The MANTRA crypto project is embroiled in controversy after its OM token crashed 90% on Sunday, with investors alleging an insider dumped its holdings, wiping out an estimated $5 billion in market value.

MANTRA Blames ‘Reckless Liquidations’ for OM Token’s Historic Crash

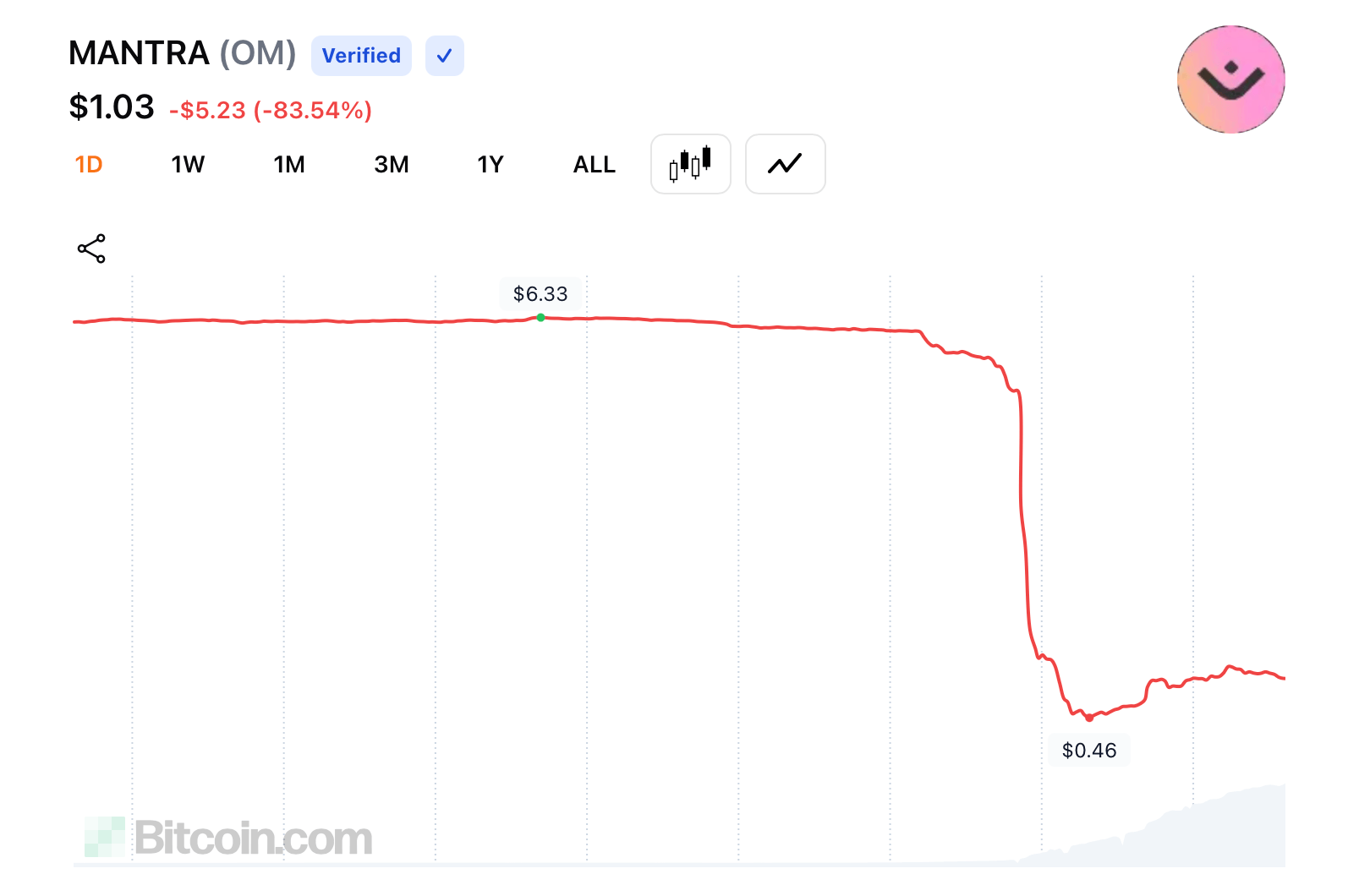

MANTRA, known for tokenizing real-world assets (RWAs) and its partnerships with Google Cloud and Dubai’s DAMAC Group, saw its OM token plummet from above $6 to $0.37 in under 24 hours. The token, which peaked at $9 earlier in 2025, now trades around $1.03 as of 7:40 p.m. EDT. Social media posts claim the team or an associated market maker sold 90% of circulating tokens, though MANTRA denies involvement.

The crash, one of crypto’s steepest single-day drops, sparked accusations of market manipulation. Critics allege the team or an insider offloaded tokens over-the-counter (OTC) and deleted MANTRA’s Telegram group, severing investor communication. Social media erupted with fraud comparisons to Terra Luna’s 2022 collapse.

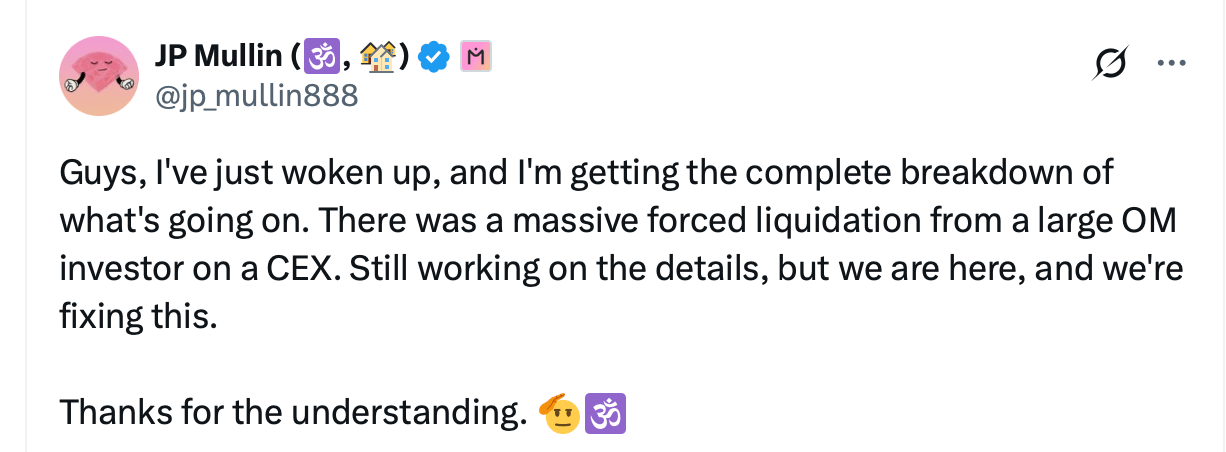

MANTRA’s X account blamed “reckless liquidations” by external actors and promised forthcoming details. “MANTRA community – we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project,” the team stated. “One thing we want to be clear on: this was not our team. We are looking into it and will share more details about what happened as soon as we can.”

Onchain sleuth ZachXBT responded by saying, “What kind of statement is this OM went down 90%+ from $5.9B to $500M mkt cap in a single candle.” Another person wrote, “’Reckless liquidations’ is a new one on me.”

Investors are demanding legal action, with some calling the incident a “scam.” As investigations continue, the incident highlights some of the volatility risks associated with specific decentralized finance (DeFi) projects, particularly those bridging traditional assets. MANTRA’s response—or lack thereof—could shape both its future and broader trust in tokenization ecosystems.

news.bitcoin.com

news.bitcoin.com