Memecoins went from a fringe internet phenomenon to a $150.6 billion market. Now they're quietly unwinding.

The crypto tokens, which are inspired by jokes, social media and pop culture and have no utility value, surged in popularity from 2020 to late 2024. They hit peak value last December, before slumping almost 70% to just over $47 billion total market capitalization in November, according to CoinGecko’s State of Memecoins Report 2025.

Trading volumes tell the same story. Daily memecoin volumes tumbled to just under $5 billion earlier this month after surging more than 760% to $87 billion in 2024 as major U.S. crypto exchanges listed tokens like WIF and PEPE. Pageviews also slid, dropping more than 80% this year, CoinGecko data shows.

DOGE$0.1302 accounts for $20 billion of total market cap, with shiba inu (INU), trump (TRUMP) and pepe (PEPE) together grabbing another $6 billion — meaning more than 50% of the capitalization is concentrated in just five tokens.

Themes that formed, but didn’t last

Growth in 2024 was fueled by easy liquidity, viral platforms such as Solana-based token factories like Pump.fun, and politically charged narratives around the U.S. election cycle that created a vibrant, if occasionally divisive, conversation.

AI- and politics-linked memecoins captured attention toward the end of the year, culminating in high-profile launches like TRUMP in early 2025. Most of those tokens have since retraced sharply, reinforcing the pattern seen throughout the cycle of rapid distribution, thin secondary demand, and little staying power once incentives fade.

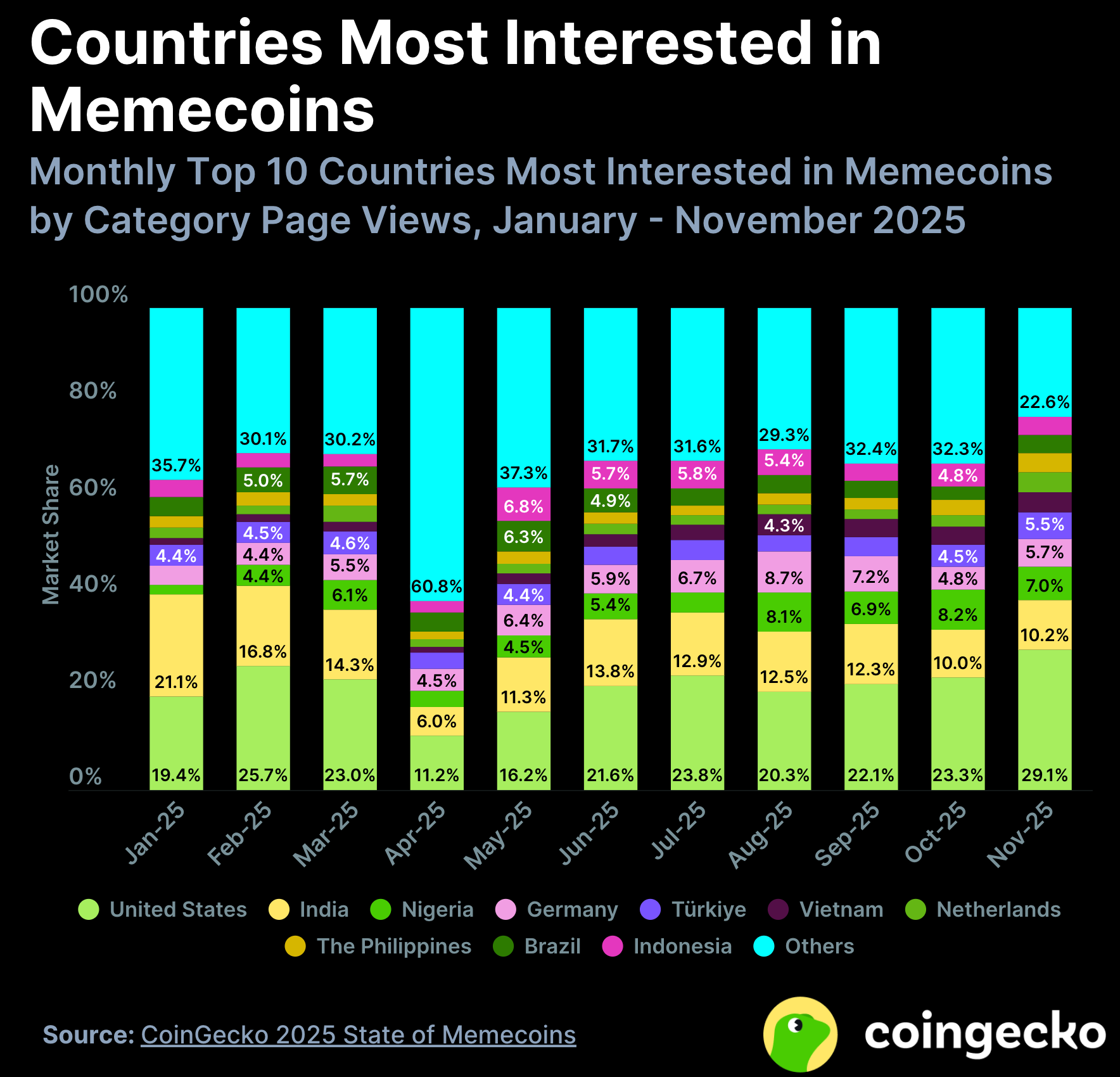

Geographically, interest skewed heavily toward the U.S., which accounted for roughly 30% of memecoin-related traffic by November 2025. But even there, engagement declined steadily as the year progressed, suggesting regulatory clarity did little to sustain speculative appetite.

Launchpads lowered the barrier to entry, but not the odds of survival.

Tokens minted through platforms like Pump.fun briefly grew to more than 20% of memecoin market cap, yet “independent” memecoins still dominate over 86% of the sector — largely because most launchpad tokens failed to build durable liquidity.

coindesk.com

coindesk.com