The latest figures reveal that the stablecoin economy expanded by 5.33% in July, with a $13.537 billion boost added over the course of the month.

USDe, USDf Steal the Spotlight With 62.55% and 103% Jumps in One Month

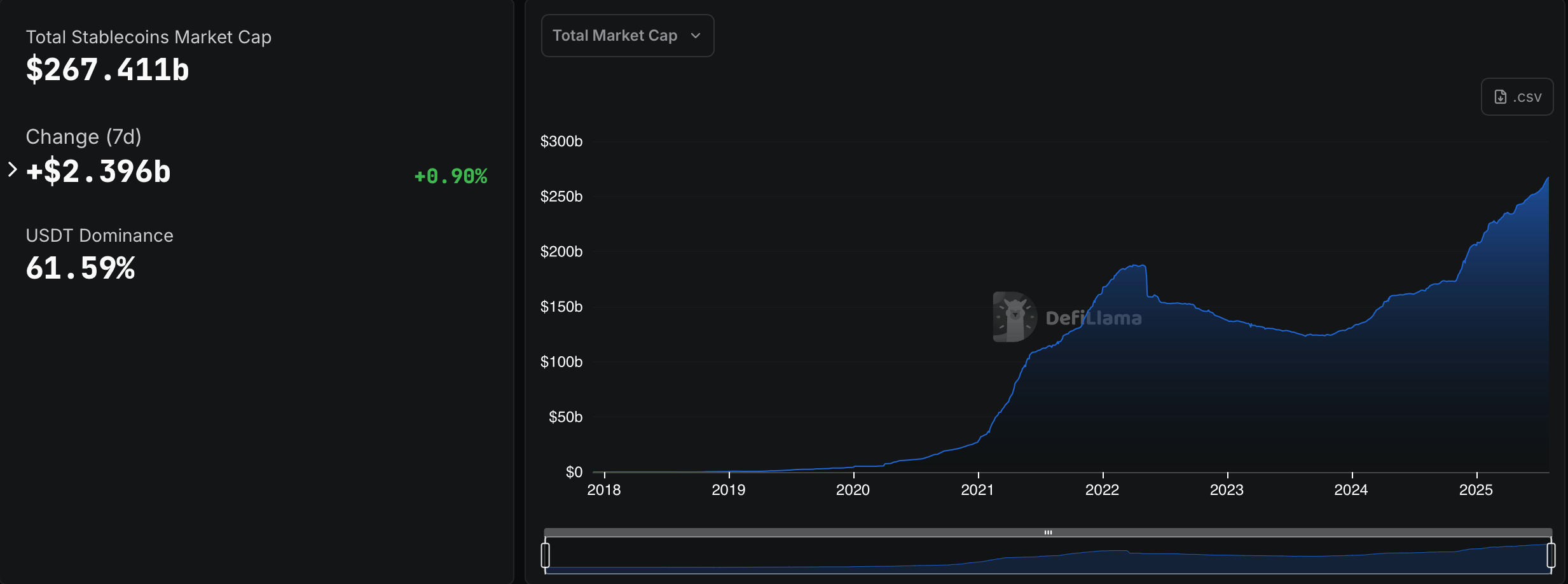

The stablecoin market keeps expanding, and if another $2.589 billion flows in next week, it’ll cross the $270 billion threshold. As of Saturday, Aug. 2, 2025, fiat-pegged tokens collectively sit at $267.411 billion—up $13.537 billion since the start of July. Tether ( USDT) still leads the pack, commanding 61.59% of the entire market.

USDT’s circulating supply grew by $5.55 billion, pushing its market cap to $164.71 billion, according to data from defillama.com. USDC followed with an additional $2.53 billion in supply, lifting its total valuation to roughly $63.99 billion. Ethena’s USDe had the biggest monthly leap—ballooning 62.55% in July after gaining $3.318 billion in supply.

USDe’s market cap now clocks in at $8.623 billion. Sky’s USDS also climbed, though at a slower pace, adding $296.82 million to reach a market value of $4.857 billion. DAI’s growth was smaller still, with just $23.57 million tacked on, bringing it to $4.305 billion.

Blackrock’s BUIDL—the U.S. Treasury-backed stablecoin—slid by over $433 million in July, trimming its valuation to $2.398 billion. World Liberty Financial’s USD1 dropped by $36.57 million during the same stretch, and now hovers at $2.17 billion. Ethena’s USDTB also shrank, falling $23.82 million to land at $1.438 billion.

Falcon’s synthetic dollar, USDf—an overcollateralized stablecoin from Falcon Finance—soared 103% in July, rocketing into the ninth slot among the top ten. The coin saw $549.72 million in new value, bringing its market cap to $1.085 billion. In tenth place sits FDUSD, currently valued at $1.032 billion after shedding $179.24 million last month.

news.bitcoin.com

news.bitcoin.com