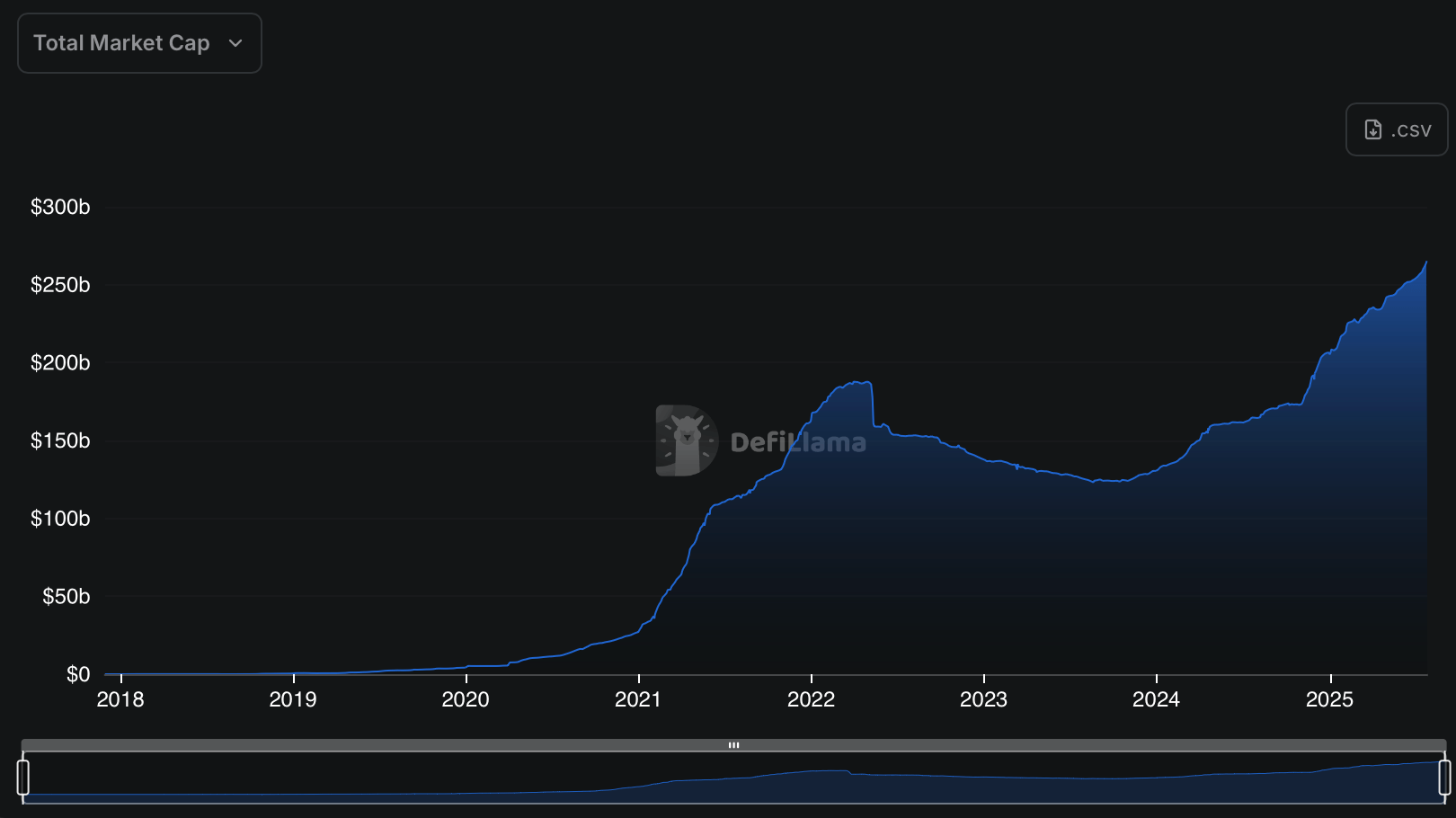

Seven days ago, the stablecoin economy broke past the $260 billion mark — and it’s been climbing ever since. Over the past week alone, the sector added nearly $5 billion, with close to $2 billion of that coming from freshly minted tether ( USDT).

Billions Minted, Rankings Bolstered—Stablecoins May be Entering Their Most Turbulent Phase Yet

Token data from defillama.com shows the stablecoin market now holds a valuation of $264.986 billion, with USDT commanding a dominant 61.86% share. At the moment, on Saturday afternoon, tether’s market cap sits at a hefty $163.90 billion, boosted by a 1.19% increase in the past week that brought 1.925 billion new coins into circulation.

Circle’s USDC holds steady in second place with a $64.015 billion market cap, though it dipped 0.54% after 348 million USDC was removed from assets under management (AUM). Ethena’s USDe posted the second-highest percentage gain among the top ten stablecoins this week, climbing 24.63%.

Roughly 1.425 billion new USDe entered circulation, pushing its market valuation to $7.212 billion. Meanwhile, Sky’s USDS led the pack with a 24.95% weekly jump, as an influx of 989.77 million USDS lifted its market cap to $4.956 billion. Stablecoins ranked five through nine by market cap all saw declines over the past seven days.

Paypal’s PYUSD inched up 2.98%, with 25.75 million new tokens issued, bringing its total valuation to $890.68 million — enough to keep it as the tenth largest stablecoin. Out of the 100 tracked stablecoins, Sky posted the biggest percentage gain this week, with USDe right behind it.

While dominant players maintain their hold, the ascent of alternatives like USDe and USDS hints at growing fragmentation within the stablecoin space. Competitive minting activity signals potential disruption ahead, especially if emerging tokens sustain momentum and attract further liquidity.

Regulations, like the newly enacted stablecoin law brought forth by the GENIUS Act, may disrupt this situation even more going forward. Standardized oversight could either reinforce dominant issuers or open new doors for challengers aiming to meet compliance head-on. Beyond that, the stablecoin economy has already been expanding at a rapid and relentless pace.

news.bitcoin.com

news.bitcoin.com