According to our recent analysis, the asset could soon break the $2.6 level and subsequently hit $5.5. Meanwhile, another analyst expects the asset to explode by 5x, as explored by CNF in a recent discussion.

- Guggenheim and Ripple have teamed up to bring a US Treasury-backed fixed-income asset to the XRP Ledger (XRPL).

- Guggenheim is reported to have issued and redeemed $10.3 trillion of Asset-Backed Commercial Paper (ABCP) in the last 27 years.

Guggenheim, a reputable investment manager in the US, has announced a strategic partnership with Ripple to expand its digital commercial paper offering effectively. According to the press statement, this development highlights the growing relationship and the relentless commitment to bridge the crypto native enterprise and traditional finance.

Meanwhile, this collaboration occurs between the blockchain company and Guggenheim Treasury Services, a subsidiary of Guggenheim. Under the terms, XRP Ledger (XRPL) would have the luxury to host a “US Treasury-backed fixed-income asset”. Additionally, Ripple is expected to allocate $10 million into the asset.

Further explaining the collaboration, RippleX executive Markus Infanger highlighted that Ripple’s stablecoin RLUSD would play a crucial role in this initiative by ensuring the availability of the commercial paper product. As noted in our previous news update, RLUSD has significantly powered Real World Finance and crypto integration since its inception, with its market cap currently surpassing $393 million.

Our research also suggests that this product is fully supported or backed by the US Treasury.

Guggenheim’s Earlier Moves and Ripple’s Role in Asset Tokenisation

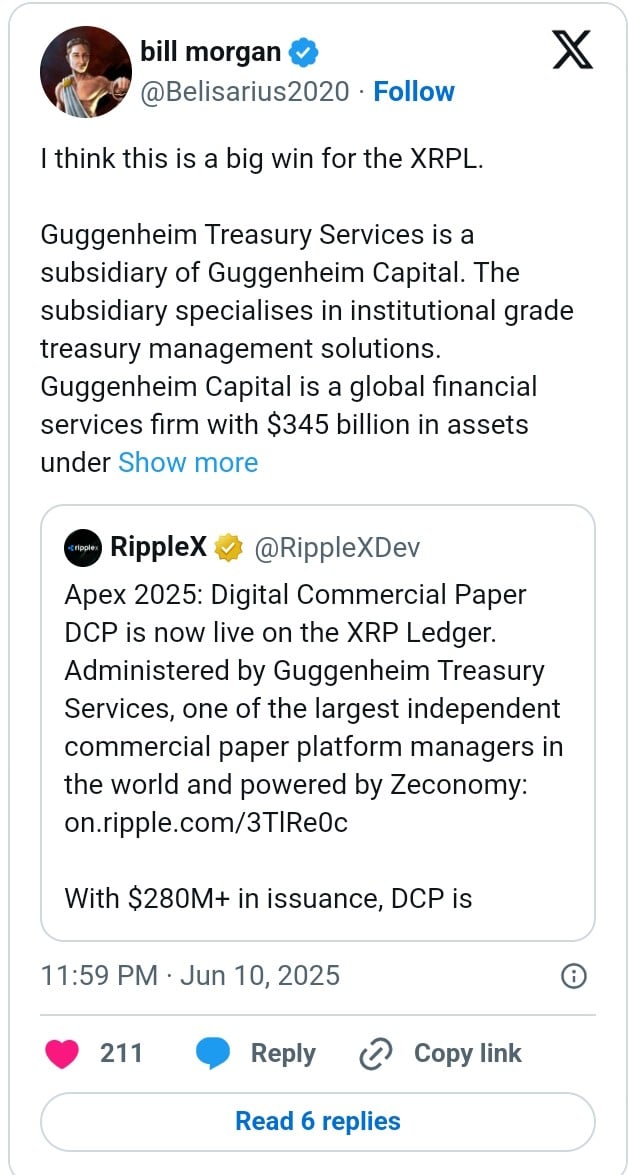

Guggenheim’s significant move within the blockchain ecosystem is not new. In 2024, it made a dramatic entry into the blockchain space by tokenising $20 million in commercial paper on the Ethereum blockchain. This historically made the product the first digital version of commercial paper. The recent development has also caught the attention of XRP Lawyer Bill Morgan who has lauded it as a big win for XRPL.

In the midst of these, Guggenheim Treasury has positioned itself among the largest “Asset-Backed Commercial Paper (ABCP) managers” in the world. Over the last 27 years, it has successfully issued and redeemed over $10.3 trillion of ABCP. Our research shows that these issuances were done through Zeconomy’s AmpFi.Digital platform.

Commenting on this, the CEO of Zeconomy Giacinto Cosenza, hinted that its success has been hinged on the unprecedented demand for digital assets.

As clearly demonstrated by the ETFs’ approval and the growth of the tokenisation space, there is a massive demand for these digital assets.

Ripple has also played an undeniable role in tokenisation as its several groundbreaking partnerships and initiatives position it at the forefront of this enviable sector. As indicated in our earlier news brief, Ripple partnered with Ondo Finance to bring tokenised U.S. Treasury securities to the XRPL. Specifically, this was reported to see the integration of a $185 million US Treasury token, OUSG, into the blockchain network within six months.

In 2024, Ripple also teamed up with Archax, a UK-based company to introduce a tokenised money market fund to the XRP Ledger. Ripple invested $5 million in Lux Fund with the company expected to bring years of experience in the institutional-grade blockchain solution.

XRPL, has, on the other hand, been largely utilised for this effect. As mentioned in our recent blog post, its decentralised exchange enables the trading of tokenised assets without the need for a special contract.

XRPL also recently powered Dubai’s first government-issued real estate digital asset. This project ensured that title deeds can be securely minted and recorded on-chain. As detailed in our earlier news coverage, this could influence the fast growth of Dubai’s tokenised real estate market which is expected to reach $16 billion by 2033.

The recent partnership with Guggenheim has marginally impacted the price of XRP which recorded almost 2% gains on its daily price chart to trade at $2.3.