Charles Hoskinson has emphasized how undervalued Cardano’s DeFi ecosystem remains, urging market participants to go long on Cardano-based decentralized exchanges (DEXes).

Hoskinson, the founder of Cardano, made this recommendation in response to a post by Cardano stake pool operator (SPO) YODA, who highlighted the recent performance of NIGHT, the native token of privacy-focused sidechain, Midnight.

NIGHT Impressive Trading Activity

In the post, YODA pointed to NIGHT’s explosive momentum, noting that the token had reached a new all-time high while generating an impressive $4.2 billion in daily trading volume across centralized exchanges.

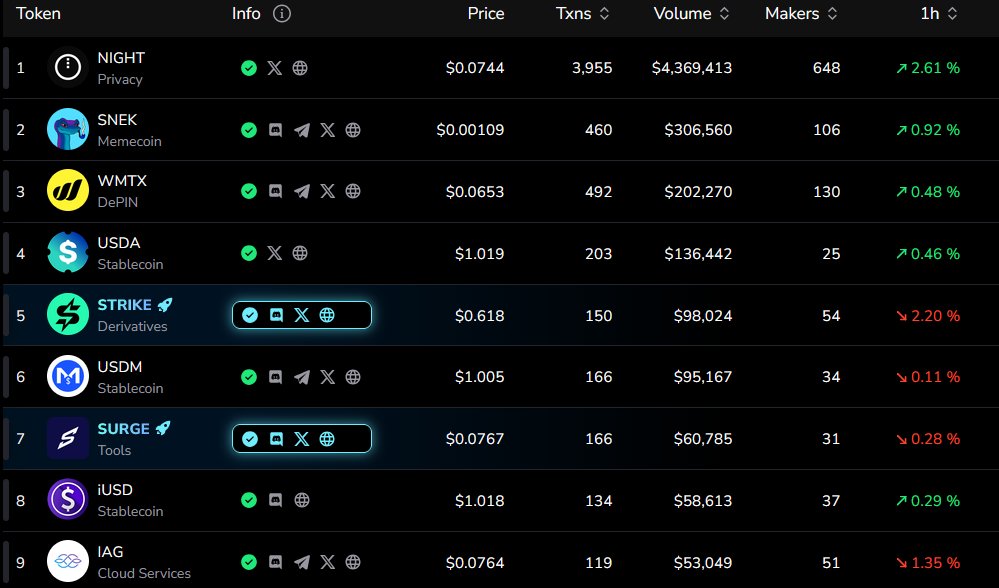

At the same time, YODA highlighted NIGHT’s trading activity on Cardano’s decentralized platforms. Citing data from DEX Screener, the SPO revealed that Cardano DEXes collectively recorded just $4.3 million in NIGHT trading volume.

While the figure appears modest when compared with centralized exchange volumes, YODA framed the performance as a relative success.

Notably, the attached screenshot shows that NIGHT significantly outperformed the second-ranked token, SNEK, which posted only $306,560 in DEX trading volume. As a result, YODA expressed optimism that the increase in NIGHT’s activity could serve as a fresh catalyst for Cardano’s DeFi ecosystem.

-

NIGHT volume on Cardano DEX

NIGHT volume on Cardano DEX

Hoskinson Highlights Infrastructure Required to Boost Cardano DEX Activity

YODA’s update underscored how far Cardano’s DeFi trails other ecosystems, despite the network’s strong technical foundations. In response, Hoskinson acknowledged the recent surge in NIGHT’s DEX volume but stressed that Cardano’s DeFi ecosystem still requires robust stablecoins and cross-chain bridges to meaningfully accelerate trading activity across its decentralized exchanges.

The Cardano founder has consistently highlighted the importance of these missing infrastructure components, particularly stablecoins, as catalysts for DeFi growth.

While Cardano already hosts a small number of stablecoins, Hoskinson has repeatedly pushed for the launch of a tier-1 stablecoin on the network and has disclosed ongoing discussions with key entities to make this a reality.

As previously reported, the lack of a reliable stablecoin on Cardano led to a costly incident in which a user operating a five-year dormant account lost an estimated $6.05 million after swapping ADA for the low-liquidity stablecoin USDA.

This incident highlights a bigger problem: without reliable stablecoins, traders cannot safely store funds, manage risk, or use more advanced trading strategies.

In addition, the lack of strong cross-chain bridges limits capital coming in from major networks like Ethereum and Solana, keeping Cardano’s DeFi ecosystem relatively isolated.

Cardano DEX Volume to Soar by 100x

Against this backdrop, he suggested that once reliable stablecoins and effective bridges are in place, the current low volumes on Cardano DEXes could expand dramatically, potentially surging by as much as 100x.

Need some stables and bridges. Then they will 100x. Now is a good time to go long on Cardano DEXes.

— Charles Hoskinson (@IOHK_Charles) December 21, 2025

In the meantime, he framed the current environment as an attractive entry point, encouraging investors to “go long” or accumulate low-cap tokens on Cardano’s decentralized exchanges in anticipation of this spike.

In Hoskinson’s view, Cardano DeFi is now in an accumulation phase, where activity and valuations remain subdued even as foundational upgrades progress.

u.today

u.today

cryptobriefing.com

cryptobriefing.com

bitcoinworld.co.in

bitcoinworld.co.in

bsc.news

bsc.news

thecryptobasic.com

thecryptobasic.com