This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

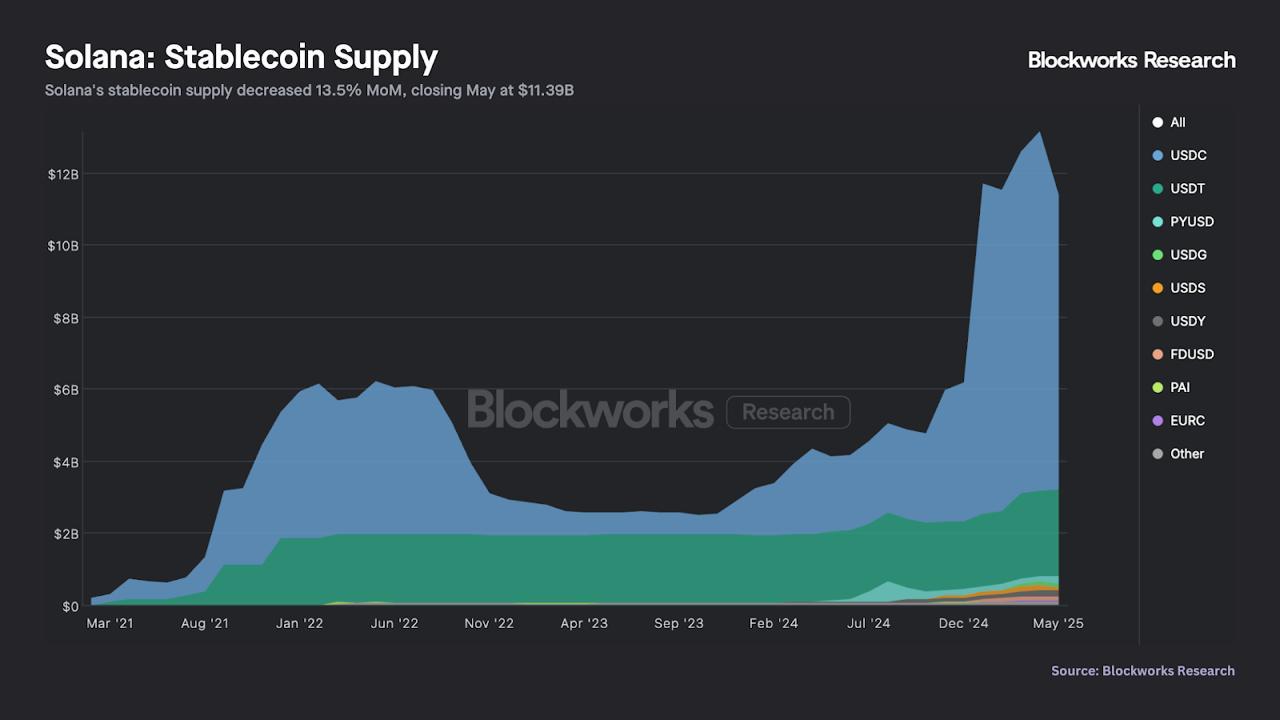

Solana’s real economic value, app revenue, and DEX volumes were all up on the order of 20-30% in May, but one noteworthy figure didn’t keep pace: stablecoin supply.

Today, there are 15% fewer stablecoins on Solana than a month ago, per Blockworks Research data. Stablecoins are often an important source of liquidity for doing things like swapping in and out of $SOL, although Solana’s stablecoin dip comes after the gray swan that was Donald Trump’s memecoin.

Solana’s stablecoin supply doubled essentially overnight when Donald Trump’s memecoin was paired with $USDC, meaning investors essentially had to buy $TRUMP with Circle’s stablecoin. Interestingly, the fresh stablecoin supply didn’t evaporate when $TRUMP investors flocked for the exits, and it even hit a fresh all-time high in April when the presidential memecoin was far from its initial highs.

So given that context, some in Solana find the decline in stablecoin supply unconcerning.

“[Y]ea this chart looks a lot better than the $SOL price chart lol,” Lulo co-founder Jesse Brauner said when I asked him about the stablecoin supply dip.

In any event, the stablecoin exodus has been led by $USDC, which saw its market cap on Solana shrink by some $1.8 billion in May, according to Blockworks Research analyst Carlos Gonzalez Campo. Perena founder Anna Yuan speculated that the sudden drop in supply could be funds shorting the dollar in a topsy-turvy macro environment.

Non-$USDC stables actually grew last month, notably including PayPal’s $PYUSD, which saw its supply grow 48%.

$PYUSD is one of several newer stablecoins vying for a piece of $USDC’s 70% market share on Solana. It’s joined by USDG — a Paxos-issued stable that pledges to share revenue with its network partners, which include Robinhood and Kraken — and USX, a forthcoming basis-trade token that its developer company dubbed “Solana’s stablecoin.”

u.today

u.today