Crypto lawyer John E. Deaton has reignited speculation about a potential Ripple Initial Public Offering (IPO), arguing that the successful public debut of digital asset firm Circle has provided a clear benchmark for what Ripple could be worth. His analysis suggests that if Circle can command its high valuation, a $100 billion valuation for a Ripple IPO is not “far-fetched.”

Deaton’s commentary centers on a direct comparison of the two companies’ financial strengths, emphasizing that Ripple’s massive XRP holdings give it a significant advantage.

I know @bgarlinghouse said @Ripple is NOT in a rush to go public. They certainly don’t need to raise capital, which is often, a primary reason to go public. But TIMING an IPO is also a big consideration. If @circle can hit a 62B-75B market cap then @Ripple, with nearly 40B XRP,… https://t.co/MSFNMy6i8E

— John E Deaton (@JohnEDeaton1) June 23, 2025

The Circle IPO as a Valuation Benchmark

The core of the argument hinges on a simple comparison of market value. Circle, the issuer of the USDC stablecoin, has achieved a landmark public valuation, setting a new precedent for how digital asset companies are valued in public markets.

Deaton’s take is that if the market values Circle at its current level, then Ripple, which possesses a fundamentally larger and more valuable balance sheet through its vast token holdings, could logically command an even higher valuation if it were to go public.

Ripple’s Financial Firepower

To support this case, the analysis points to Ripple’s own treasury. Ripple currently holds nearly 40 billion XRP, which, at a trading price of $2.15, translates to a valuation of around $80 billion. This estimate is based on today’s price and XRP’s circulating supply of 59 billion tokens. Notably, XRP’s market cap has now reached over $116 billion, underlining its position as a dominant force in the crypto sector.

This substantial balance sheet means Ripple is not in urgent need of raising capital, allowing it to time any potential IPO strategically. However, the success of other crypto-related IPOs has made the prospect of a public listing more attractive.

XRP Market and Technical Context

This high-level valuation discussion is taking place against the backdrop of a cautious XRP market. The price of XRP is currently trading at $2.15, up 5.90% in the last 24 hours but still down 4.5% over the past seven days.

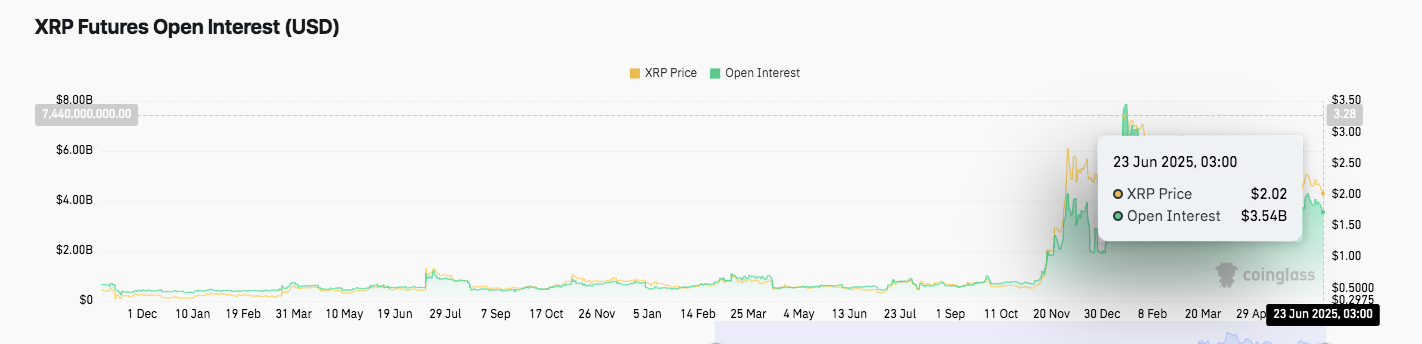

The XRP Futures Open Interest data offers deeper insights into market behavior. Open Interest remained below $2 billion for most of 2024.

But in late November, it surged rapidly, reaching $7.44 billion by early 2025. This increase mirrored XRP’s bullish price rally. As of June 23, Open Interest stands at $3.54 billion well above pre-rally levels indicating robust trader involvement.

However, while trader interest remains high, technical indicators suggest caution. The Relative Strength Index (RSI) at 32.68 signals that XRP is approaching oversold territory. Historically, such levels have triggered notable rebounds in price.

While the MACD indicator currently suggests negative momentum, with both lines below zero, weakening bearish pressure hints at possible shifts. Additionally, the consistent engagement in futures trading shows traders are still positioning for further volatility, or possibly a recovery.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com