Asset management firm Canary Capital has filed for a trust in Delaware to create a product offering staking exposure to the Injective (INJ) token, a move that pushes the boundaries of crypto-based financial products in the United States.

The development, which has fueled a rally in the INJ token, comes as U.S. regulators are signaling concerns over the legality of such “staked” ETF structures.

Canary Capital’s Delaware Trust

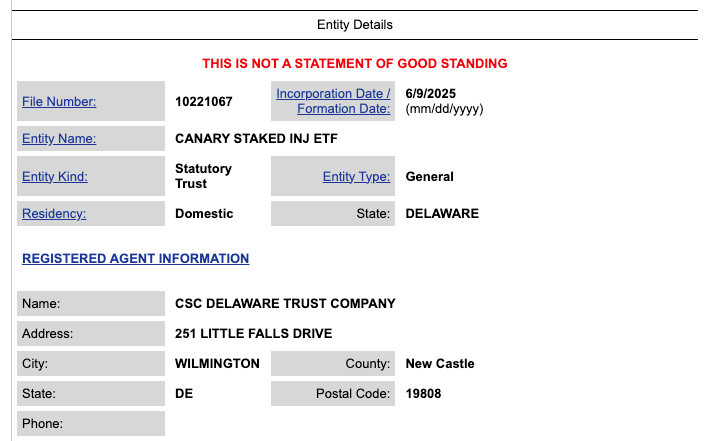

The Delaware Division of Corporations website confirms that the “Canary Staked INJ ETF” was formed on Monday. This filing is typically the first step in launching an ETF in the United States.

While creating a Delaware trust does not guarantee the eventual launch of an ETF, it highlights Canary Capital’s plans to offer exposure to staked INJ.

INJ Token Jumps Over 5% on ETF Filing News

The news has sparked immediate interest in the INJ token. Since the announcement, the token has gained 5.41% over the past 24 hours. It now trades at $14.22, a significant improvement from the intraday low of $13.23.

The ongoing bullish performance has improved INJ’s weekly trajectory. At press time, the coin boasts a seven-day return of 12%. According to DappRadar, the Injective blockchain has witnessed a slight uptick in transactions and user activity compared to figures from earlier this month.

Related: Injective ($INJ) Price Prediction for May 24: Bulls Push Above Key Fib Zone as $15 Eyed

Previous ETF Efforts

Canary Capital has a history of exploring crypto ETFs. In April, the company filed for an ETF to hold and stake Tron (TRX) tokens, generating yield through staking. Additionally, 21Shares recently launched an INJ ETF in Europe, which tracks the INJ token and captures staking yield for reinvestment.

Meanwhile, despite the growing interest in crypto ETFs, the U.S. SEC has raised concerns about the legality of staking ETFs under current securities laws. Last month, the SEC staff informed REX Financial and Osprey Funds that their proposed ETFs tracking Ethereum (ETH) and Solana (SOL) with staking features might not meet the definition of an investment company required for listing.

However, industry analysts remain optimistic. Bloomberg ETF analyst Eric Balchunas noted that REX Financial’s lawyers believe they can work out the legal issues. This sentiment is echoed by Canary Capital, which is likely to face similar challenges but is proceeding with its plans.

Related: Canary Capital Amends Solana ETF Filing to Include Marinade SOL Staking; SEC Delays Decision

Canary Capital has not publicly commented on its INJ trust, and no SEC filings have been made beyond the Delaware registration. Still, if the firm follows through with a formal ETF application, it could become the first U.S.-based fund to offer direct staking exposure to the Injective token.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com