The rapid ascent of XRP in the ETF arena continues to attract major voices from traditional finance.

In a tweet, Canary Capital CEO Steven McClurg highlighted “strong institutional demand” driving the asset’s breakout. His remarks come as XRP ETFs edge closer to the $1 billion milestone. The ongoing move marks one of the fastest early growth phases in the history of U.S. crypto ETFs.

Canary Capital: Institutions Are Rushing In

Responding to Ripple CEO Brad Garlinghouse, McClurg said Canary Capital identified the institutional appetite for XRP early. He described the firm as “humbled” to be involved and noted that his background in managing institutional capital made the demand impossible to ignore.

He also drew a link between XRP’s surge in ETF inflows and the rise of Ripple’s stablecoin, RLUSD, predicting the stablecoin will “blow past other stablecoins” under the leadership of Garlinghouse and the Ripple team. According to McClurg, the growth of both products is interconnected.

We are very humbled to be a part of this. I spent the majority of my career managing institutional money, and Canary identified the strong institutional demand for XRP.

Watch RLUSD blow past other stable coins under the guidance of Brad and the Ripple team.

The growth of the two… https://t.co/8wlZ5Kx6UL— Steven McClurg (@stevenmcclurg) December 8, 2025

Garlinghouse: XRP Is Fastest to $1B Since ETH

Garlinghouse’s announcement highlighted how quickly XRP is capturing market share. Less than four weeks after launch, XRP has become the fastest U.S. spot crypto ETF to reach $1 billion in assets under management since Ethereum’s ETF in 2024.

Several crypto ETFs debuted in 2025 before XRP, but XRP products have overtaken them all with record inflows.

For context, the Solana ETF commenced trading on October 28 and has so far registered $640 million in inflows and $890 million in total assets.

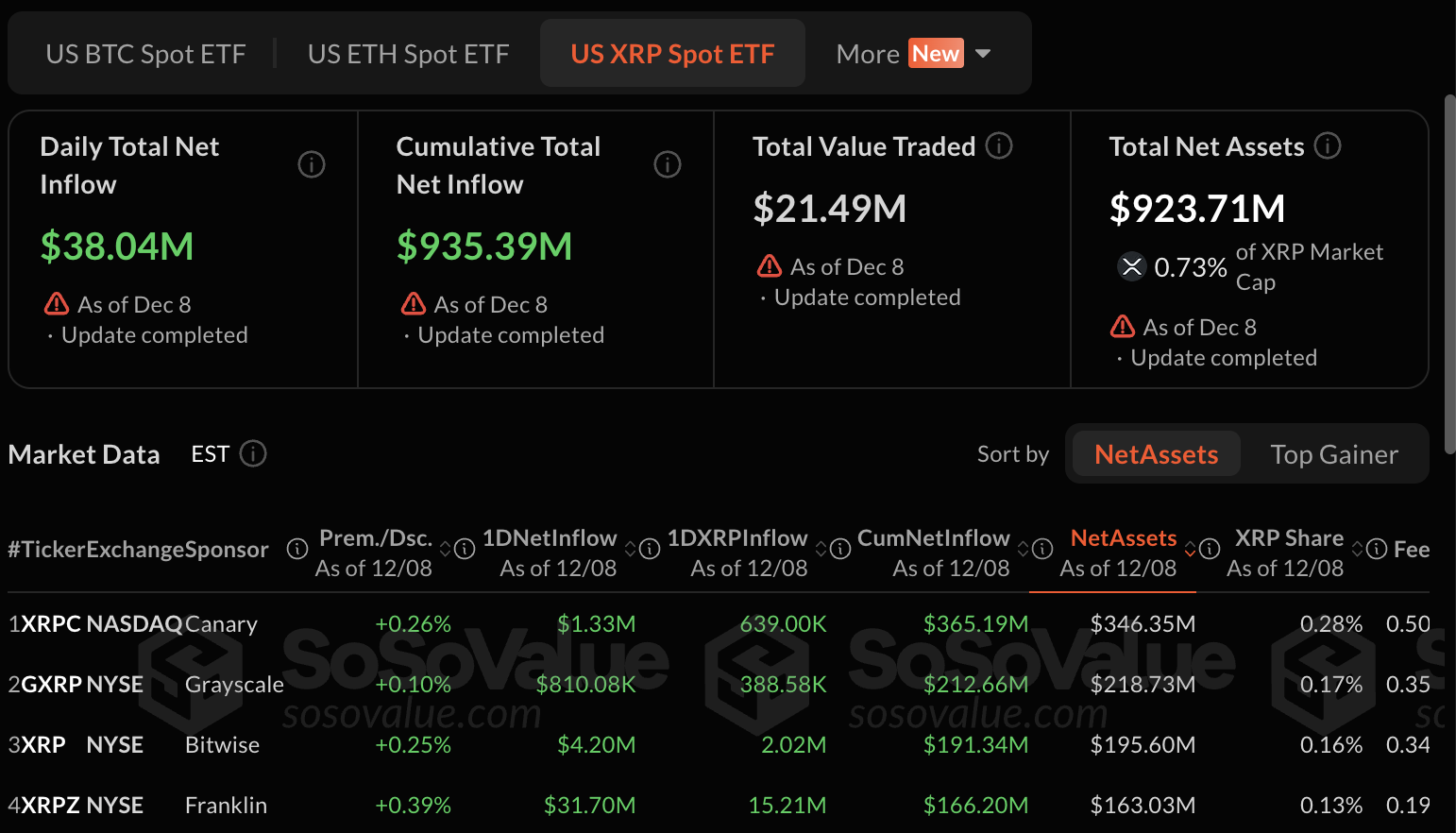

Meanwhile, XRP ETFs, which started trading on November 13, have welcomed $935 million in inflows—just inches away from the $1 billion milestone.

XRP ETFs have reached this point with zero days of outflows since launch. Major issuers, including Canary Capital, Grayscale, Franklin Templeton, Bitwise, and soon 21Shares, have helped accelerate adoption.

-

XRP ETF inflow data

XRP ETF inflow data

The Ripple CEO said the recent surge in investment highlights two key points. Firstly, people have been waiting for safe, regulated ways to invest in crypto. Secondly, strong community support matters for new investors entering through retirement and brokerage accounts.

Traditional Finance Wakes Up to XRP

Amid the ongoing momentum, well-known portfolio manager Michael Gayed disclosed he “might do something related to XRP.”

The comment drew attention, given his success with other products. For many in the XRP community, Gayed’s shift further confirms growing curiosity from seasoned institutional strategists.

Ripple Says This Is Still the Beginning

Meanwhile, Ripple CEO maintains that crypto ETFs make up only 1% to 2% of the global ETF market, leaving significant room for long-term expansion.

And with XRP ETFs approaching the $1 billion mark faster than almost any other crypto product, the institutional wave may only be getting started.

Other commentators in the XRP community, such as YouTuber Moon Lambo, believe the ongoing ETF records imply that XRP has already proven itself as a long-term, legitimate crypto asset. In his view, debates about its longevity are now irrelevant.

thecryptobasic.com

thecryptobasic.com