On Friday, June 13, Blum, a Telegram-native platform focused on memecoin discovery and onchain trading, finally unveiled the tokenomics for its $BLUM token. This disclosure comes ahead of the highly anticipated Token Generation Event (TGE) scheduled for this month, marking a pivotal moment for the project. Amid recent developments, including the arrest and subsequent departure of co-founder Vladimir Smerkis in mid-May, the release offers clarity to the community. With the airdrop snapshot completed on June 7, the tokenomics provide a detailed roadmap for how the 1 billion $BLUM tokens will be distributed and utilized. This article explores the structure, allocations, and implications of Blum’s tokenomics, offering readers a comprehensive understanding of what lies ahead.

Total Supply and Initial Distribution

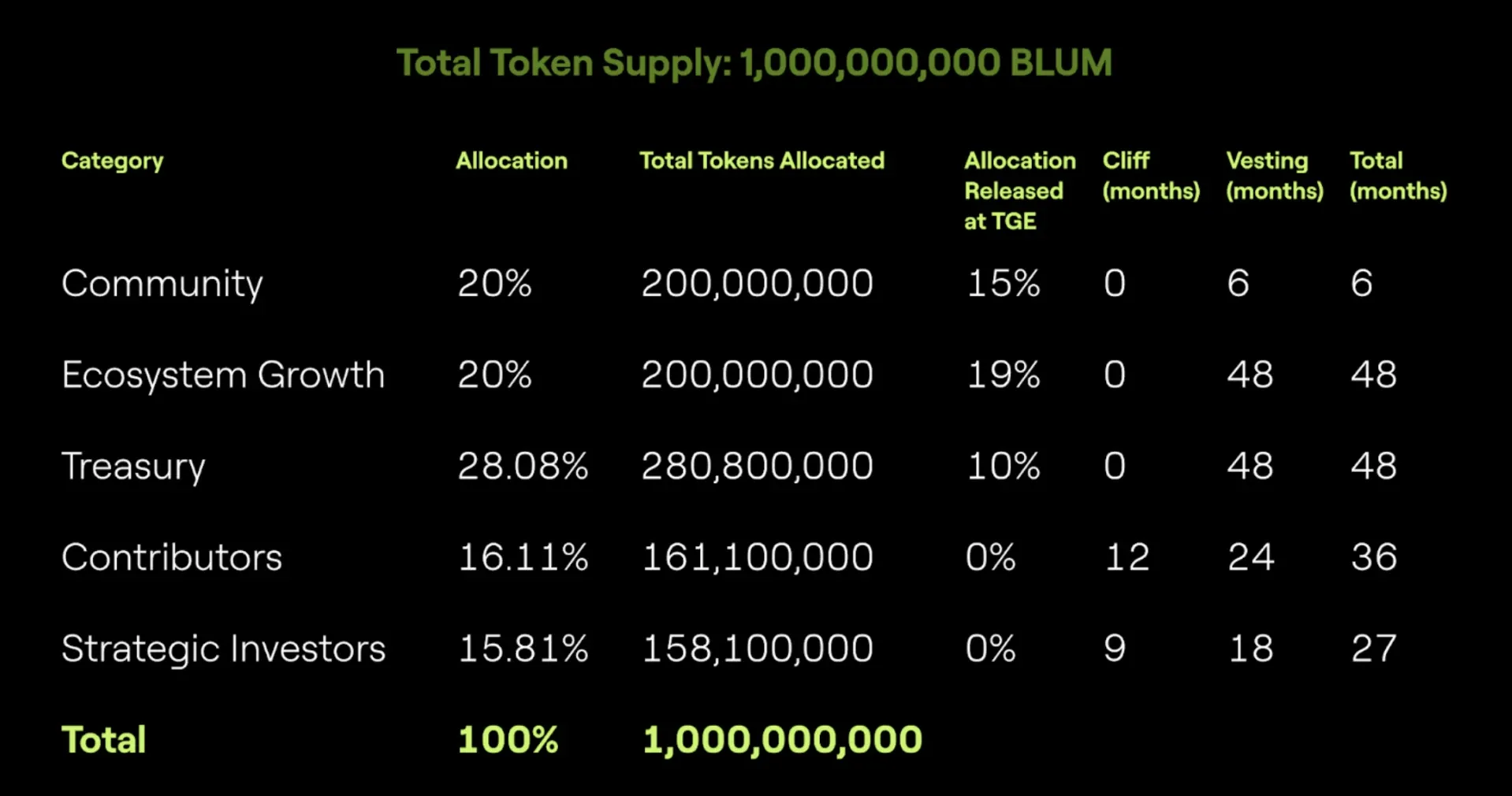

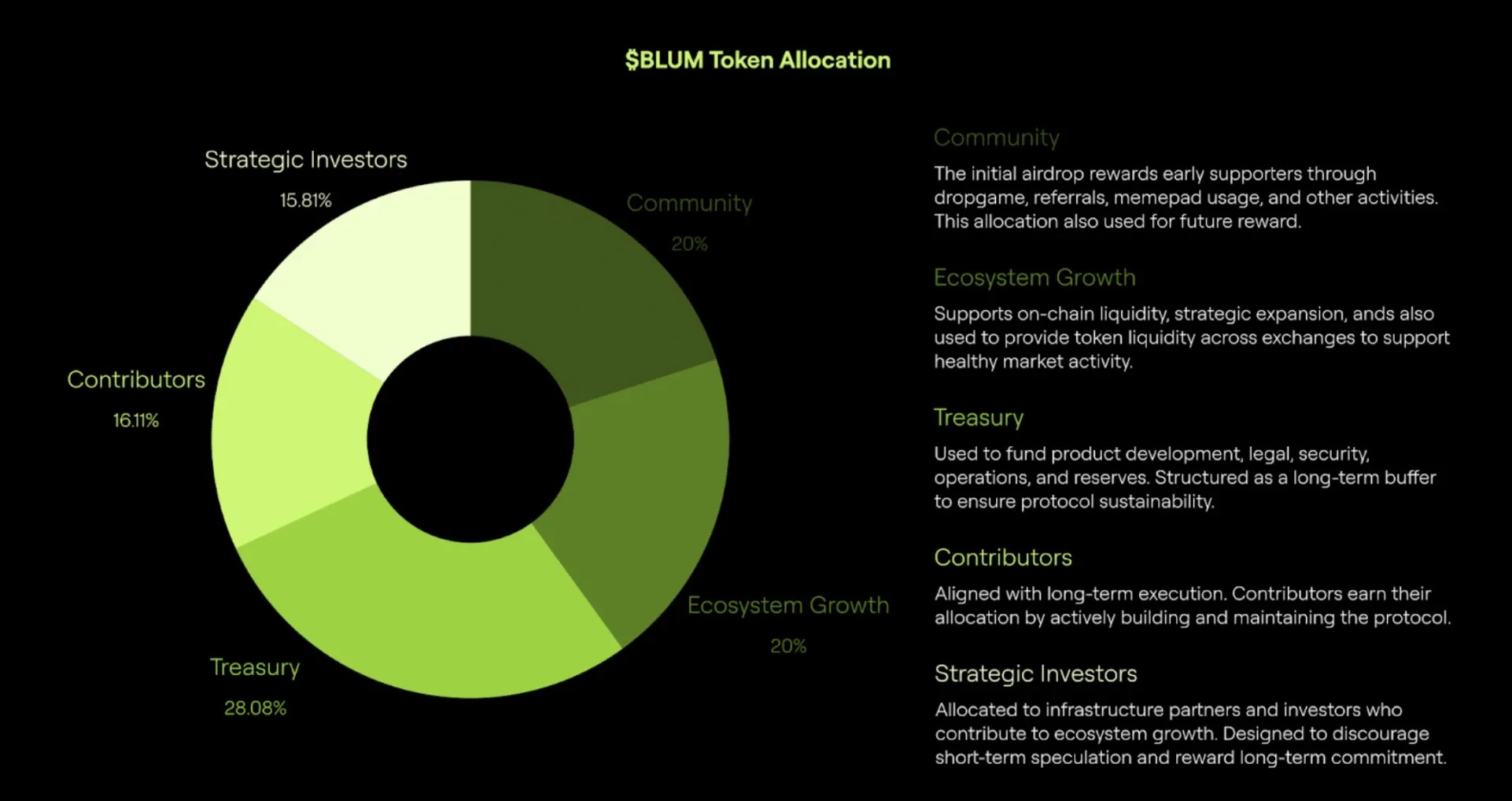

Blum has set the total supply of $BLUM at 1 billion tokens, a fixed amount designed to support the ecosystem’s growth. A notable feature is the absence of immediate unlocks for the team or investors at launch. Instead, the initial circulation prioritizes the community and ecosystem development, a choice that sets Blum apart from projects with early insider distributions. Each allocation serves a specific purpose, aiming to balance growth, incentives, and long-term sustainability without adding unnecessary complexity.

