- ProShares has updated its XRP ETF filing to a new effective date of June 25, showing continued efforts to gain SEC approval.

- The update is boosting sentiment in the XRP market, accompanied by price surge.

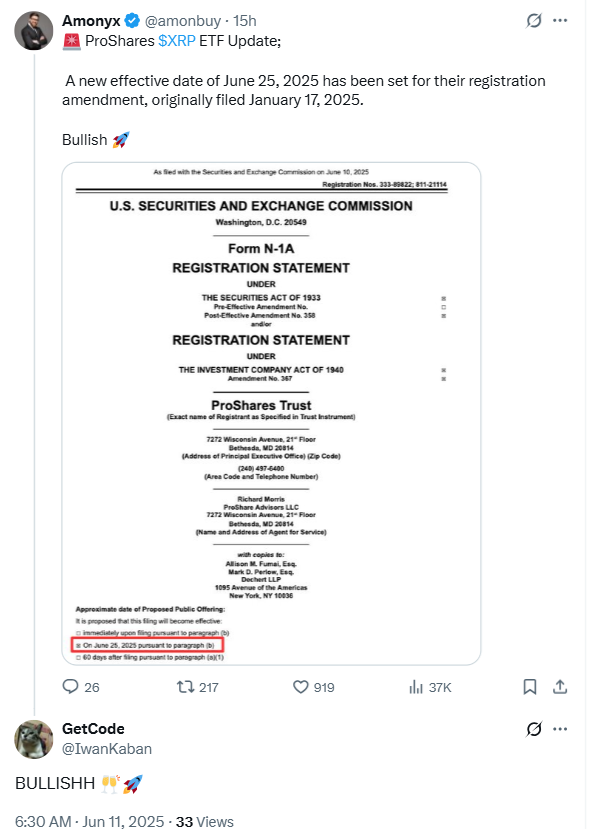

ProShares has updated its XRP ETF filing, a sign that the push for approval by the United States Securities and Exchange Commission (SEC) is still in motion. The revised date, now set for June 25, 2025, replaces an earlier timeline and reflects continuing steps in a regulatory journey that began in January.

XRP ETF Filing Gains Attention as New Date Emerges

As highlighted in our previous news brief, the US SEC has approved ProShares to launch the first-ever XRP Exchange-Traded Fund (ETF).

It is worth noting that the XRP ETF update from ProShares, shared publicly on June 10, 2025, shows that the process has not stalled. Instead, the firm is working on a timeline best suited for the takeoff.

Initially submitted in January 2025, the filing has been revised through Form N-1A. This is a standard document required for open-end funds such as exchange-traded funds. This form outlines the operational details of the proposed fund and is subject to a full review by the SEC.

After Amonyx posted the news on X, crypto observers on social media quickly picked up on the updates, sparking a mix of reactions. Some users welcomed the progress. One comment described the shift as bullish, suggesting optimism about the potential launch.

Others, however, expressed concern about the date change, noting earlier delays such as the missed April 30 expectation.

The new June 25 date offers a clearer point of focus as the community continues to monitor developments. Meanwhile, another XRP ETF application, this one from Franklin Templeton, awaits a decision.

As mentioned in our previous article, the anticipated ruling on Franklin Templeton’s proposed Spot XRP ETF is expected by June 17. The overlap of these filings has added pressure on the SEC to respond on time.

SEC’s Role Remains Central to XRP’s Outlook

Based on previous results from ETF filings for digital assets, the possible approval of an XRP ETF carries weight for investors. It would allow people to invest in XRP without directly buying the cryptocurrency.

Likewise, ProShares, known for its range of ETF offerings, appears confident in XRP’s potential, partly due to Ripple’s role in developing the XRP Ledger. The project has been very successful in terms of growing adoption.

As noted earlier, crypto analysts SMQKE said that Bitcoin and Ethereum are too slow and expensive for global payments. However, XRP can handle more transactions at a lower cost, making it better for banks and cross-border use.

Although Bitcoin and Ethereum ETFs received the green light in 2024, XRP faces a more complicated path. Past legal battles involving Ripple have placed the token under tighter scrutiny. Still, April 2025 data showed a 7% rise in XRP’s price following Franklin Templeton’s filing, suggesting strong investor interest. At the moment, price is up 1.26% to $2.318.

As June 17 and 25 approach, market participants continue to wait for clear direction. The SEC’s decision could set the tone for how XRP fits into mainstream investing and whether it will join the growing list of crypto assets available through exchange-traded funds.