Key Insights:

- Societe Generale’s crypto arm Societe Generale-FORGE announced USD CoinVertible (USD) stablecoin launch.

- USDCV stablecoin will exist on both the Ethereum and Solana public blockchains, which could increase its adioption.

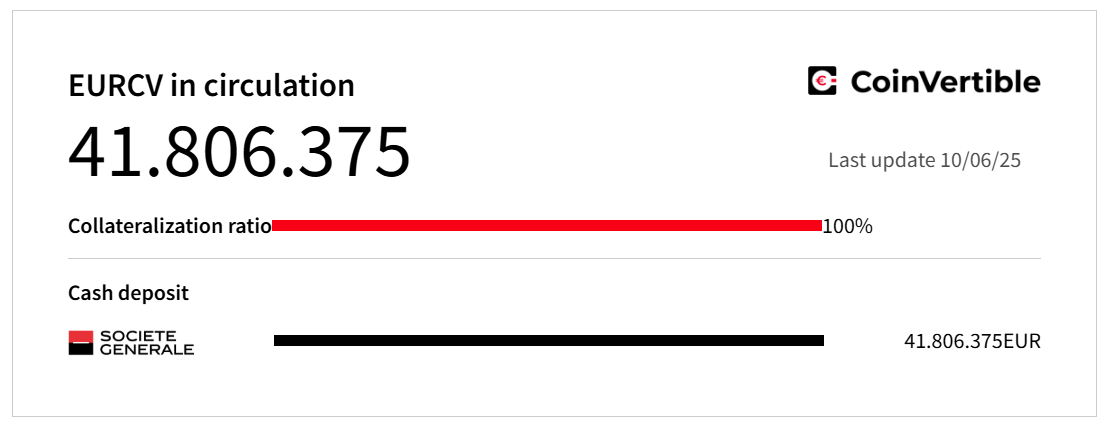

- The stablecoin issuer had already launched EUR CoinVertible (EURCV) stablecoin in April 2023 and shared collateral composition and valuation on a daily basis.

- The USDCV stablecoin is likely to launch in early July, but will not be available for trading to US persons.

Europe banking giant Societe Generale’s crypto arm on Tuesday announced the launch of a USD-pegged stablecoin named the USD CoinVertible (USDCV). The new stablecoin is available on both the Ethereum and Solana blockchains. The stablecoin is set to be available for trading from next month.

Societe Generale’s Crypto Arm Announces USD-Pegged Stablecoin

In a press release on June 10, Societe Generale-FORGE, the crypto arm of French bank Societe Generale, revealed plans to launch the USD CoinVertible stablecoin. Notably, the stablecoin will exist on both the Ethereum and Solana public blockchains.

The Bank of New York Mellon Corporation (BNY) was announced as the reserve custodian for the USDCV stablecoin. The bank added that the stablecoin is an electronic-money token (EMT) fully compliant with the Markets in Crypto-Assets (MiCA) regulation.

“The stablecoin market remains largely US Dollar denominated. This new currency will enable our clients, either institutions, corporates or retail investors, to leverage the benefits of an institutional-grade stablecoin,” said Jean-Marc Stenger, CEO of Societe Generale-FORGE.

Societe Generale-FORGE is licensed as an Electronic Money Institution (EMI) by the French “Autorité de contrôle prudentiel et de résolution” (ACPR).

USD CoinVertible Follows EUR CoinVertible Stablecoin

The company clarified that the latest move comes after a successful launch of EUR CoinVertible (EURCV) stablecoin in April 2023. EURCV has allowed investors exposure to stablecoin markets and seamless Bitcoin (BTC) and Ethereum (ETH) trading.

Societe Generale-FORGE plans to offer real-time conversion between fiat currencies and stablecoin, facilitating transactions in both EUR and USD.

USD CoinVertible and EUR CoinVertible are established to support crypto trading and cross-border payments. As well as, on-chain settlement, foreign exchange transactions, and collateral and cash management.

The stablecoin issuers disclosed an early July timeline for USDCV trading. Moreover, the collateral composition and valuation backing the USDCV will be publicly disclosed on a daily basis, similar to EURCV, on the SG-FORGE website.

USD CoinVertible Not Available to US Persons

The company revealed that USD CoinVertible (USDCV) stablecoin will not be available to US persons, similar to EUR CoinVertible (EURCV). It is because EURCV and USDCV stablecoins were not registered under the U.S. Securities Act of 1933. Thus, they are excluded from offering, selling, pledging or otherwise transferring at any time, except in an “offshore transaction.”

At the time of writing, the EURCV market cap was $47.71 million. It is comparatively low to other Euro-pegged stablecoins such as EURC and STATIS EURO (EURS).

However, institutions are gradually adapting to changes in the cash market. With stablecoins catalyzing much of this change due to 24/7 capabilities.

Carolyn Weinberg, Chief Product & Innovation Officer at BNY believes stablecoins have the potential to enhance resiliency, drive operational efficiencies, and create new opportunities for companies and investors.

thecoinrepublic.com

thecoinrepublic.com