. As network activity grows, burns can outpace minting, creating net supply contraction.

Injective has already burned roughly 6.85 million INJ through its Community BuyBack program and application fees, representing about 6% of circulating supply. IIP-617 accelerates this trajectory by making deflation automatic rather than dependent on one-off decisions.

Where Do the Votes Stand?

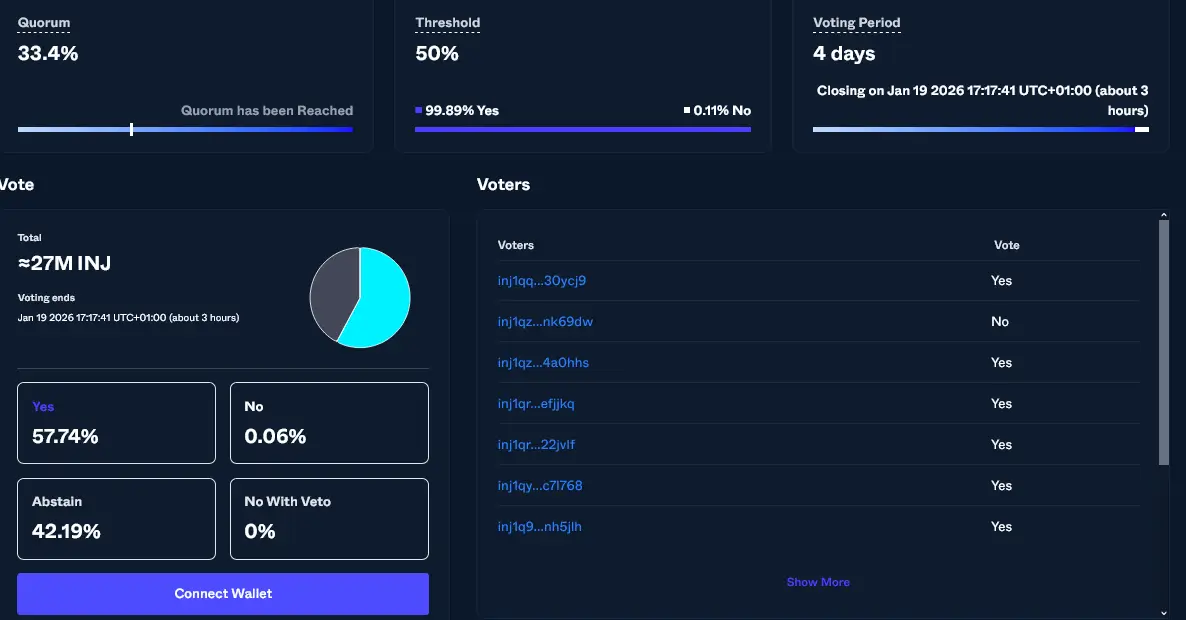

The numbers tell a clear story. Approximately 27 million staked INJ have participated in the vote. Among those who cast a Yes or No vote, support is near-unanimous: 99.89% voted Yes while just 0.11% voted No.

Looking at total voting power, 57.74% voted Yes, 0.06% voted No, and 42.19% chose to Abstain. No votes were cast for the No With Veto option.

The proposal reached quorum on January 16, one day after Injective Labs submitted it. Governance rules require at least 33.4% participation from staked INJ for a proposal to be valid, and the 50% approval threshold has been cleared by a wide margin.

If the proposal passes as expected, implementation could begin as early as January 20.

How Is the Community Reacting?

Sentiment across social media leans heavily bullish. Supporters highlight the long-term alignment between network growth and token scarcity. Posts urging "Vote Yes" have dominated Injective-related discussions, with users comparing the deflationary model to Bitcoin's fixed supply.

The skeptics raise a fair point though. At current activity levels, INJ remains net inflationary. The 8.88% annual minting rate exceeds what burns remove from circulation. Without broader adoption driving more network fees, the math doesn't flip to net deflation.

"Even if passed, INJ will remain net inflationary," one trader noted on X. "Only wider adoption can make burns dominate the mint rate."

This tension between structural improvements and real-world adoption defines the debate. The proposal creates the framework for deflation, but execution depends on Injective attracting more users and transaction volume to its DeFi applications.

What This Means for INJ Holders

For stakers, the proposal reinforces the value of long-term participation. Reduced issuance means less dilution, while enhanced burns funded by network revenue create direct alignment between ecosystem growth and token value.

The timing matters too. Tokenomics upgrades have become a theme across major protocols, from Ethereum's fee burns to Solana's supply mechanics. Injective positioning itself as a top deflationary asset fits this broader trend of networks competing on economic design.

Risks remain. If adoption stalls, the inflationary baseline continues. The proposal changes parameters, not code, meaning no technical risks from new smart contract deployments. But the economic thesis depends entirely on Injective's ability to grow its user base.

Monitor the final vote count at the Injective Hub. Results should be confirmed shortly after 16:17 UTC today.

Learn more atinjective.com | Follow@injective on X

Sources

- Injective Hub Proposal 617 – Official governance portal with live voting data and proposal details

- Injective official X announcement – Original IIP-617 announcement and community updates

decrypt.co

decrypt.co

u.today

u.today