This approach begins with the community, which receives 20% of the total supply, or 200 million $BLUM. Half of this—100 million tokens—supports the pre-launch airdrop, rewarding early participants in the Drop Game, Memepad users, referrers, and others who engaged in qualifying activities. The remaining 100 million tokens are reserved for future programs and community initiatives. For the airdrop portion, 30% unlocks at the TGE, with the remaining 70% vesting linearly over six months. This gradual release ensures active users gain ownership while encouraging sustained participation as the ecosystem expands.

Key Allocations and Vesting Schedules

The tokenomics outline five primary allocations, each with distinct vesting schedules to align incentives with long-term goals.

- Community (20%): As noted, this segment supports early adopters. The 30% TGE unlock followed by a six-month vesting period allows users to benefit early while preventing a sudden market flood.

- Ecosystem Growth (20%): Another 200 million $BLUM is dedicated to scaling the platform. This includes onchain liquidity, exchange listings, developer grants, product integrations, and infrastructure partnerships. A 19% unlock at TGE is accompanied by an 81% vesting period over 48 months, creating a flexible pool to drive adoption and innovation.

- Treasury (28.08%): The largest allocation, 280.8 million $BLUM, funds product development, audits, legal support, security, operations, and reserves. Only 10% unlocks at TGE, with the remaining 90% vesting over 48 months. This long-term buffer aims to ensure protocol sustainability, giving Blum financial stability to address future needs.

- Contributors (16.11%): This 161.1 million $BLUM pool rewards those building the protocol—engineers, designers, community managers, and more. A 12-month cliff precedes a 24-month vesting schedule, with no tokens unlocking at TGE. Contributors earn their share through active involvement, tying rewards to ongoing commitment.

- Strategic Investors (15.81%): The 158.1 million $BLUM allocated here goes to infrastructure partners and investors supporting ecosystem growth, such as through cross-chain integrations and market-making. A 9-month cliff is followed by 18-month vesting, with no TGE unlock. This structure discourages short-term speculation and rewards long-term dedication.

The Role of $BLUM in the Ecosystem

$BLUM serves as the utility token at the heart of Blum’s ecosystem, connecting the Memepad, Trading Bot, and future integrations. Its design supports real utility from the outset, enabling trading fee reductions, staking opportunities, and access to launchpads. The tokenomics reflect a strategy to reward long-term participation while funding growth responsibly. By avoiding immediate team or investor unlocks, Blum aims to maintain a clean launch, focusing on community engagement and ecosystem development.

The vesting schedules, ranging from six months for airdrop participants to 48 months for treasury and ecosystem growth, ensure a gradual distribution. This approach could stabilize the token’s value post-TGE, though it depends on market reception and adoption rates. Readers should note that while the tokenomics are now public, the exact TGE date remains unconfirmed, though expectations point to late June based on earlier statements.

Community Reactions

Blum’s journey to this point has not been without challenges. The arrest of co-founder Vladimir Smerkis in mid-May raised questions about the project’s stability. The team addressed this in a statement, reaffirming confidence despite his departure. The TGE, initially hinted at for June on May 26, follows the June 7 airdrop snapshot, which locked in user eligibility based on Blum Points, Meme Points, and referrals. The tokenomics reveal, shared via Blum’s official X account, has drawn varied reactions. Some community members express optimism about the community-focused allocation, while others continue to seek details on the TGE timeline and exchange listings.

For readers, this means staying informed through official channels like Blum’s website and X posts. Checking comments on these updates offers insight into community sentiment, though reactions remain mixed as the TGE nears.

The Path Ahead

The unveiled tokenomics provide a clear framework for $BLUM’s role in Blum’s ecosystem. Active users can anticipate rewards from the airdrop, while builders and investors are incentivized for long-term contributions. The lack of a confirmed TGE date leaves some anticipation for users, but the structure suggests a deliberate effort to prioritize sustainability over a rushed launch.

As June progresses, the community will watch closely for further announcements, particularly regarding the TGE and potential exchange listings. For now, the tokenomics offer a solid foundation, balancing immediate benefits with a vision for future growth.

bsc.news

bsc.news